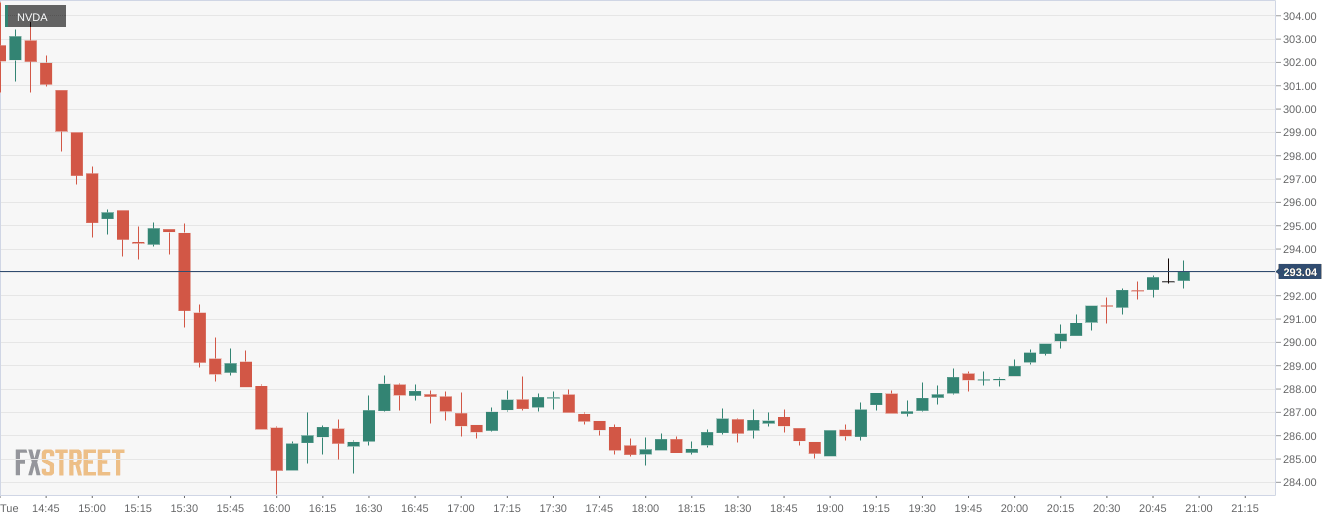

NVDA Stock Prediction: NVIDIA tumbles despite impressive presentation at CES

- NASDAQ:NVDA fell by 2.76% during Tuesday’s trading session.

- NVIDIA reveals several new partnerships with EV makers.

- A factory fire causes the broader semiconductor industry to plummet.

NASDAQ:NVDA saw the ups and downs from 2021 continue on Tuesday, but much of its decline was due to general weakness in growth sectors once again. Shares of NVIDIA fell by 2.76% and closed the second trading day of the year at $292.90. The NASDAQ tumbled by 1.33% just a day after starting 2022 off on the front foot. Blue chip stocks were the winners on Tuesday, as rising interest rates saw a cycle back to value stocks. The Dow Jones spiked by 214 basis points as the markets remained fragmented to start the year. Semiconductor stocks helped drag the NASDAQ down as AMD (NASDAQ:AMD), Intel (NASDAQ:INTC), and Marvell Technology (NASDAQ:MRVL) were all trading below water alongside NVIDIA.

Stay up to speed with hot stocks' news!

Tuesday saw NVIDIA present its latest technologies at the annual CES expo and the company did not disappoint. NVIDIA revealed a new partnership with Chinese EV makers like Nio (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng (NYSE:XPEV) have all adopted its NVIDIA Drive Hyperion platform. This is an autonomous driving technology that will help close the gap between these EV makers and industry leader Tesla (NASDAQ:TSLA).

NVIDIA stock chart

Another factor that sent the semiconductor industry spiralling out of control? ASML (NASDAQ:ASML) is a manufacturer of machinery that produces semiconductor microchips. Well, on Friday of last week, ASML’s Berlin factory caught fire and some believe this could have an impact on production in the short-term. ASML provides chips for both Samsung and Taiwan Semiconductor (NYSE:TSM), which supply many of the semiconductor companies around the world including NVIDIA. The extent of the damage has yet to be determined, but it seems like investors were already fearing for the worst on Tuesday.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet