NVDA Elliott Wave technical analysis [Video]

![NVDA Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Software/man-developing-software-637435356543561169_XtraLarge.jpg)

NVDA Elliott Wave Analysis Trading Lounge Daily Chart,

NVIDIA Corp., (NVDA) Daily Chart,

NVDA Elliott Wave technical analysis

Function: Counter trend.

Mode: Corrective.

Structure: Flat.

Position: Intermediate wave (4).

Direction: Downside in wave (4).

Details: At this point we are looking for a three wave move in wave (4), with equality of C vs. A as target at 84$.

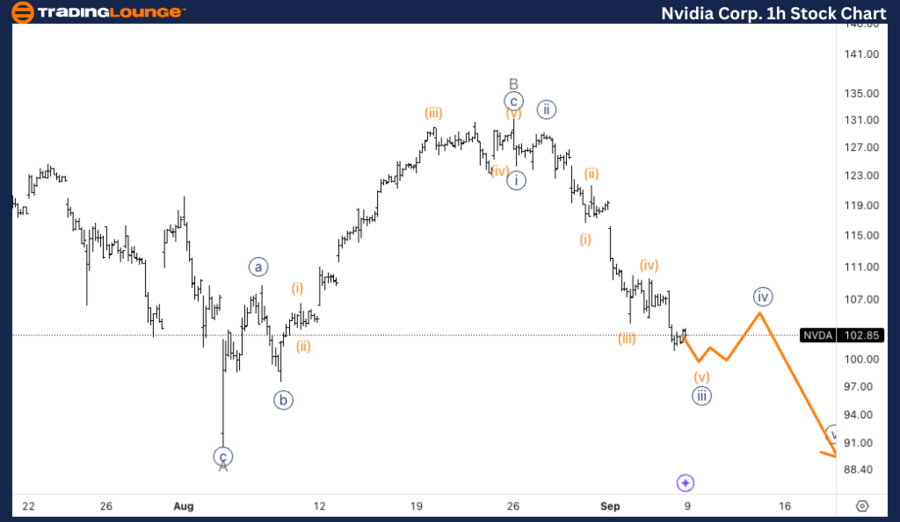

NVDA Elliott Wave Analysis Trading Lounge 1H Chart,

NVIDIA Corp., (NVDA) 1H Chart.

NVDA Elliott Wave technical analysis

Function: Countertrend.

Mode: Corrective.

Structure: Flat.

Position: Minor wave C.

Direction: Downside within wave C.

Details: Looking for further downside within wave C as we seem to be unfolding lower. We could expect a bounce in wave {iv} as we hit TL1 at 100$.

This analysis provides an Elliott Wave interpretation for NVIDIA Corp. (NVDA) based on both the daily and 1-hour charts. It outlines the current corrective trend and the key levels to watch as the stock navigates through a significant wave (4) correction.

NVDA Elliott Wave technical analysis – Daily chart

NVIDIA is in a corrective structure, likely a flat correction, unfolding as a three-wave move. Currently, the stock is moving lower within wave C, and the next target for wave (4) is set at 84$, where equality between wave C and wave A is expected. This suggests a deeper correction before the resumption of the long-term trend.

NVDA Elliott Wave technical analysis – One-hour chart

NVIDIA is currently progressing lower in wave C, and the next key support level is expected around 100$, near Trading Level1 (TL1). A bounce in wave {iv} of C could occur around this level before the final push lower to complete the correction. This would align with the structure's flat pattern, where wave C typically unfolds as a five-wave move.

Technical analyst: Alessio Barretta.

NVDA Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.