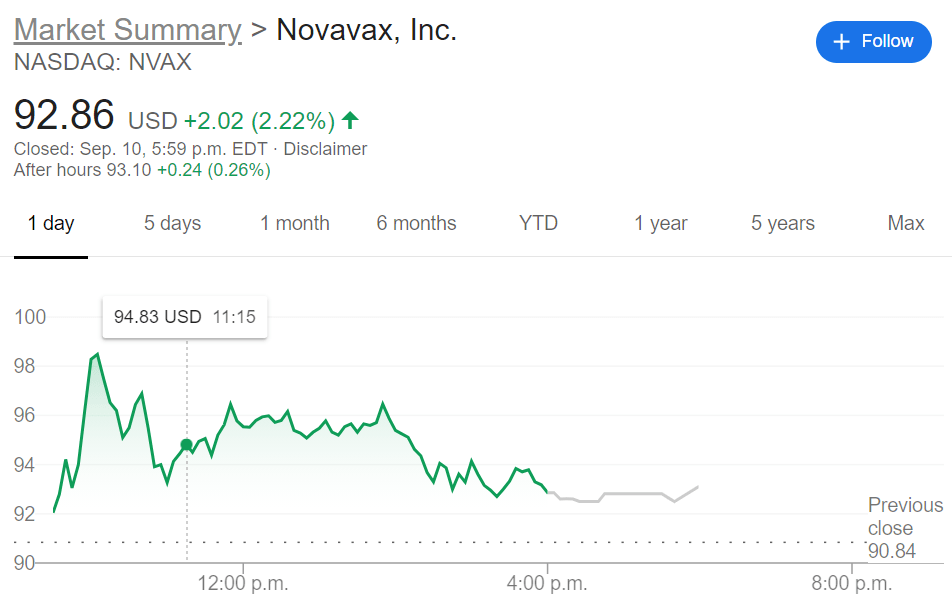

- NASDAQ:NVAX gains 2.22% on Thursday despite broader market dip.

- News of AstraZeneca halting its COVID-19 vaccine study has boosted other rivals in the industry.

- Novavax has dropped nearly half of its market cap during the last month, enticing bargain investors.

NASDAQ:NVAX has gained where its rivals have faltered as the race for the coronavirus vaccine took a turn for the worse when AstraZeneca (NYSE:AZN) announced it was halting its final phase clinical study due to adverse effects reported in patients. Shares of Novavax jumped over 15% during the next few days as investors rushed to secure their stakes in AstraZeneca’s chief rivals. The small boost was nice for Novavax investors but the biotech stock is still down nearly 45% over the past 30 days and is down over 50% from its 52-week highs of $189.40 – although shares are still up an astounding 1500% over the last year.

Industry rivals like Moderna (NASDAQ:MRNA), Pfizer (NYSE:PFE), and BioNtech (NASDAQ:BNTX) all benefited from AstraZeneca’s falter, although each stock has been up and down until the end of the week. Some analysts are speaking about if a Biden Administration would hand out the same loans to these biotech companies for a coronavirus vaccine but with AstraZeneca’s failure, the desperation for a vaccine has heightened.

NVAX Stock News

Investors should act fast if they believe NVAX has a chance at taking over the lead in Operation Warp Speed. Shares have settled and Novavax also has a flu vaccine called NanoFlu that is coming down the pipe that could translate to another revenue stream moving forward. NanoFlu is getting ready to be submitted for final FDA approval which could mean that Novavax and its investors may not have to rely on a successful coronavirus vaccine for the stock to return to its previous levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD gains ground above 0.6300 ahead of Chinese data

The AUD/USD pair gathers strength to near 0.6325 during the early Asian session on Monday. The uptick of the pair is bolstered by the weaker US Dollar and special plans from the Chinese government to boost consumption and raise incomes.

EUR/USD: A move to 1.1000 re-emerges on the horizon

EUR/USD enjoyed a broadly upbeat run last week, extending its strong recovery and briefly surpassing the 1.0900 handle to reach multi-month highs. Although the rally lost some momentum as the week wore on, the pair still ended with a solid performance on the weekly chart.

Gold: Bulls act on return of risk-aversion, lift XAU/USD to new record-high

Gold capitalized on safe-haven flows and set a new record high above $3,000. The Fed’s policy announcements and the revised dot plot could influence Gold’s valuation. The near-term technical outlook suggests that the bullish bias remains intact.

Week ahead: Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears.Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.