Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with NORTHERN STAR RESOURCES LTD – NST. Our recently updated forecast for NST in the Top 50 ASX Stocks service is still active. We have identified a bullish opportunity with NST, setting up wave (iii)-purple of wave ((iii))-blue that could push much higher.

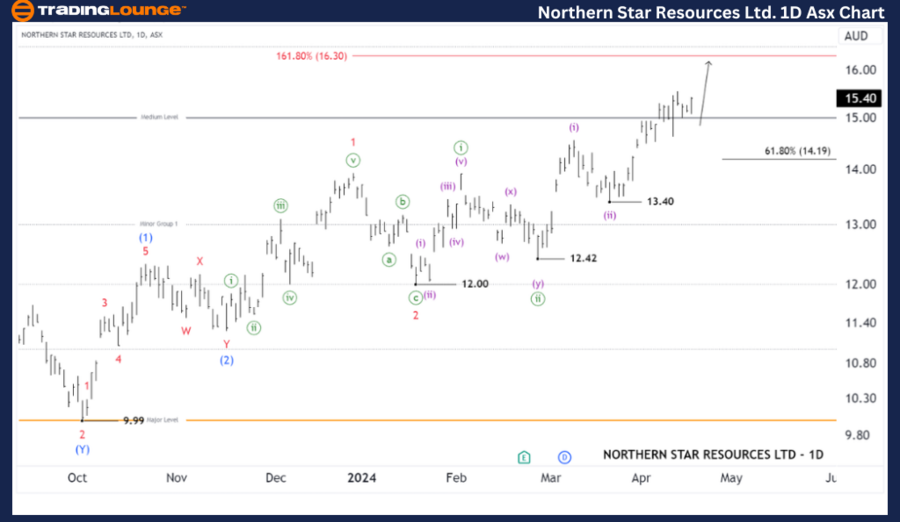

ASX: Northern Star Resources Ltd – NST Elliott Wave technical analysis

Function: Major trend (Intermediate degree, blue).

Mode: Motive.

Structure: Impulse.

Position: Wave (iii)-purple of Wave ((iii))-green of Wave 3-red of Wave (3)-blue.

Recent analysis: Accurate forecast.

Details: The detailed short-term outlook shows that wave (3)-blue is unfolding, subdividing into waves 1 and 2-red, which have completed, and wave 3-red is currently unfolding to push higher. At a smaller degree, wave (iii)-purple is opening to push even higher, targeting an immediate objective around 16.30, while maintaining a price above 14.19 is an advantage and strong support for this bullish outlook.

Invalidation point: 13.4 .

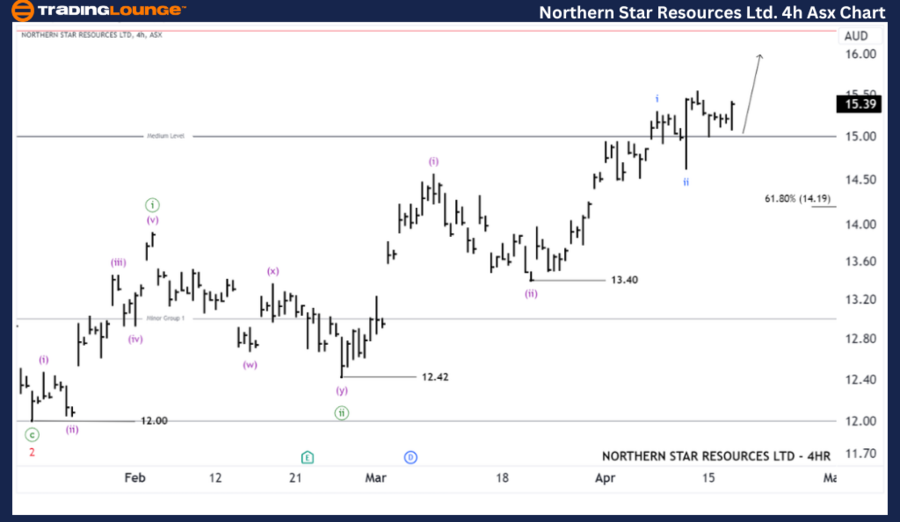

ASX: Northern Star Resources Ltd – NST four-hour chart analysis

Function: Major trend (Minute degree, green).

Mode: Motive.

Structure: Impulse.

Position: Wave (iii)-purple of Wave ((iii))-green.

Details: The shorter-term outlook indicates that the (iii)-purple wave seems to be unfolding to push higher. It is subdividing into the i-blue and ii-blue waves, with the ii-blue wave potentially just completed. The iii-blue wave might be ready to push higher as long as the price remains above the support level at 14.19, which would be advantageous for this perspective.

Invalidation point: 13.40.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: NORTHERN STAR RESOURCES LTD – NST aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Northern Star Resources Ltd Elliott Wave technical forecast [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD holds gains below 1.1000 ahead of US CPI release

EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

GBP/USD trades firm above 1.2850, US CPI data awaited

GBP/USD sustained the rebound above 1.2850 in European trading hours on Thursday. The British Pound capitalizes on risk appetite, courtesy of Trump's tariff pause, allowing the pair to recover ground. But further upside hinges on the US CPI data and US-Sino trade updates.

Gold price rallies further beyond $3,100; eyes all-time high amid US-China tariff war

Gold price continues to attract safe-haven flows amid rising US-China trade tensions. Bets for multiple Fed rate cuts weigh on the USD and also benefit the precious metal. A solid recovery in the risk sentiment fails to undermine the safe-haven XAU/USD pair.

XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.