North Korea's repeated actions are a serious challenge to international peace

In early trade today, Japan urged residents to take shelter early Tuesday morning after North Korea had been reported to have fired another one ballistic missile over the north of the country.

This escalation of Pyongyang’s missile tests has prompted immediate backlash from Tokyo and has put markets on risk-off alert.

South Korea’s Joint Chiefs of Staff (JCS) confirmed the missile passed eastward over Japan after launching from North Korea’s Mupyong-ri area in Jagang Province at around 7:23 a.m. local time.

South Korea's national security council on Tuesday condemned the test and said these constant provocations by the North cannot be tolerated.

"South Korea clearly states that North Korea's continued provocations cannot be overlooked and will come at a cost, while we will seek various measures against North Korea, including strengthened sanctions within the international community, based on close cooperation with the United States," according to a statement published after the national security council convened a meeting.

The launch has increased the tally for 2022, the most prolific year for ballistic missile tests since Kim Jong Un assumed power in North Korea in 2012, according to the Unification Ministry and a CNN tally as of this past weekend. According to CNN’s count, Tuesday’s launch marks North Korea’s 23rd missile launch this year, including both ballistic and cruise missiles.

Addressing the media Tuesday, Japanese Prime Minister Fumio Kishida condemned the launch.

“Recent repeated ballistic missile launches are outrageous and we strongly condemn it,” Kishida said during a press conference at his official residence.

Japan won't rule out any options, including counterattack capabilities, as it looks to strengthen its defences in the face of repeated missile launches from North Korea, Defence Minister Yasukazu Hamada said on Tuesday.

"In light of this situation, we will continue to examine all options, including so-called 'counterattack capabilities' and not rule out anything as we continue to work to fundamentally strengthen our defence abilities," Hamada told a briefing.

The mounting concern is a nuclear test by N.Korea that would be a game changer as this would provoke international outcry and a response from the US.

Pyongyang has carried out six nuclear tests since 2006, with the most recent, and most powerful in 2017.

Satellite images taken in recent months show signs of activity in a tunnel at the nuclear test site Punggye-RI.

In the meantime, Japan's chief cabinet secretary Matsunosaid said that North Korea's repeated actions are a serious challenge to international peace and Japan will work with allies appropriately when asked whether Japan will impose further sanctions on North Korea.

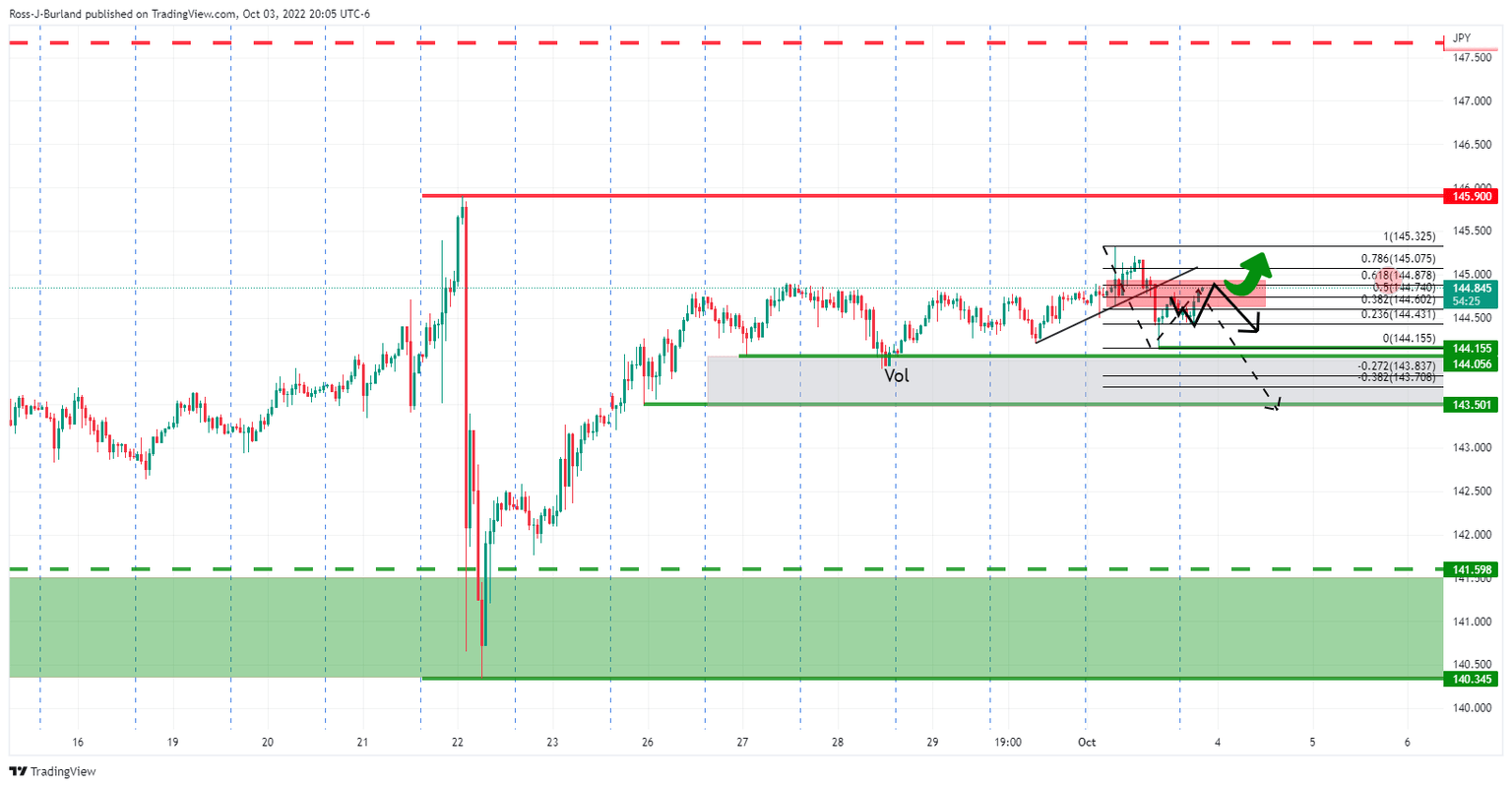

Meanwhile, the yen was slightly bid on the news early in the day but has since been moved lower by a resurgence in the greenback in tokyo, with USD/JPY now trading higher by some 0.19% to 144.82.

USD/JPY is moving in on a 61.8% retracment level in the 144.80s and a break here will leave a bias for the upside for the day ahead with eyes on the prior highs near 145.30. However, if resistance holds, then there will be significant risk of a move t test below 144.00.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.