- Nokia has been on the radar of the /wallstreetbets investor community.

- NOK a technology dinosaur, will it return?

- Nokia announces results that are steady but uninspiring!

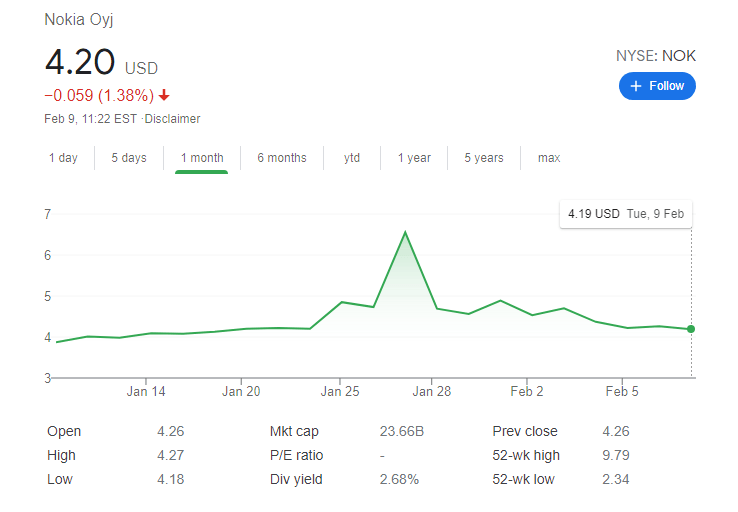

Nokia (NOK) has been edging lower on Tuesday, falling nearly 10 cents or around 2% to $41.8 at the time of writing. The gradual decline still leaves the Finnish multinational's stock above levels seen in mid-January – yet below the surge prices of over $6 recorded toward the end of last month. Bulls on shares of the former cellphone maker giant may be encouraged by its upbeat financials. Most importantly, Free Cash Flow has turned positive. Will bargain-seekers and Reddit retail traders push shares forward? Nokia is all about Connecting People, as the company's old slogan goes.

Nokia has been one of the stocks of 2021, soaring volatility and soaring volumes were the result of a doubling of the NOK share price in January. NOK found itself caught up in the Reddit-fueled /wallstreetbets phenomenon. Nokia was seen as a battered down, former tech behemoth, just waiting to regenerate. Blackberry, another dinosaur from the early age of mobile phone use, also coincidentally was targeted by the /wallstreetbets group.

Nokia was the biggest mobile phone maker in the world in the early days of the mobile phone industry. Producing innovative and reliable handsets that were snapped up by consumers. Nokia (NOK) was the Apple (AAPL) of the time during the embryonic mobile phone days.

The rise of the smartphone sounded the death knell for Nokia. The smartphone killed off Nokia’s (NOK) dominance as it failed to move with the times. Apple (AAPL) introduced the iPhone and the world was changed forever. Not a smartphone but a handheld computer. Other manufactures quickly realized the changing landscape and launched competing products, Google (GOOGL) launched Android to compete. Asian manufactures such as Samsung became Apple's main competitor but Nokia (NOK) failed to move with the times.

All this has seen Nokia slide from its place as the biggest, most traded stock in the EuroStoxx with a share price near $60 in June 2000 to its current position where investors are excited by the share price nearly doubling from $4.50!

NOK Stock Forecast

So where to from here? The Reddit boom appears to be over with the NOK share price quickly collapsing back toward its starting point for the year. NOK is now only up 7% for 2021, closing on Friday at $4.22. Perhaps the fact that Nokia is not a heavily shorted stock compared to Gamestop, AMC, and others, precipitated the sharp decline.

Nokia reported modest results on Feb 4 with EPS and Revenue coming in mostly unchanged from a year earlier. NOK did not give any guidance for the year ahead.

Back to normality

NOK shares are back to their more recent range, having given up all gains fuelled by the /wallstreetbets phenomenon. Nokia was forced to issue a statement at the peak of the Reddit rally saying it had no reason for the surge in its share price and that its underlying business had not changed.

This alone should mean a return to long-term averages for NOK and results confirmed the trend with flat revenue and EPS.

NOK Technical analysis

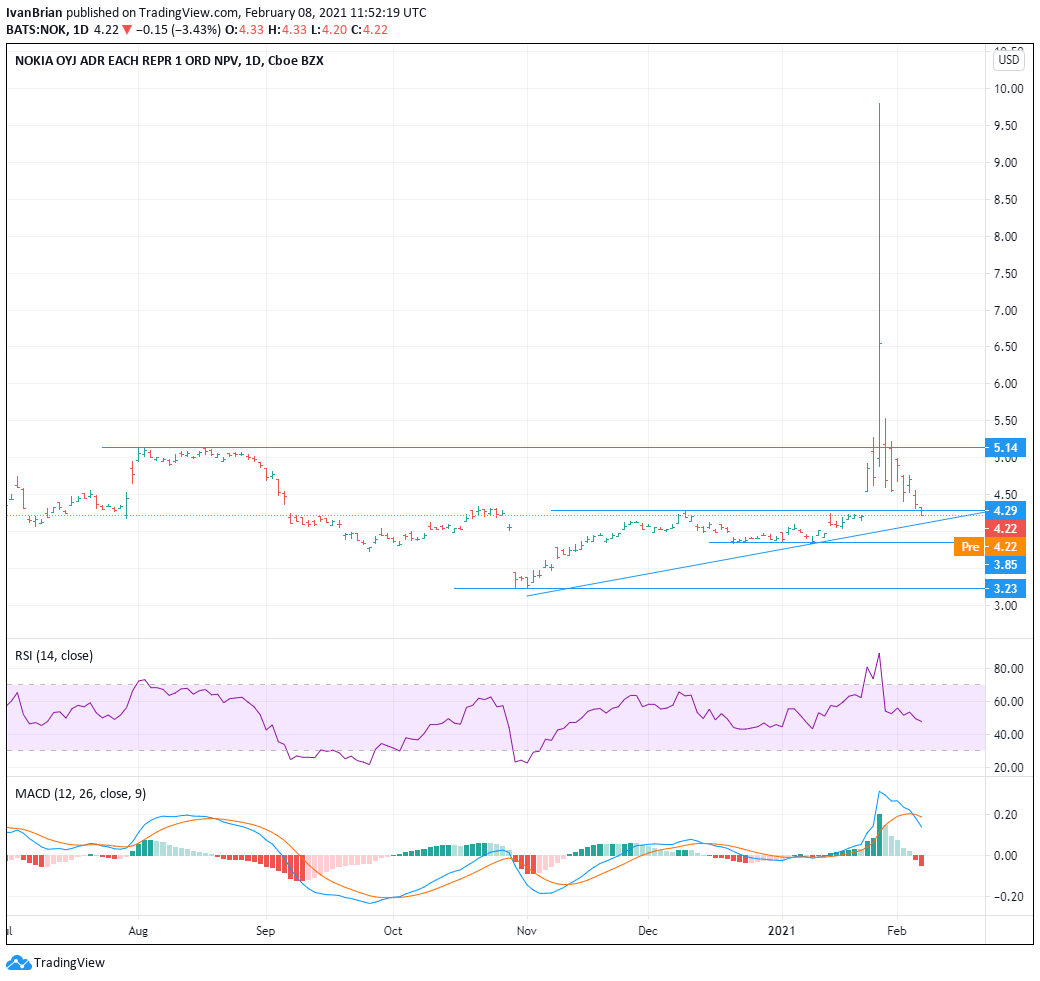

So back to normality then! Support at $4.29 was broken on Friday. Next support at $3.85 is key to keeping the bullish tone intact. $5.14 is the first resistance to the upside, ignoring the crazy price action around Jan 27. The open on Jan 27 of $4.99 is also resistance, being the starting point for the explosion. MACD has crossed to give a bearish signal, the RSI is neutral.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades in a rangebound mood around $3,300

Gold now seems to have embarked on a daily consolidation around the $3,300 mark per troy ounce following an all-time peak near $3,320 during early trade. Continued concerns over the escalating US-China trade tensions and a weakening Greenback, support the demand for the metal prior to Powell's speech.

EUR/USD remains consolidative around 1.1350 on firmer US Retail Sales

EUR/USD maintains its daily gains around the 1.1350 region on the back of the resumption of the bearish tone in the Greenback, which showed no reaction to the stronger-than-expected Retail Sales in March. Later in the day, investors are expected to closely follow Fed Chairman Powell’s comments on the economic outlook.

GBP/USD recedes from tops and revisits the 1.3250 zone

GBP/USD extends its positive streak on Wednesday, now coming under some selling pressure around the 1.3250 after earlier multi-month tops around the 1.3300 mark. The daily uptick comes on the back of the weaker US Dollar and easing inflationary pressure in the UK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.