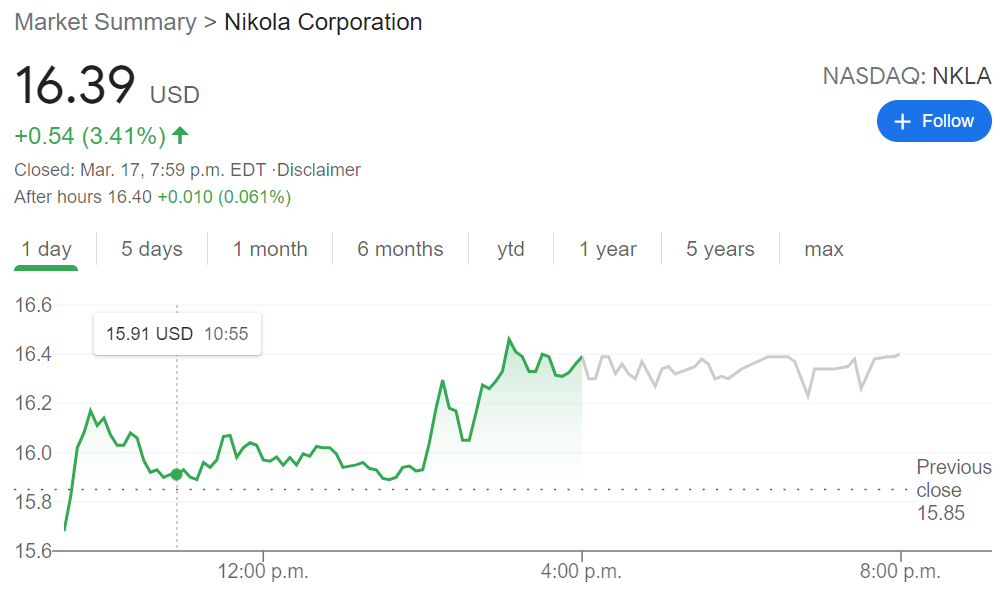

- NASDAQ: NKLA gained 3.41% as the broader markets finished the trading session strong.

- Nikola strategic partner Hanwa dumped half of its shares according to an SEC filing.

- Nikola plans to raise $100 million in capital to fund the completion of its production facility in Arizona.

NASDAQ: NKLA has continued its erratic performance into 2021 and even without founder and former CEO Trevor Milton, the company just cannot seem to find its way. On Wednesday the beleaguered electric truck stock took advantage of the bullish end to the trading day and added 3.41% before the closing bell. Shares are now down a staggering 40% since Nikola hit $28.58 during the Reddit meme stock short squeeze in late January. Nikola is trading well below its 50-day and 200-day moving averages, and continues to trend back down towards the NAV price of $10.00 before its SPAC IPO merger.

Stay up to speed with hot stocks' news!

Another bearish announcement came after hours on Wednesday as a crucial strategic partner parted with half of its stake in Nikola. Hanwa, a large business conglomerate based out of South Korea, reportedly sold off 11 million shares for an estimated value of $180 million. It is the second major stakeholder that has parted ways with Nikola as fuel cell supplier Robert Bosch GmbH, more commonly known as Bosch, also sold off 4 million shares in December of 2020. This also follows months of posturing between Nikola and General Motors (NYSE:GM), which seriously diluted the partnership after Nikola was struck with allegations of fraud.

NKLA Stock price prediction

Nikola itself is selling $100 million of its shares to raise further capital for its new production facility in Arizona. The stock plummeted on the news during Tuesday’s trading session, even though Nikola announced plans to develop delivery trucks for Anheuser-Busch (NYSE:BUD) as well as continuing with its BEV truck development in Germany.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD continues soft as markets digest employment data

The AUD/USD declined by 0.34% to 0.6470 in Thursday's session, extending its decline to a fresh three-month low of 0.6460. The US Dollar is easing after mixed data, while weak Australian employment data has reduced inflationary concerns, which might change the outlook of the Reserve Bank of Australia.

USD/JPY jumps above 156.50 after Japanese GDP, eyes on US Retail Sales data

The USD/JPY pair extends the rally to around 156.60, the highest level since July 23 during the early Asian session on Friday. The upward movement of the pair is bolstered by the firmer US Dollar broadly. Traders brace for the US October Retail Sales, which is due later on Friday.

Gold falls as Powell signals Fed's patience on lowering rates

Gold recovers some ground on Thursday yet remains trading below its opening price for the fifth consecutive day, undermined by the Greenback’s advance for its own fifth consecutive day. A slightly hot inflation report in the US and solid jobs data sponsored XAU/USD’s leg down toward the 100-day SMA.

Bitcoin Price Forecast: BTC eyes $100K, what are the key factors to watch out for?

Bitcoin trades below $90K in the early Asian session on Friday as investors realized nearly $8 billion in profits in the past two days. Despite the profit-taking, Bitwise CIO Matt Hougan suggested that BTC could be ready for the $100K level, fueled by increased stablecoin supply and potential government investment.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.