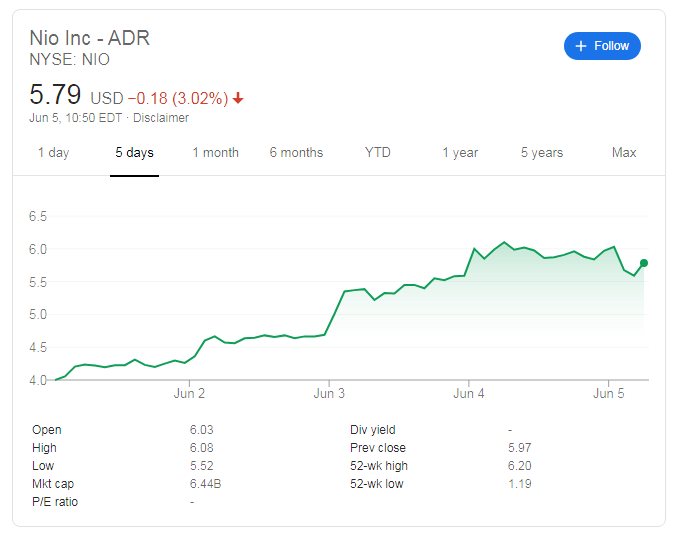

- NIO's stock price has been hesitating under $6.

- Tesla's Elon Musk called for competition, albeit in another context.

- A better rating from Goldman Sachs and a shift toward cars may further boost the stock.

Can NIO, an electric car-maker, surge to new highs? The Chinese carmaker is little-known in a world dominated by Elon Musk's Tesla, but the electrical car celebrity, also known for SpaceX and anti-lockdown politics, may have room to run.

Musk complained about the lack of competition, referring to another billionaire VIP, Jeff Bezos of Amazon. He vented his anger at Amazon's downing of a book he wrote before the online retail behemoth reinstated that book. Nevertheless, Musk's comment opens the door for much-needed competition in the EV space.

Fei Fang, an analyst with Goldman Sachs, upgraded his recommendation for NIO, setting a target of $6.40. He cited an improving burn-rate for the firm and suggested it may break even once it hits the 10K car / month production milestone.

Sales are 30% up on the year despite Elon Musk's high profile and price cuts enacted by Tesla. Moreover, Fang states that Musk's firm lost its prestige gap by lowering the price, making consumers indifferent.

Citizens across the world have enjoyed the cleaner air that was coronavirus' silver lining. That inspires governments, especially in Europe, to expand their shift toward electric cars. As Washington and Beijing grow further apart, China and the EU may get closer, potentially opening a market for NIO.

NYSE: NIO forecast

The next move higher in NIO's stock price depends on breaking above $6 which is a psychologically significant level, or more precisely, above $6.20, which is the 52-week high. The low in the past 52 weeks was $1.19, so the carmaker is now work more than five times its value at the lows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rebounds from session lows, stays below 1.0600

EUR/USD recovers from the session low it set in the European session but remains below 1.0600 on Tuesday. Although the US Dollar struggles to gather strength following disappointing housing data, the risk-averse market atmosphere caps the pair's rebound.

GBP/USD remains under pressure below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday, pressured by safe-haven flows. BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook but this comment failed to boost Pound Sterling.

Gold remains propped up by geopolitics

Gold retreats slightly from the daily high it touched near $2,640 but holds comfortably above $2,600. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help XAU/USD hold its ground.

Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.