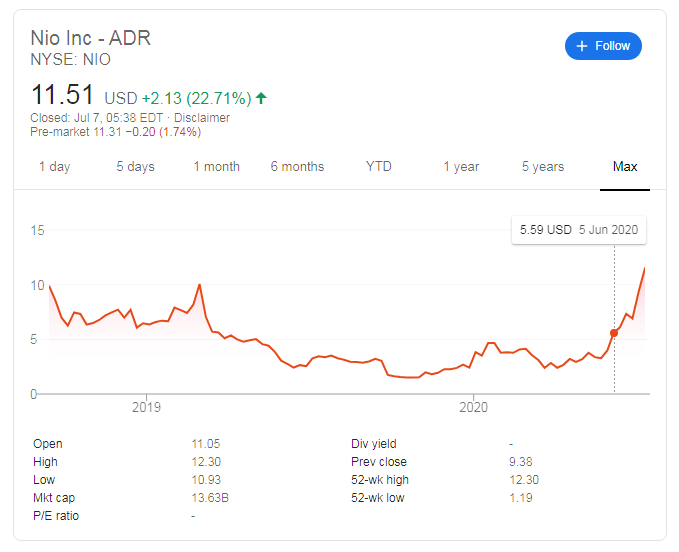

- NYSE: NIO has hit a record high of $11.51 following robust sales for the second quarter.

- The Chinese electric car maker benefits from a robust financial standing following government support.

- Elon Musk's Tesla, a competitor, is seen as overvalued by some and encourages investment in rivals.

Has NYSE: NIO at its peak? Shares of NIO Inc have closed at the highest ever on record, At Monday's closing price of $11.51, the Chinese electric carmaker's stock price has surpassed the previous peak of $10.60 recorded in March 2019.

Now valued at over $13 billion, can NYSE: NIO extend its gain? Looking at pre-market trading, it may endure a minor downward correction. Nevertheless, it has good reasons to rise.

NIO news today

The primary driver of NIO's ascent was its report of June's sales. Sales of EBs surged by 179% yearly and for the entirety of the second quarter, they are up around 191% in comparison to the parallel period in 2019. That is nearly tripling its sales.

Production in the Beijing-based company is working smoothly after China overcame the coronavirus crisis. The surge has shown NIO's resilience to the shock.

Full Q2 results are due out only at some point in August, but the company has a robust financial footing. While the company is trading in New York, it receives funding from the Chinese government. Backing from economic development authorities has allowed NIO to set up a new factory around Hefei, where it is based.

The third reason for the surge in NYSE: NIO stems from its competition. The No. 1 name in EVs is Tesla – owned by Elon Musk. The celebrity billionaire, who recently supported Kanye West's run for US President, has also benefitted from robust revenues, which added some $14 billion to Tesla's valuation.

However, Musk's firm is also benefiting from hype and may be overvalued. Its market capitalization topped that of Toyota, which produces 25 times more cars. Is Tesla in bubble territory? Those seeking EV investment may prefer NIO, especially after its successful results, as well as other companies.

See

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.