- NYSE: NIO gained 8.37% during Friday’s trading session.

- Chinese economic data shows production costs are on the decline.

- China’s EV giant BYD makes plans for a new production site in Thailand.

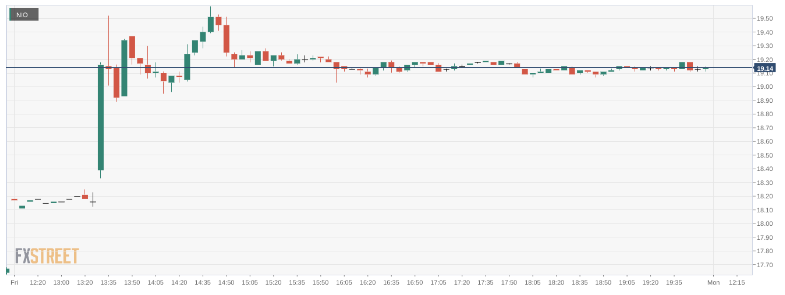

NYSE: NIO closed out the week on a strong note as the Chinese EV maker managed to post a near 4.0% gain over the past five trading sessions. On Friday, shares of Nio jumped higher by 8.37% and closed the trading week at a price of $19.16. Stocks rallied for the third straight day and snapped the three-week losing streak following the Jackson Hole Symposium. All three major averages closed higher on Friday. Overall, the Dow Jones added 377 basis points, the S&P 500 gained 1.53%, and the NASDAQ rose by 2.11% during the session.

Stay up to speed with hot stocks' news!

What had Nio surging by more than 10% during intraday trading? Chinese economic data revealed consumer prices and producer costs both slowed during the month of August. The August CPI rose by 2.5%, which was slower than the 2.7% for July and well below the 2.8% that was widely forecasted by analysts. The results were the first sign that the Chinese economy could be recovering despite the ongoing COVID lockdowns. The data sent the Hang Seng index in Hong Kong higher during Asian trading as well. Nio in particular had mentioned that higher costs were eating into their margins in the previous quarter, so lower production costs will likely lead to higher profits.

NIO stock forecast

China’s EV leader BYD has made plans for its first production facility outside of China. The company announced it will build a location in Thailand with production to begin as early as 2024. The move is the latest in BYD’s global expansion that will see the company debut EVs in markets like Japan and Germany in the near future.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains above 1.0800 after EU inflation data

EUR/USD is holding gains above 1.0800 in the European session on Tuesday after the mixed Eurozone inflation data. The pair is driven by renewed US Dollar weakness as attention turns toward the US jobs survey and ISM PMI data amid looming Trump's reciprocal tariffs.

GBP/USD turns higher above 1.2900 ahead of US data, tariffs

GBP/USD has regained upside traction above 1.2900 in Tuesday's European trading. A fresh round of US Dollar selling lift the pair ahead of the top-tier US economic data releases and Wednesday's tariffs announcements.

Gold price hits new all-time high ahead of Trump’s reciprocal tariffs

Gold price edges higher again for a second day this week and for the first day of the second quarter of 2025. The precious metal trades slightly above $3,130 at the time of writing and the new all-time high was eked out at $3,149 this Tuesday.

JOLTS job openings set to decline modestly in February

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to decline to 7.63 million on the last business day of February.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.