Nio Stock News and Forecast: NIO pops as Deutsche reaffirms Buy rating

- NIO stock soars over 13% on Monday as markets rally.

- NIO remains a buy at Deutsche Bank.

- NIO is down 35% year to date and over 40% from a year ago.

Nio (NIO) stock performed well on Monday as equities rallied again after a strong Friday. NIO though was a notable gainer as it surged over 13% higher to close Monday at $21.75.

NIO stock news

The news in my opinion is not news at all. Rather the reporting is perhaps a bit overly bullish. Deutsche Bank merely reiterated its Buy rating on NIO. It did not upgrade its rating, and it kept its price target at $39. This is the same Deutsche Bank that only as recently as August lowered its price target from $45 to $39 and maintained a buy rating. This seems a bit like a fuss about nothing.

Others on social media are pointing to Bank of America raising their price target for NIO. Correct, they moved it from $29 to...wait for it...$30!

Meanwhile, Citi dropped its price target from $41.10 to $31.30 after results last week. JPMorgan also cut its price target from $30 to $25, last week. Nio reported earnings last week that were mixed. EPS came in lower than consensus at $-0.20 versus $-0.18, but revenue of $1.54 billion did beat their mark by just over $100 million. Nio said it expects Q3 vehicle deliveries to be 32,000 at the midpoint of the guided range. Overall then, analysts remain mostly bullish on the stock with a current mean price target of $32.99 from Refinitiv. Much ado about nothing then.

NIO stock forecast

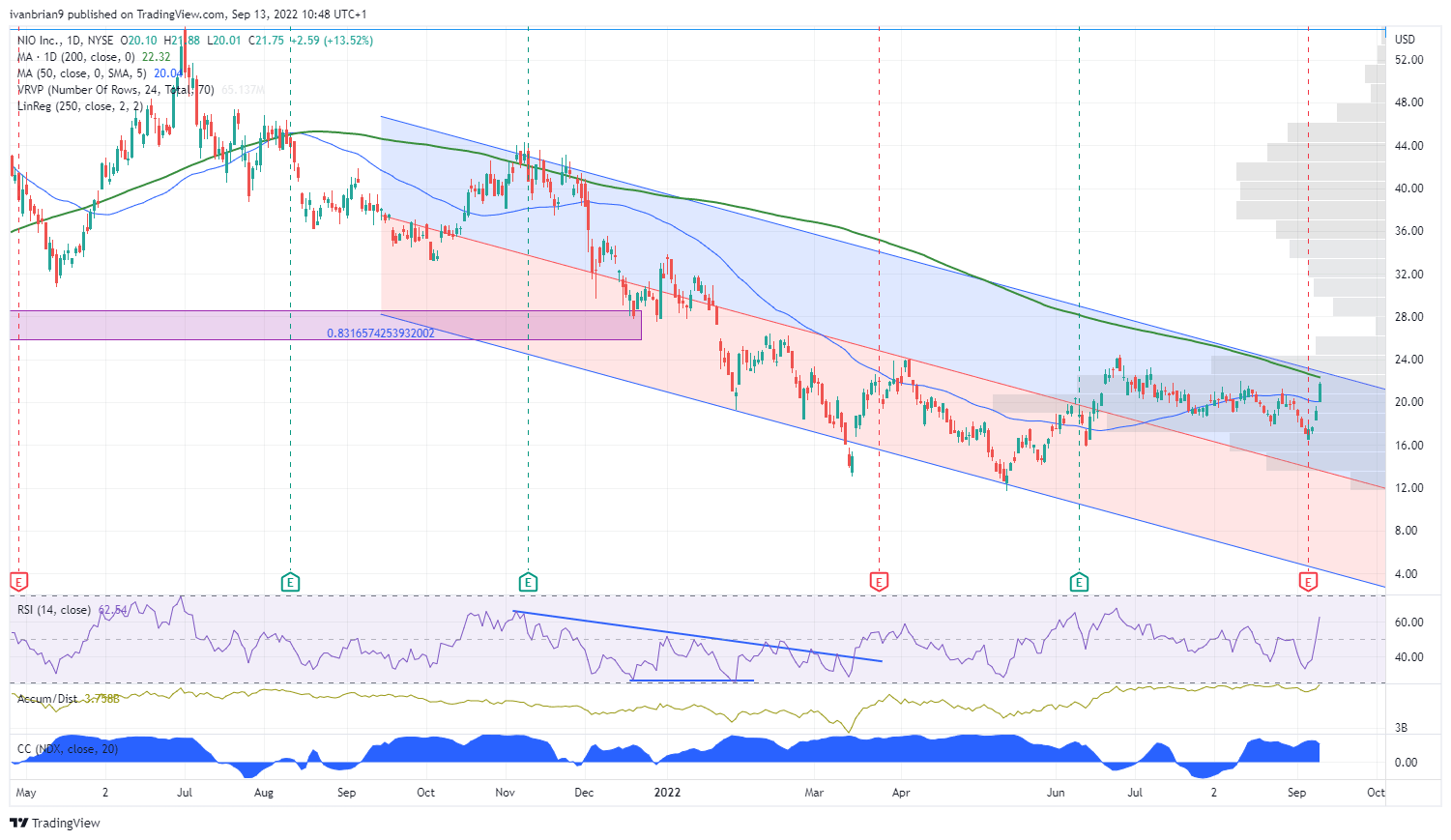

NIO has now more or less retraced to the 200-day moving average. This is a big resistance level and may prove difficult to break at $22.32. Most likely the move on Monday was a combination of risk-on and China-on, as well as reports that the proposed restrictions on NVIDIA chips going to China will not affect Nio. Breaking the 200-day moving average will then see $24.51 as the next resistance, which would confirm a new bullish trend. $20 is the pivot.

NIO stock, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.