Nio Stock News and Forecast: NIO earnings preview

- Nio stock surged on Friday to close over 10% higher in New York.

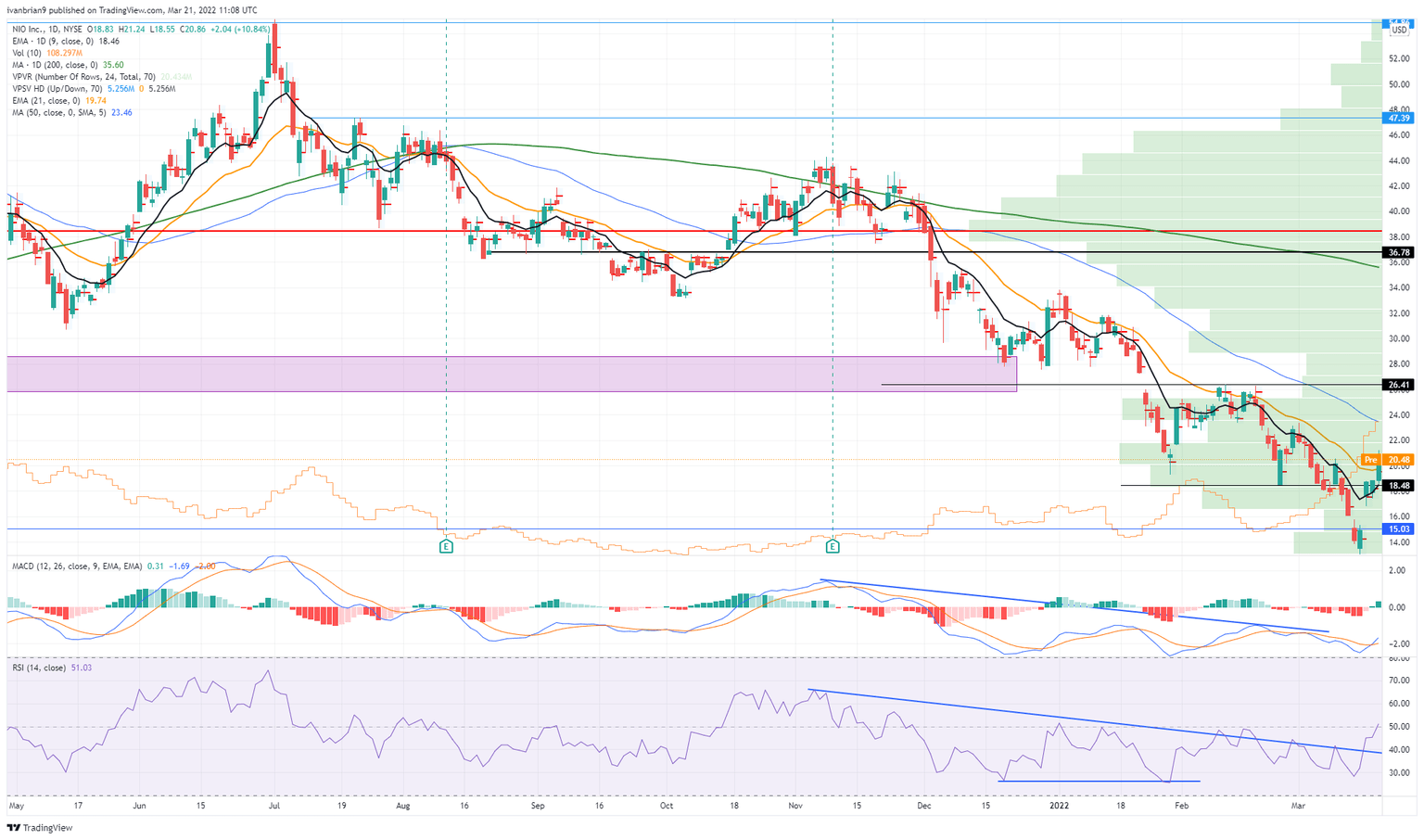

- NIO stock closes above the $18.48 key resistance level.

- Nio is set to report earnings later this week.

NIO stock shot back into contention on Thursday and Friday once the Chinese verbal intervention took place. For those not familiar, NIO and other Chinese tech stocks have been under severe pressure the last few months as worries over possible delisting hit sentiment. Regulatory concerns and a possible crackdown by Chinese authorities also hit many Chinese tech stocks and made them uninvestable in the words of investors. However, all this changed last week when Chinese authorities finally intervened to prop up sentiment. This caused a massive rally in Chinese tech stocks with NIO brought along for the ride. NIO stock closed up 25% on Wednesday and added nearly 10% on Friday.

NIO Stock News

We note overnight that news of price hikes from NIO have been put on the back foot. Other EV automakers such as Tesla have been hiking prices in response to rising input costs, especially nickel. A recent report from Morgan Stanley estimated that commodity hikes should add about $2,000 to the price of an EV, and Tesla and others have been forced to raise prices. NIO however is for now bucking the trend. IGreatBI, a technology media company, quoted Qin Lihong, cofounder and president of NIO, saying NIO would not raise prices at this time. This comes as Li Xiang, CEO of Chinese EV maker Li Auto (LI), said via translation from CNEVPost that price hikes are on the way for all EV makers and the timing depends on contracts made with battery suppliers. He said the cost of batteries rose by a ridiculous amount.

Nio reports earnings on Thursday.

NIO Stock Forecast

We had for some time a bullish divergence on the Relative Strength Index (RSI), but the NIO share price kept on falling, so the timing was difficult. Now the sharp move higher has seen the RSI break out of the long-term downtrend. This signals that a possible bottom is in place. The Moving Average Convergence Divergence (MACD) too has broken out. Holding $18.48 is key. The next resistance is the 50-day moving average at $23.46, followed by $26.41.

NIO chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.