NIO Stock Forecast: Nio Inc tanks as weak guidance overshadows earnings beat

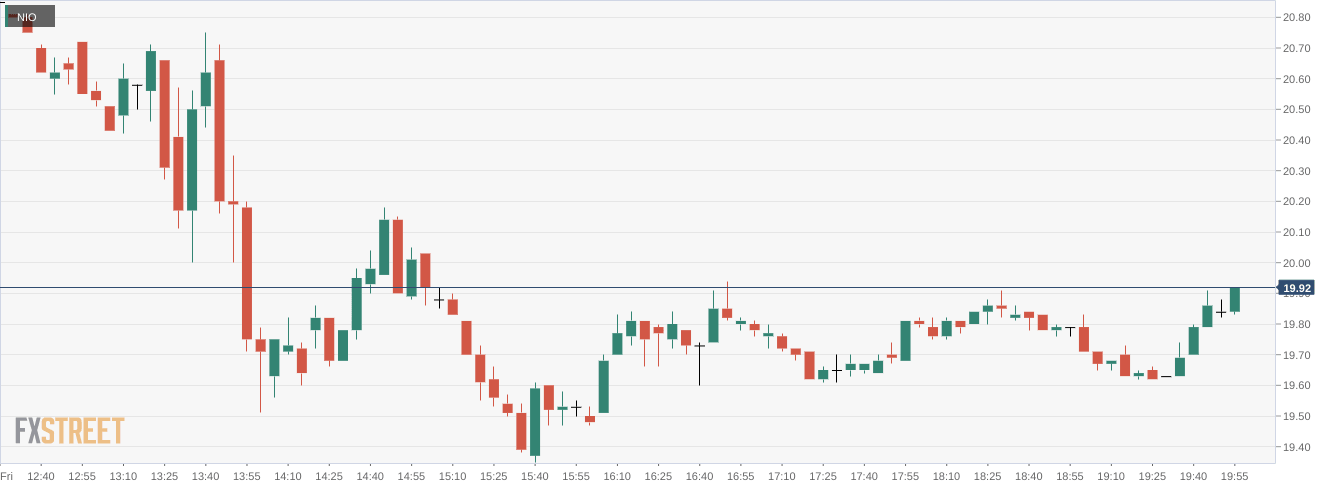

- NYSE:NIO fell by 9.42% during Friday’s trading session.

- Nio beat Wall Street expectations for the quarter, but deliveries guidance was underwhelming.

- The long-term outlook is still positive for Nio despite the stock selling off.

NYSE:NIO had an earnings report that was in line with what most investors and analysts expected, but the stock still tumbled during Friday’s session. Shares of Nio plummeted by 9.42% and closed the trading week at $19.91. The week closed on a mixed note, as investors weighed interest rate hikes and the ongoing situation in Ukraine. All three major indices did manage their second consecutive positive weeks. The Dow Jones gained 153 basis points, while the S&P 500 eked out a 0.51% rise. The NASDAQ was the lone index in the red, falling by 0.16% to close the week.

Stay up to speed with hot stocks' news!

After the close on Thursday, Chinese EV maker Nio reported its Q4 2021 earnings. The numbers were mostly impressive as Nio reported $1.6 billion in sales which represented a 49% year over year rise. The company delivered 25,034 vehicles in the fourth quarter and 91,429 vehicles in the full year 2021. Gross margins also rose significantly from 11.5% in 2020 to 19% in 2021. The only number that analysts didn’t approve of was the guidance for 25,000 to 26,000 deliveries in the first quarter of 2022. Analysts were expecting 28,000 from Nio.

NIO stock price

It might be surprising to long-term investors that Nio sold off as much as it did on Friday. The numbers were good and in line with what most people expected. Deliveries were already expected to be lower given the ongoing supply chain issues and global chip shortage. Long-term investors will want to chalk this up to an overreaction, and might want to take advantage of depressed prices.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet