NIO Stock Forecast and Quote: NIO increases deliveries by 400% and tops $40

- NIO releases an update on Q1 2021 deliveries.

- The Chinese EV maker saw deliveries rise over 400% YoY.

- XPeng also reported a jump in EV deliveries.

Update April 1: Investors in NIO (NYSE: NIO) do not seem to be fooled on April Fool's Day – shares have good reasons to rise, most notably due to the firm's massive sales. A leap of 400% defies previous negative prospects and sends the stock above $40. However, it is still well below the March 1 closing level of nearly $50 and far under the 52-week peak of $66.99. The Chinese carmaker has significant competition from XPeng and other vehicle markers. Nevertheless, the companies compete in different niches, allowing them to grow in parallel.

NIO shares are surging ahead on Thursday in early pre-market trading as the company releases details of Q1 2021 deliveries. NIO and other electric vehicle makers are also receiving a boost from President Biden's $2 trillion infrastructure plan.

Stay up to speed with hot stocks' news!

NIO is a Chinese electric vehicle (EV) manufacturer founded in 2014 that designs, manufactures and sells smart vehicles. It is also involved in the autonomous driving sector.

NIO stock news

NIO released Q1 2021 delivery data early on Thursday. The numbers have clearly reassured investors with the shares jumping. NIO had earlier announced it has suspended production for five days due to semiconductor shortages. The suspension is in its Hefei plant beginning on March 29. A global semiconductor shortage has been an ongoing problem for auto manufacturers in 2021.

Anyway, let us look at the delivery numbers! NIO delivered 7,257 vehicles in March 2021, an increase of 373% YoY. NIO delivered 20,060 vehicles in the quarter ending March 2021. This is a 423% increase YoY. NIO also said cumulative deliveries of its ES8, ES6 and EC6 hit 95,701.

XPeng (XPEV) also released delivery numbers, and these too showed impressive growth.

XPeng delivered 5,102 smart electric vehicles for March 2021, a 384% YoY growth and a 130% MoM increase.

Shares in XPeng are also taking the news positively and are up 13% in Thursday's pre-market at $38.41. See more on XPeng deliveries and technical levels.

Electric vehicle stocks were all strong on Wednesday as President Biden unveiled his $2 trillion infrastructure plan. As part of the plan, $621 million is earmarked for infrastructure, roads and electric vehicle development. Tesla, the EV sector leader, jumped 5% on Wednesday.

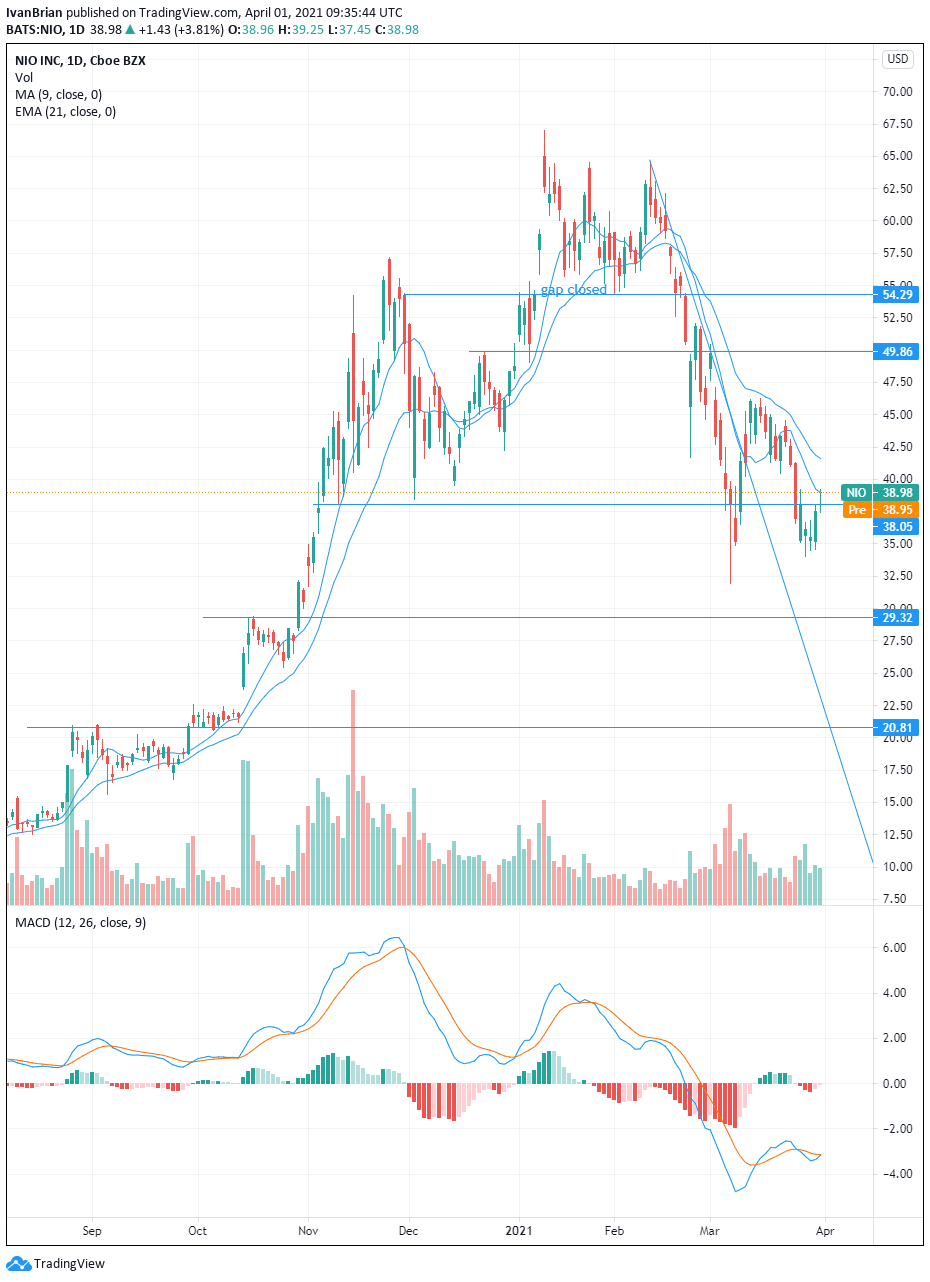

NIO technical analysis

NIO shares have been under considerable pressure, having had a huge appreciation in 2020. NIO shares rose from $2.53 to $48.74 in 2020. The EV sector, in general, saw huge gains in 2020 as EVs became mainstream and Tesla entered the S&P 500 index.

2021 has been more of a struggle for NIO as investors look to justify such wild gains from the previous year. The fundamentals still look a little stretched, but a continued record growth in deliveries would allow earnings to effectively catch up with the share price.

NIO released Q4 results on Monday, March 8.

EPS was -$0.16 versus an estimate of -$0.07, according to Refinitiv. Revenue came in slightly ahead of expectations at $1.03 billion versus $1.01 billion. This is a rise of 133% from a year earlier.

The outlook was relatively conservative and disappointed investors. This delivery update may help temper recent disappointment.

The valuation is still stretched by traditional methods. NIO is not forecast to turn a net profit until 2023, based on the latest Refinitv data, and even then at the current price that would give a P/E of 257. This is a P/E matched by very few companies except maybe Tesla. Investors will seize on NIO becoming the next Tesla. But Tesla might not even be the next Tesla as more and more legacy automakers enter the EV space.

Volkswagen recently announced its intention, and the share price has rocketed. The EV sector is to become a lot more competitive. So longer term this one is a cautious investment as it is very early stage.

Short-term traders do not really need to worry too much about the underlying fundamentals or valuation ratios. The trend is more important.

Here we have some better news. The MACD indicator is just about to cross over, giving a bullish signal. Another day of gains should see them cross. If NIO holds gains then the recent low at $34 is a higher low than the previous. So a bullish trend could be forming of higher lows. To confirm we need a higher high. The first resistance to take out is the 9-day moving average at $38.95, then $40.38, and then $46.18 would give a higher high. Breaking the low at $31.91 from March 5 would be bearish.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.