- Nio stock falls in Tuesday's premarket as it releases delivery numbers for February.

- Li Auto also reports the delivery number for February on Tuesday.

- NIO surged on Monday as the EV sector recovered from recent heavy losses.

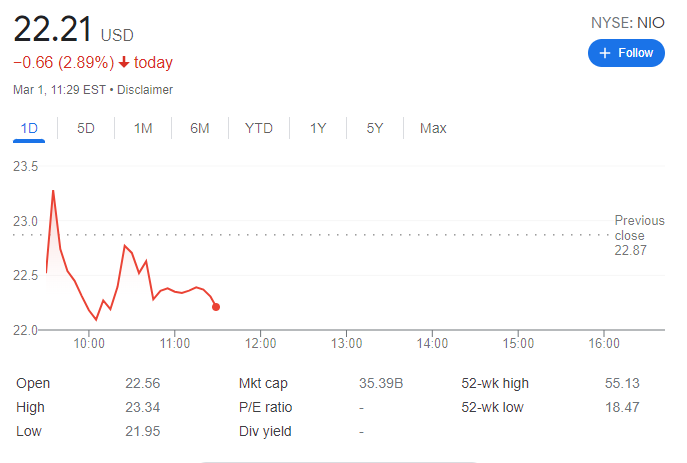

Mid-afternoon update: Global indexes took a turn to the worst in the European morning amid renewed attacks on Ukraine from Russia, and as the latter ignores global sanctions and peace talks. Wall Street opened in the red and continues to fall as the day goes by, while commodities aim north, crude oil backed by fears or supply shortage, and gold pushed by safety demand. In this scenario, NIO stock maintains the red, trading at $22.21 per share, down 2.89% at the time being.

At the same time, demand for government bonds keeps raising, pushing yields lower, as investors are temporarily ignoring inflationary pressures. Worth noting that escalating tensions in Eastern Europe are weighing on odds for rate hikes, particularly from the Bank of England and the European Central Bank. On Wednesday, US Federal Reserve chief Jerome Powell will testify before Congress and provide fresh clues about the country’s monetary policy.

Previous update: Nio is being weighed down on Tuesday by the Russia-Ukraine conflict, as well as read-across from EV competitor Lucid (LCID) missing earnings and cutting its production outlook in the afterhours on Monday. Nio stock is down 0.8% to $22.60. Shares of the EV maker dropped to a session low of $21.95 at about 10:00 AM EST. Brent oil is up 6.9% to $104.71, which is a worrying sign to US equity markets as high oil prices reduce consumer spending and can lead to recessions. Lucid shares are down more than 12.3% at $25.40, which is somewhat better than the premarket when they were down more than 16%. Tesla is now up 1.4%, Li Auto (LI) is up 2.5%, and Xpeng (XPEV) is down 4%. Nio shares are now trading at the same price as October 2020 and about 50% lower than their all-time high.

Nio stock (NIO) looks set for fresh losses on Tuesday as the company reported delivery numbers for February. These delivery numbers showed a month-on-month decline but a yearly increase of nearly 10%. NIO will release its fourth quarter and full-year 2021 earnings report on Thursday, March 24.

Nio Stock News

Nio reported February deliveries of 6,131 vehicles, representing a 9.9% yearly gain. Nio delivered 15,783 vehicles in 2022, an increase of 23.3% yearly. Nio's February deliveries are 36.4% lower than in January, but that can be largely attributed to the Lunar New Year festivities in China. February is also the shortest month of the year. The China-based EV maker ceased production from January 31 to February 6 for the holiday period, so essentially we are looking at a three-week comparative figure.

Nio also said it received a letter of in-principle approval on February 28 to list on the Hong Kong Stock Exchange. NIO stock in Hong Kong and New York are expected to be fully fungible and interchangeable, according to Benzinga. Li Auto (LI) also reported delivery numbers for February, and these also showed a monthly decline due to the Lunar New Year. Li Auto deliveries fell 31.3% in February versus January.

As it stands NIO stock is trading some 2% lower in Tuesday's premarket. The risk-reward was skewed to the downside as Nio stock rose 9% on Monday. EV stocks jumped on the back of some position closing with Russia Ukraine talks ongoing on Monday. However, the sector is likely to remain under pressure on Tuesday. Bad earnings from Lucid overnight will not help the sector. Lucid missed on earnings per share, revenue, and slashed its 2022 forecasts. Lucid is down 13% in Tuesday's premarket.

Lucid Stock: LCID earnings mean the game is up

Nio Stock Forecast

There is nothing too dramatic in these figures. The headline probably looks bad but can be explained away. However, there is certainly nothing here for bulls to get excited about. Nio remains in a strong downtrend, and only breaking $27.34 will change that. $19.31 remains the short-term pivot. Below here more losses are likely. Above this level some stabilization may take place.

Nio chart, daily

A break of $19.31 will then likely see a move to the next high-volume support at $13.90, as we can see from the weekly chart below.

NIO stock chart, weekly

Prior Update, 9:30 AM, EST: Nio looks likely to remain under pressure on Tuesday as global stock markets continue to retreat on news of the massive Russian convoy headed for Kyiv. Markets had taken some solace from talks between Russia and Ukraine breaking up yesterday with an agreement for further talks. Now with oil prices spiking back over $100 and European stocks again moving sharply lower, the prospects for US stocks look grim on the open. Lucid shares are down an unprecedented 16.4% in the premarket at $24.25, though Tesla is now even in Tuesday's premarket. All this will likely see Nio stock open lower, and currently the shares are indicating 1% lower at $22.61. This means Nio stock is now trading at the same price as October 2020 and about 50% lower than its all-time high.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0400 in quiet trading

EUR/USD continues to fluctuate in a tight channel at around 1.0400 in the European session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to find direction.

GBP/USD declines toward 1.2500 as markets turn cautious

GBP/USD stays under modest bearish pressure and retreats toward 1.2500 on Friday after posting small losses on Thursday. The cautious market mood doesn't allow the pair to gain traction, while trading volumes remain low following the Christmas break.

Gold struggles to build on weekly gains, holds above $2,620

Gold enters a consolidation phase and trades below $2,630 on Friday after closing in positive territory on Thursday. The risk-averse market atmosphere helps XAU/USD limit its losses as investors refrain from taking large positions heading into the end of the holiday-shortened week.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.