- NIO stock tumbles on Thursday as SEC may delist it.

- The Chinese EV automaker shares plunged over 15% on Thursday after rising on Wednesday.

- Nio Inc is still high-risk early stage and this adds more uncertainty.

Update: NIO stock plunged 15.17% on Thursday, hitting the lowest in two months at $14.87 before settling above the $15 mark. The slump in the Chinese Electric Vehicle (EV) maker came after the US U.S. Securities and Exchange Commission (SEC) widened its regulatory crackdown on US-listed Chinese companies for not disclosing audit reports. Additionally, the BOE warning on an incoming recession spooked markets and triggered a massive sell-off on global indices, not sparing Wall Street, with the tech-heavy Nasdaq Composite Index losing about 5% on the day. All eyes turn towards the US Nonfarm Payrolls data for fresh trading opportunities as an eventful week draws to a close.

NIO stock keeps struggling after the Wall Street open, as the Chinese electric vehicle builder is feared to be delisted on the US stock market by the US Securities and Exchange Commission. NIO shares are down almost 10% at the time of this update (less than one hour into the open), having met resistance after Wednesday's Fed-induced relief rally by hitting and being unable to rally past the 20-day Simple Moving Average. Nio Inc. has been on a long-term downtrend since hitting an all-time high in January 2021, and the political issues at the top level between the US and China have only aggravated it. Back below $17, the immediate support for the stock is at the year-to-date low of $13.

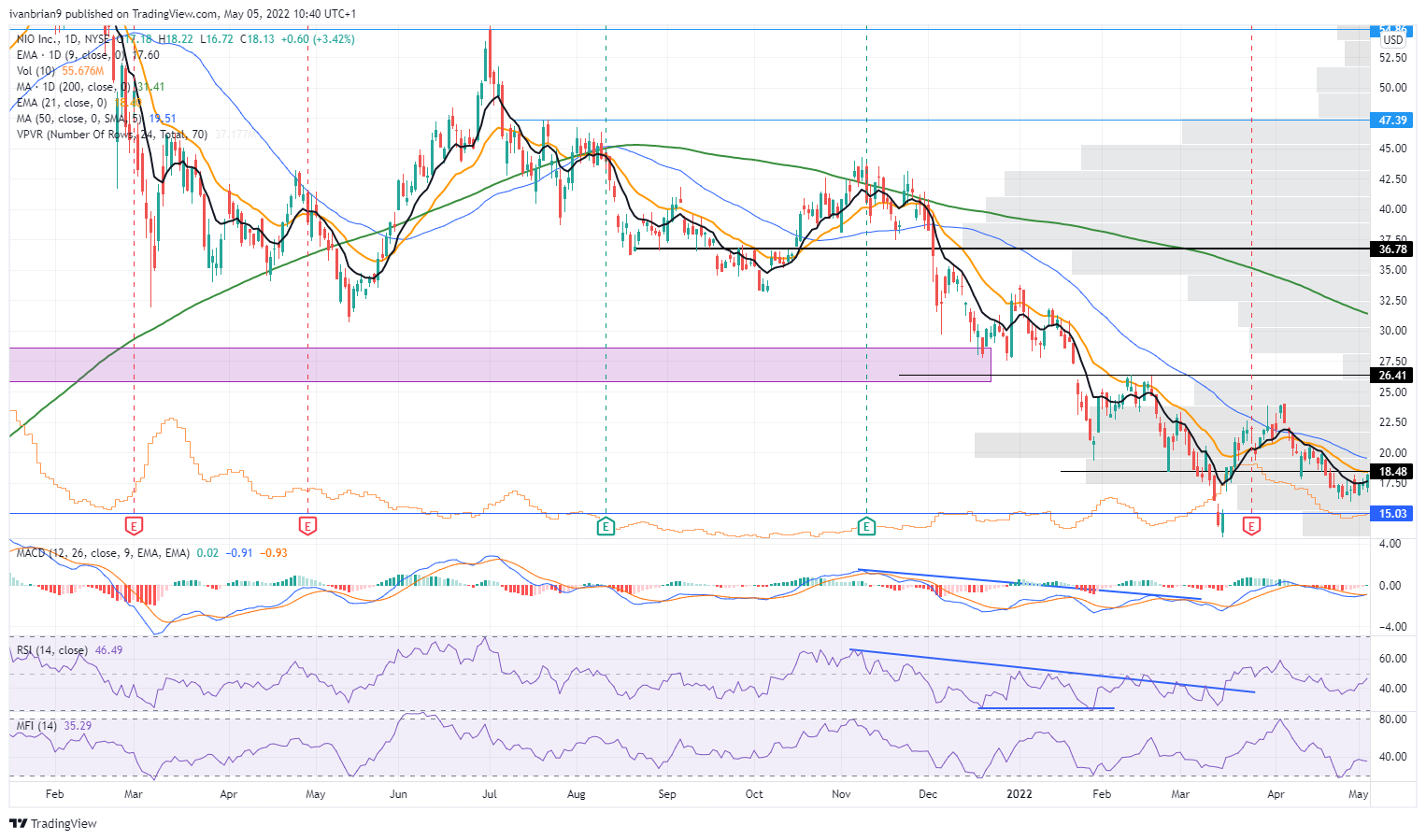

NIO stock daily price chart

NIO stock is once again under pressure as the SEC has added it to its delisting list. "Delisting list" is a bit of a tongue twister and it is certainly putting investors in a stick-or-twist situation just when hopes for a possible detente between Chinese and US securities regulators had been growing. This latest development just adds further confusion to the Chinese ADR sector and is likely to lead to another rush to the exits from US investors.

This malaise has been ongoing ever since the pulled Ant Group IPO, then came the DIDI debacle, and now the potential for multiple delistings of Chinese stocks.

NIO stock news: Nio fighting to avoid US delisting

NIO has pledged to keep working with both Chinese and US regulators as the company said it will aim to keep its dual listings in New York and Hong Kong. The Chinese electric vehicle constructor statement reads like this:

"NIO is aware that the Company has been provisionally identified by the SEC under the HFCAA on May 4, 2022 U.S. Eastern Time. The Company understands such identification may result from its filing of the annual report on Form 20-F for the fiscal year ended December 31, 2021... NIO has been actively exploring possible solutions to protect the interest of its stakeholders. On March 10, 2022, the Company completed a secondary listing of its Class A ordinary shares on the Main Board of the Hong Kong Stock Exchange (the “HKEX”) under the stock code “9866.” The Class A ordinary shares listed on the HKEX are fully fungible with the ADSs listed on the NYSE"...NIO will continue to comply with applicable laws and regulations in both China and the United States, and strive to maintain its listing status on both the NYSE and the HKEX in compliance with applicable listing rules.

This is not exactly reassuring in our view. Nio Inc. says it has been exploring solutions such as listing in Hong Kong. Fine, but that solution does not help US investors. While NIO says it will strive to maintain its listing on the NYSE it outlines no plans on how to achieve this. A tacit admission perhaps that it has no control over the situation in reality. This is at a higher level and is a political decision between the US and China. Again nothing to comfort US investors.

NIO stock forecast: Wait-and-see until US-China standoff settles

Nothing to do here but exit and stick to the sidelines in our view. If the situation gets resolved then NIO stock should recover and investors will have ample opportunity and likely cheaper prices to reenter and buy NIO shares, but this may drag on. With the global political situation in turmoil and China attempting to walk a fine line between Russia and the US, this decision will take time.

The updated SEC list included some other retail favorites like Pinduoduo (PDD), JD.com (JD), XPeng (XPEV), and others, amounting to 88 in total. Expect losses on Thursday for those names.

NIO stock chart, daily

* The author is long Alibaba.

Previous updates

Update: NIO stock plummeted a whopping 15.06% on Thursday, to finish the day at $15.40 per share. Wall Street collapsed after soaring in the Fed's aftermath, as the Bank of England put stagflation fears back on the table. The central bank warned the UK may fall into recession before year-end, sending investors into panic-selling mode. The Dow Jones Industrial Average ended the day down 1,060 points, while the S&P 500 shed 4.34%. The Nasdaq Composite was the worst performer, down roughly 5%. Stocks plunged without rhyme or reason, as US government bond yields soared to fresh four-year highs. The dismal market mood is likely to persist through the Asian session and ahead of the release of the US Nonfarm Payroll report on Friday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.