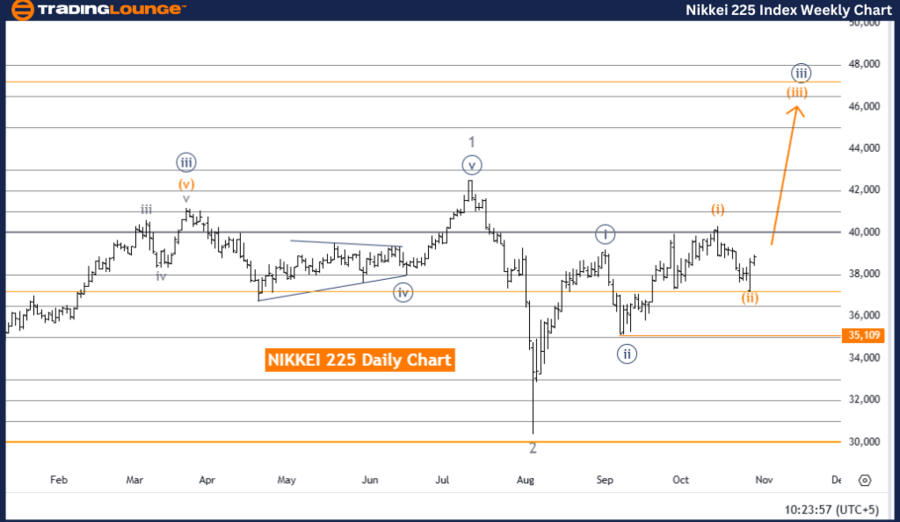

Nikkei 225 (N225) Elliott Wave Analysis - Trading Lounge Day Chart

Nikkei 225 (N225) Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Orange Wave 3.

-

Position: Navy Blue Wave 3.

-

Direction next higher degrees: Orange Wave 3 (Started).

-

Details: Orange wave 2 appears completed; orange wave 3 is now in progress.

-

Wave cancel invalid level: 35,109.

The daily Elliott Wave analysis for Nikkei 225 (N225) indicates a bullish trend supported by an impulsive mode in orange wave 3, which is part of the broader cycle in navy blue wave 3. This structure suggests the index is in an upward phase, with orange wave 3 actively progressing, expected to drive further gains as it advances within navy blue wave 3, confirming a continued bullish outlook.

Orange wave 3, characterized by its impulsive nature, aligns with a strong bullish sentiment, marking a robust upward movement for the Nikkei 225. The completion of the preceding orange wave 2 confirms the start of this new upward phase in orange wave 3, indicating a series of likely upward moves as the bullish trend progresses.

The next higher degree direction remains consistent with orange wave 3, which has just begun within the broader Elliott Wave sequence. As the trend persists, the Nikkei 225 is anticipated to move higher, with some minor corrections along the way, though the general movement is expected to remain upward.

A critical reference level is set at 35,109, serving as the invalidation point for the current wave structure. If the index falls below this level, it would invalidate the current bullish wave count, potentially indicating a change in trend. However, as long as the index remains above this level, the bullish wave structure is valid.

Summary: The daily chart analysis for the Nikkei 225 reflects a bullish trend within orange wave 3 of navy blue wave 3. With orange wave 3 underway and showing strong upward momentum, the analysis supports continued gains in the Nikkei, with 35,109 as the key level for wave cancellation to confirm the trend.

Nikkei 225 (N225) Elliott Wave Analysis - Trading Lounge Weekly Chart

Nikkei 225 (N225) Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Navy Blue Wave 3.

-

Position: Gray Wave 3.

-

Direction next higher degrees: Navy Blue Wave 3 (Continuing).

-

Details: Navy Blue Wave 2 appears complete; Navy Blue Wave 3 is now in play.

-

Wave cancel invalid level: 35,109.

The weekly Elliott Wave analysis for the Nikkei 225 (N225) reflects a bullish trend, marked by an impulsive structure currently in navy blue wave 3, which is part of the broader gray wave 3. This wave structure suggests sustained upward momentum, as navy blue wave 3 remains active, building on the completed navy blue wave 2.

With navy blue wave 3 underway, this phase signifies a notable and vigorous upward movement within the Elliott Wave cycle, supporting a strong bullish outlook for the Nikkei 225. The impulsive nature of navy blue wave 3 suggests the current rally will likely see further gains, characterized by a pattern of higher highs and higher lows, reinforcing the bullish market sentiment.

The next higher degree direction remains consistent with the ongoing upward movement of navy blue wave 3, indicating a positive trajectory within the current wave structure. This aligns with a long-term bullish trend in the Nikkei 225 as gray wave 3 progresses.

The critical reference level for this structure is set at 35,109, which acts as the invalidation threshold. If prices fall below this level, it would invalidate the current Elliott Wave count, suggesting a potential reevaluation of the trend. However, as long as prices stay above this level, the bullish wave count remains valid, supporting the ongoing upward trend.

Summary: The weekly analysis of Nikkei 225 shows a strong bullish trend within navy blue wave 3, positioned in gray wave 3, with navy blue wave 3 expected to continue advancing. This ongoing trend remains valid as long as levels stay above 35,109, indicating further gains as the bullish Elliott Wave structure persists.

Technical analyst: Malik Awais.

Nikkei 225 (N225) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD pierces 1.06, finds lowest bids in a year

EUR/USD trimmed further into low the side on Tuesday, shedding another third of a percent. Fiber briefly tested below 1.0600 during the day’s market session, and the pair is poised for further losses after a rapid seven-week decline from multi-month highs set just above 1.1200 in September.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

Ripple could rally 50% following renewed investor interest

Ripple's XRP rallied nearly 20% on Tuesday, defying the correction seen in Bitcoin and Ethereum as investors seem to be flocking toward the remittance-based token. XRP could rally nearly 50% if it sustains a firm close above the neckline resistance of an inverted head and shoulders pattern.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.