NexGen Energy (NXE) is a Canada-based company with a focus on acquisition, exploration, and development of Canadian uranium projects. The company owns a portfolio of prospective uranium exploration assets in Athabasca Basin, which are some of the largest in the world. The stock has dropped 80% from its 2017 high to $0.50 / share at the March 2020 low. However, since then it has rallied 10x higher. It is speculative as it’s not yet producing uranium, but its potential and also the bullish uranium market prove to be supportive of the stock.

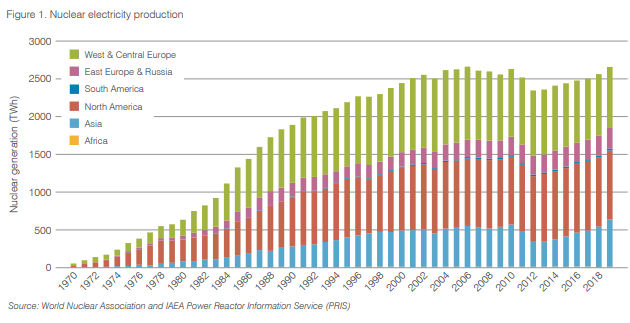

Nuclear energy production

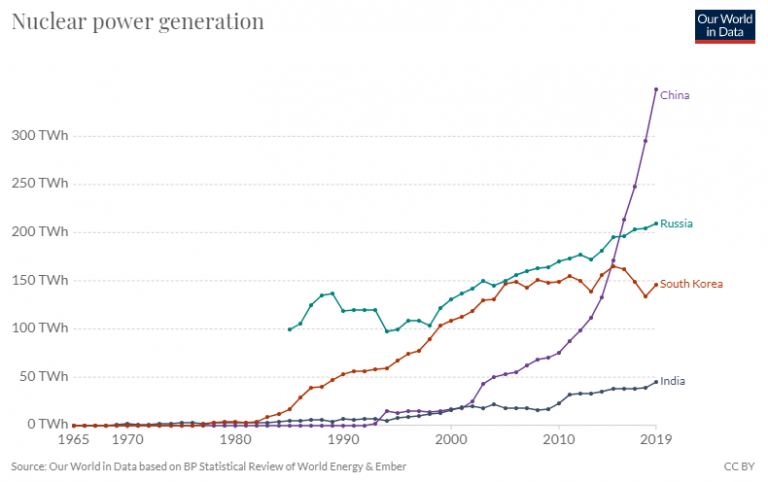

The chart above shows 50 years of nuclear energy production which is a good proxy for uranium demand. After the Fukushima disaster in 2011, many nuclear power plants came offline. However, we have seen a pickup in the demand again. Most of the growth in nuclear power plants came from emerging markets as the chart below shows:

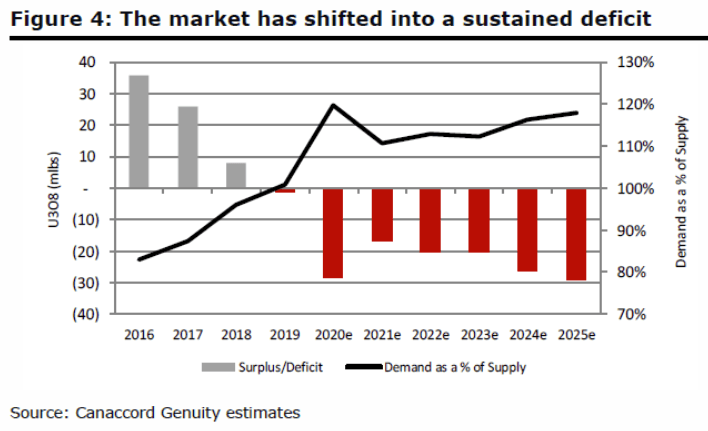

Supply on the other hand continues to decline starting from 2016 due to the low Uranium price. It has created a demand-supply imbalance. The Covid-19 further exacerbates the deficit and between demand and supply.

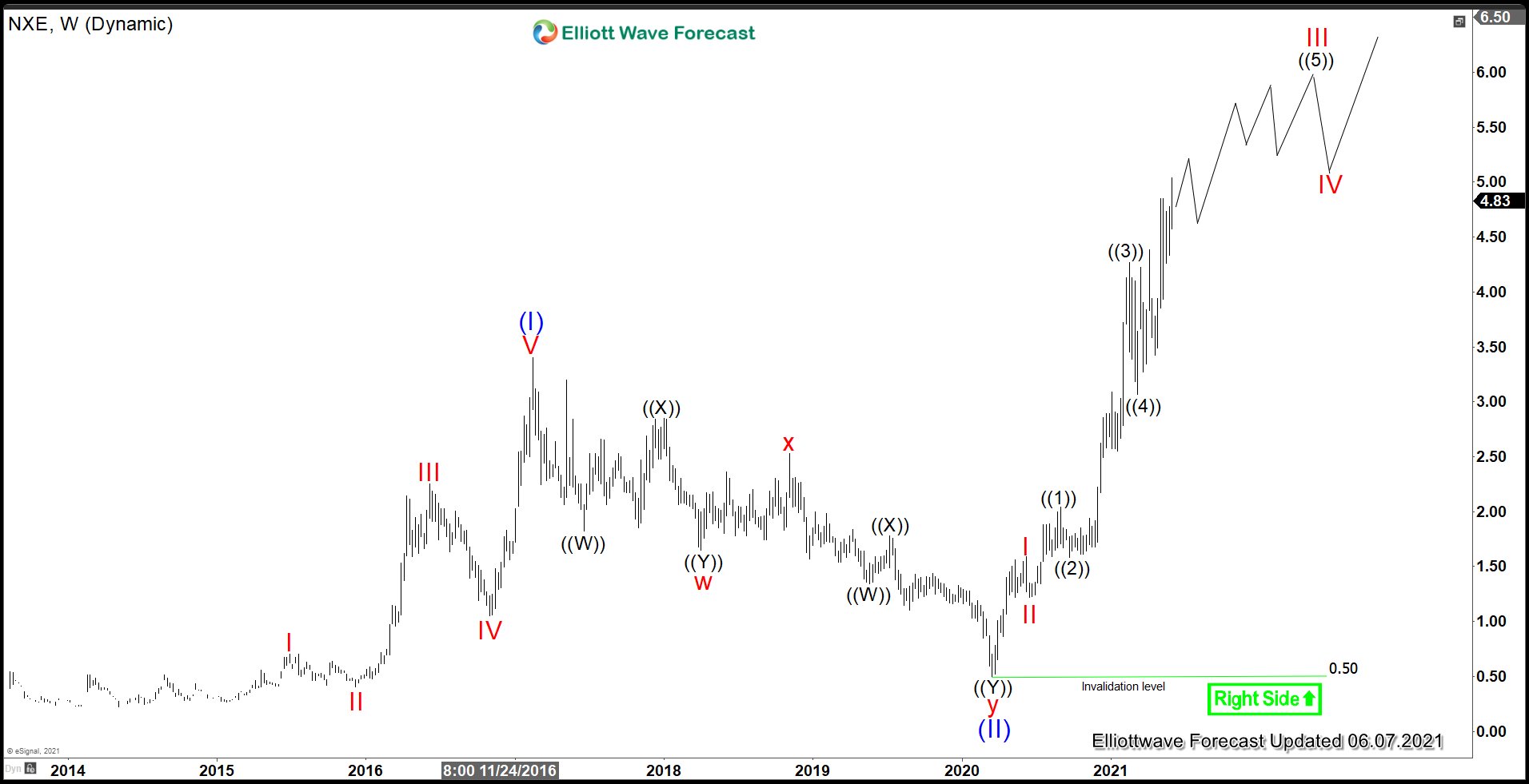

$NXE weekly Elliott Wave chart

Weekly chart above shows the rally from all-time low unfolding as a 5 waves impulse Elliott Wave structure. Wave (I) ended at $3.04, and dips in wave (II) ended at $0.50. Wave (III) is currently in progress and unfolding as another impulse in lesser degree. Up from wave (II), wave I ended at $1.59 and pullback in wave II ended at $1.22. Expect the stock to remain supported and dips to find support in 3, 7, 11 swing for further upside.

$NXE daily Elliott Wave chart

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD continues to grind out further losses

EUR/USD continued to drift into the basement on Wednesday, clipping into a 54-week low and settling within touch range of 1.0550. Fiber continues to shed weight on the charts as broader FX markets pivot full-bore into holding the Greenback.

GBP/USD sheds weight for a fourth straight day on Wednesday

GBP/USD eased further into the low end on Wednesday, trimming further south of the 200-day Exponential Moving Average in a one-sided bearish decline as the pair closes in the red for a fourth consecutive trading day.

Gold extends slide to fresh two-month low

After shedding some ground throughout the first half of the day, the US Dollar is back in fashion. XAU/USD trades at its lowest in two months in the $2,580 region and is technically poised to extend its slump.

Australia unemployment rate expected to remain steady for third straight month in October

The Australian Unemployment Rate is foreseen stable at 4.1% in October. Employment Change is expected at 25K, much lower than the 51.6K posted in September. AUD/USD is under pressure and may soon pierce the 0.6500 mark.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.