NWS Elliott Wave technical analysis

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with NEWS CORPORATION. – NWS. We see NWS.ASX continuing to push higher with wave (5)-orange.

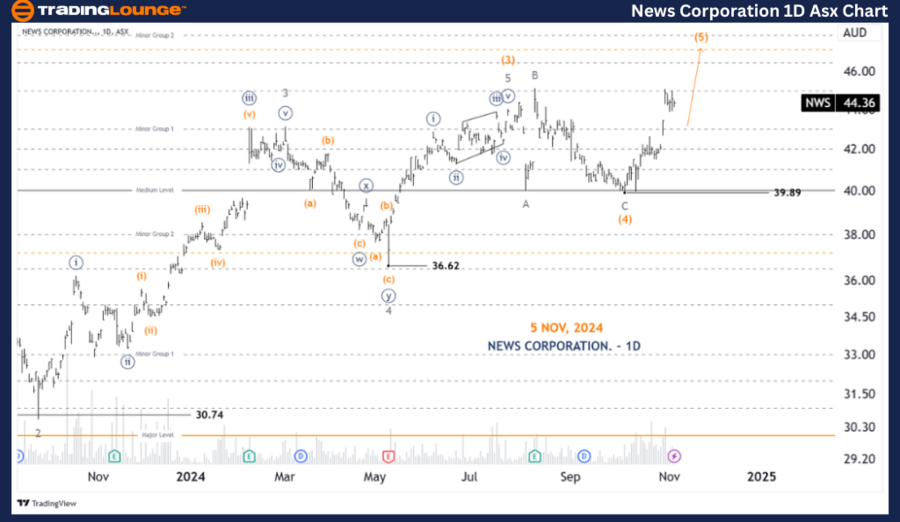

ASX: NWS one-day chart (semilog scale) analysis

Function: Major trend (Intermediate degree, Orange).

Mode: Motive.

Structure: Impulse.

Position: Wave (5)-orange.

Details: Wave (4)-ornage has ended as an Expanded Flat, and since the low at 39.89 wave (5)-orange is unfolding to push higher, towards the next targets like 47.00 - 48.00 - 50.00.

Invalidation point: 39.89.

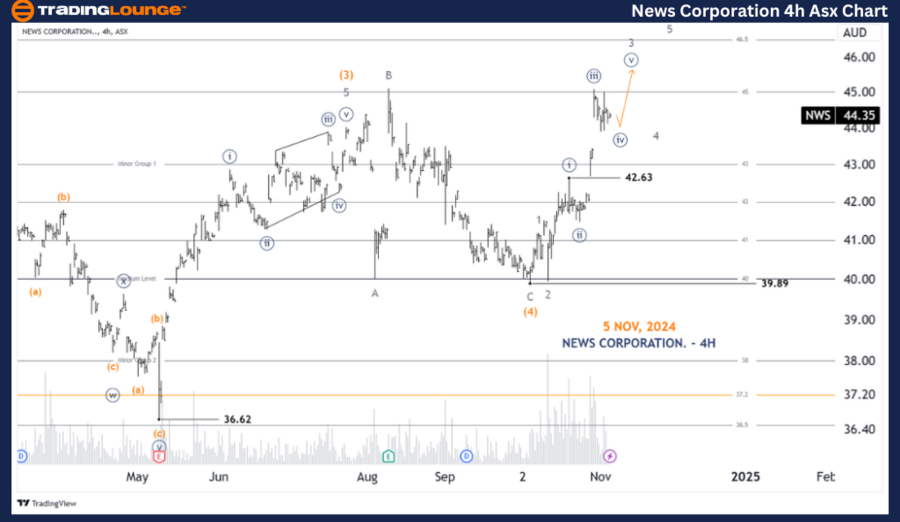

ASX: NWS four-hour chart analysis

Function: Major trend (Minor degree, grey).

Mode: Motive.

Structure: Impulse.

Position: Wave ((iv))-navy of Wave 3-grey.

Details: Since the low at 39.89, wave (5)-orange is unfolding towards higher targets like 47.00 - 48.00 - 50.00. It is subdividing into wave 1-grey to wave 3-grey itself, again wave 3-grey is an Extension, and it is subdividing into the nearest wave ((iv))-navy, basically it needs a bit more time, and after it completes wave ((v))-navy will push higher and simultaneously complete the entire wave 3-grey, which suggests that a pullback lower with wave 4-grey is needed, and finally wave 5-grey will return to its trajectory.

Invalidation point: 42.63.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: NEWS CORPORATION. – NWS aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

News Corporation Elliott Wave technical forecast [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

AUD/USD rises back above 0.6500 after hawkish RBA Bullock's comments

AUD/USD edges higher to regain 0.6500 in Asian trading on Friday. The pair capitalizes on upbeat Australian Private Capex data for October and hawkish comments from RBA Governor Bullock. A broadly muted US Dollar also aids the Aussie's uptick amid light trading.

USD/JPY extends sell-off to near 150.00 after hot Tokyo CPI

USD/JPY extends sell-off to test 150.00 in Friday's Asian session following the release of hotter-than-expected November inflation figures from Tokyo, Japan’s capital. The data strengthens the case for another BoJ rate hike in December, sending the Japanese Yen through the roof.

Gold recovery faces healthy resistance; will buyers succeed?

Gold price extends its gradual recovery mode and tests the critical $2,670 resistance early Friday, having hit a weekly low of $2,605 on Tuesday. A broadly subdued US Dollar (USD) performance alongside the US Treasury bond yields lend support to the Gold price upswing.

ASI's FET rallies following earn-and-burn mechanism launch

The Artificial Superintelligence Alliance (FET) saw double-digit gains on Thursday after it announced plans to burn up to 100 million tokens as part of its Earn-and-Burn mechanism, set to begin in December.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.