New Zealand Dollar falls to seven-week low as RBNZ cuts interest rate by 50 bps

- The New Zealand Dollar edges lower in Wednesday’s early European session.

- RBNZ cut the interest rate by 50 bps to 4.75% as anticipated.

- The September FOMC Minutes will be in the spotlight on Wednesday.

The New Zealand Dollar (NZD) loses momentum to near the lowest level since mid-August on Wednesday. The Reserve Bank of New Zealand (RBNZ) decided to cut the Official Cash Rate (OCR) by 50 basis points (bps) from 5.25% to 4.75% at its October meeting, as widely expected. The Kiwi attracts some sellers in an immediate reaction to the interest rate decision. Additionally, Chinese officials disappoint traders without more major stimulus. This, in turn, drags the proxy-China NZD lower against the Greenback as China is a major trading partner to New Zealand.

Moving on, traders will keep an eye on the Federal Open Market Committee (FOMC) Minutes later on Wednesday. On Thursday, the attention will shift to the US Consumer Price Index (CPI) data for September. In case the report shows a softer-than-expected outcome, this could weigh on the USD and help limit the pair’s losses.

Daily Digest Market Movers: New Zealand Dollar remains weak after RBNZ interest rate decision

- According to the RBNZ Monetary Policy Statement (MPS), the committee assesses that annual consumer price inflation is within its 1 to 3% inflation target range.

- The Committee agreed that it is appropriate to cut the OCR by 50 basis points to achieve and maintain low and stable inflation while seeking to avoid unnecessary instability in output, employment, interest rates, and the exchange rate, noted the RBNZ MPS.

- Federal Reserve (Fed) Vice Chair Philip Jefferson said on Tuesday the US central bank's 50 basis points (bps) interest rate cut in September was aimed at keeping the labor market strong even as inflation continues to ease, per Reuters.

- Atlanta Fed President Raphael Bostic stated on Tuesday that the jobs market is not showing signs of weakness, adding that despite significant progress on inflation, overall price figures have not yet hit target levels.

- New York Fed president John Williams said he strongly supported a rate cut by 50 basis points (bps) last meeting and that the two additional 25 bps reduction this year is a “pretty reasonable representation of a base case,” per Reuters.

Technical Analysis: New Zealand Dollar resumes downside bias

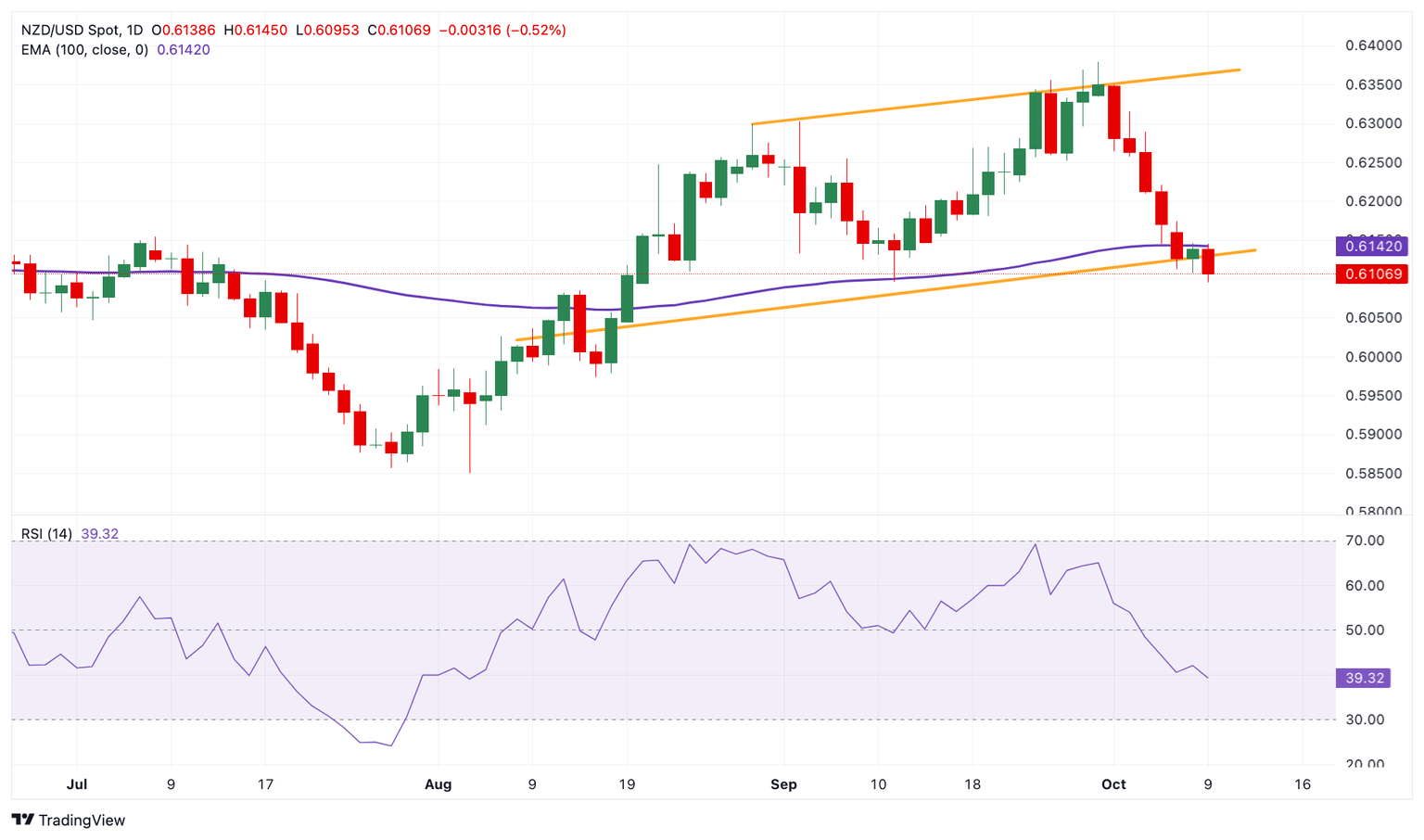

The New Zealand Dollar weakens on the day. The NZD/USD pair continues its downtrend as it crosses below the key 100-day Exponential Moving Average (EMA) and is poised to break below the ascending trend channel on the daily chart. The downward momentum is supported by the 14-day Relative Strength Index (RSI), which stands below the midline near 41.10, supporting the sellers in the near term.

A decisive break below the lower limit of the trend channel of 0.6135 could pave the way to the 0.6000 psychological level. Sustained trading below this level could lead to a drop towards 0.5974, the low of August 15.

On the upside, the 100-day EMA at 0.6142 acts as an immediate resistance level for the pair. Extended gains will see a rally to 0.6254, the high of September 6. The additional upside filter to watch is 0.6300, a round figure, en route to 0.6365, the upper boundary of the trend channel.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.