New Zealand Dollar trades mixed after positive start on risk appetite

- The New Zealand Dollar trades mixed after a positive start on risk appetite.

- Risky assets rise on hopes of central banks cutting interest rates.

- The RBNZ has not committed to cutting rates, however, as inflation remains high despite slow growth.

The New Zealand Dollar (NZD) trades mixed on Tuesday as markets adopt a positive risk tone, benefiting commodity currencies like the New Zealand Dollar over safe havens, yet the US Dollar gains a bid following more positive data.

The NZD/USD edges lower following the release of US Durable Goods Orders for February, which roundly beat expectations, according to data from the US Census Bureau.

The data showed headline Durable Goods Orders rising 1.4% when 1.3% had been forecast, and Durable Goods Orders ex Defense rising 2.2% when 1.1% had been estimated. Durable Goods ex Transport also beat forecasts, coming in at 0.5% versus 0.4% expected. Finally Nondefense Capital Goods ex Aricraft rose 0.7% versis 0.1% expected.

New Zealand Dollar suffers from negative fundamentals

Despite this recent uptick, the New Zealand Dollar is under pressure from bearish fundamentals.

Recent data showed the New Zealand economy fell into a technical recession in the fourth quarter of 2024, whilst headline inflation remained relatively high at 4.7% during the same reporting period, even if it fell from the 5.6% recorded in Q3.

Despite weak growth, the Reserve Bank of New Zealand (RBNZ) does not envision itself cutting interest rates due to high inflation. Elevated price growth is partly a result of structural issues such as a tight labor market, which in turn keeps wage inflation high.

In a speech about monetary policy at a Chartered Accountants’ event on Tuesday, RBNZ Chief Economist Paul Conway reiterated the bank's core message that interest rates would have to remain high for some time yet in order to bring down inflation.

“Interest rates need to remain at a restrictive level for a sustained period of time to meet our inflation objective,” said the notes from the speech, repeating the RBNZ’s official line.

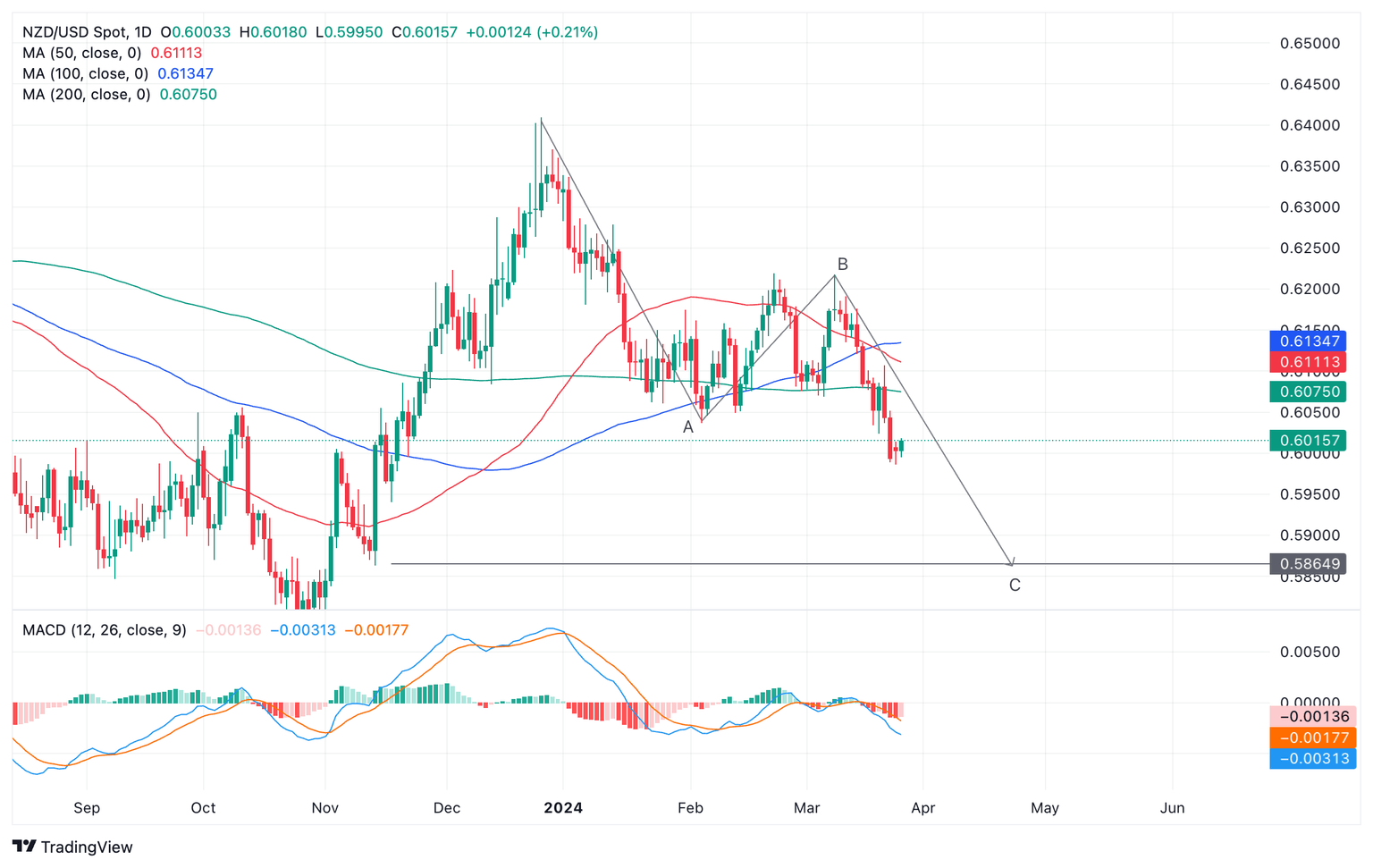

Technical Analysis: New Zealand Dollar pulls back in downtrend

NZD/USD – the number of US Dollars one New Zealand Dollar can buy – continues pulling back within a short-term downtrend.

The pair recently broke out of a Wedge pattern and is forecast to continue falling until it reaches the conservative target for the pattern.

New Zealand Dollar versus US Dollar: 4-hour chart

According to technical analysis theory, the target lies at a distance equivalent to the height of the wedge extrapolated lower. In the case of NZD/USD it suggests more downside to a conservative target at 0.5964, the 0.618 Fibonacci ratio of the height of the pattern extrapolated from the breakout point lower. The full ratio (1.000) provides a further target at 0.5892.

New Zealand Dollar versus US Dollar: Daily chart

Adding to the bearish outlook is the possible formation of an ABC pattern or Measured Move on the daily chart.

If so, NZD/USD could be unfolding in the final wave C of the pattern, which could stretch to a long-term target at 0.5864, where wave C is equal to wave A.

Only a break above the 0.6107 March 21 high would bring into doubt the bearish bias.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.