New Zealand Dollar weakens ahead of FOMC Minutes

- The New Zealand Dollar loses ground, snapping the three-day winning streak in Wednesday’s Asian session.

- The softer US Dollar and positive risk sentiment support NZD/USD.

- Investors await the FOMC Minutes on Thursday ahead of Fed Chair Powell's speech.

The New Zealand Dollar (NZD) edges lower on Wednesday after retracing from ten-week highs near 0.6164. The extended decline of the USD Index (DXY) and improved risk sentiment after China rolled out further measures to support the real estate sector might boost the Kiwi as China is New Zealand's largest trading partner.

On the other hand, the dovish remarks from the Reserve Bank of New Zealand (RBNZ) after a surprise rate cut last week might limit the pair’s upside. Investors will keep an eye on the Federal Open Market Committee (FOMC) Minutes, which is due on Thursday. All eyes will be on Fed Chair Powell's speech at the Jackson Hole symposium on Friday. Any dovish comments from Powell are likely to undermine the USD and create a tailwind for NZD/USD.

Daily Digest Market Movers: New Zealand Dollar loses traction as traders await the FOMC Minutes

- China implemented further measures to boost the real estate sector. At least 10 city governments in China have relaxed or scrapped new-home price guidelines to allow market demand to play a bigger role, per Bloomberg.

- The People’s Bank of China (PBOC) decided to hold the one-year and five-year Loan Prime Rates (LPR) steady on Tuesday at 3.35% and 3.85%, respectively.

- New Zealand’s Trade Balance arrived at NZD -$9.29B YoY in July versus $-9.5B prior. Exports decreased to $6.15B in July versus $6.17B in June, whereas Imports increased to $7.11B compared to $5.45B in previous readings.

- Federal Reserve (Fed) Governor Michelle Bowman said on Tuesday that she remains cautious about any shift in the policy because of what she sees as continued upside risks for inflation. She warned that overreacting to any single data point could jeopardize the progress already made, per Reuters.

- The markets are now pricing in a nearly 67.5% odds of a 25 basis points (bps) Fed rate cut in its September meeting, down from 77% on Tuesday, according to the CME FedWatch Tool.

Technical Analysis: New Zealand Dollar resumes its positive outlook

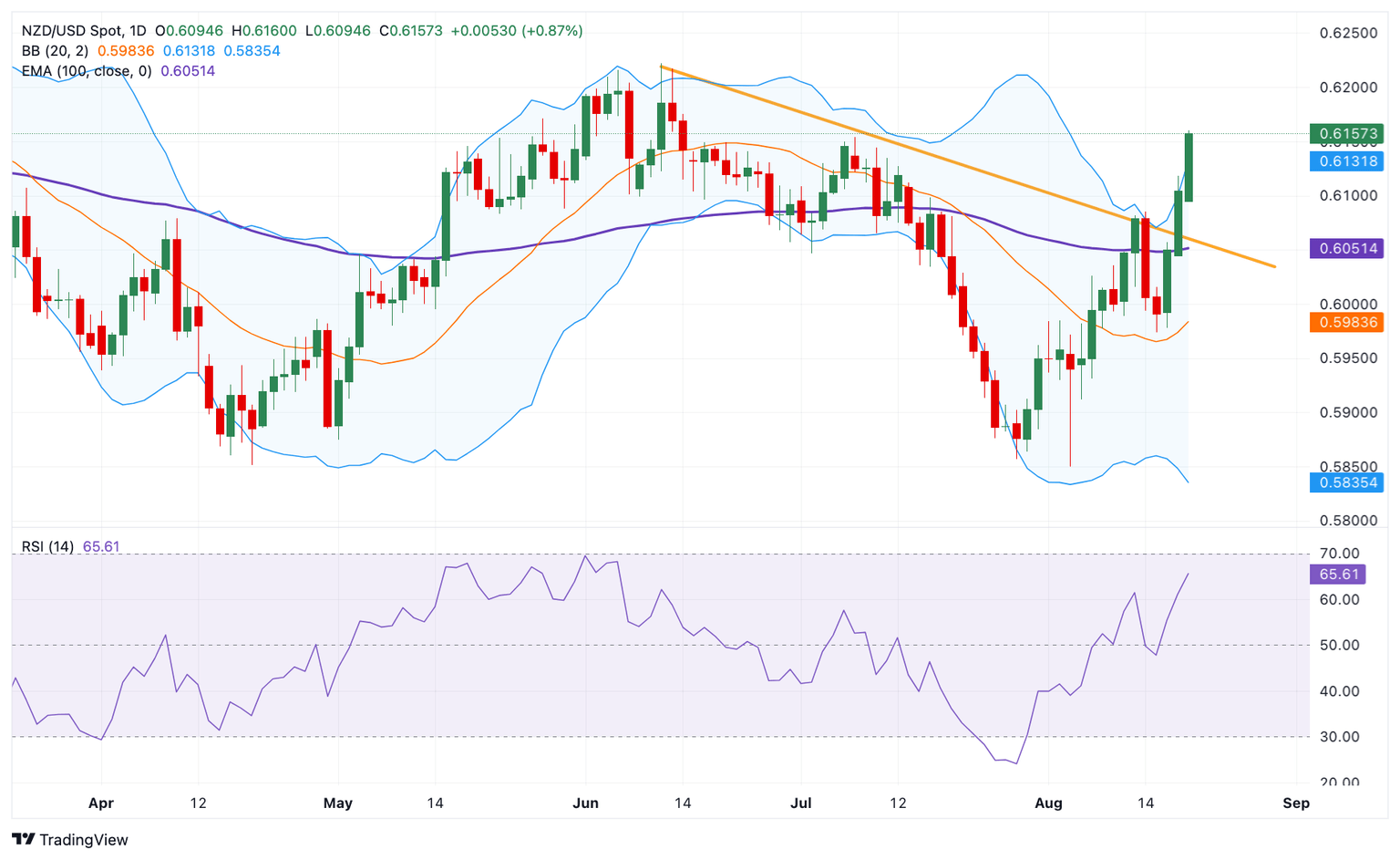

The New Zealand Dollar trades on a softer note on the day. The NZD/USD pair keeps the bullish vibe on the daily chart as the pair holds above the descending trendline and the key 100-day Exponential Moving Average (EMA). The upward momentum is bolstered by the 14-day Relative Strength Index (RSI), which stands above the midline near 65.60, suggesting that further upside looks favorable.

The immediate resistance level emerges at 0.6222, the high of June 12. Further north, the next hurdle is seen at 0.6279, a high of January 12. The additional upside filter to watch is 0.6360, a high of December 29, 2023.

On the downside, the 0.6130 psychological mark acts as an initial support level for the pair. The next contention level is located near the resistance-turned-support level at 0.6070. Sustained trading below this level could lead to a drop towards 0.5974, the low of August 15.

(This story was corrected on August 21 at 01:30 GMT to say in the article, that the first reading of US August S&P Global PMI will be due on Thursday, not on Wednesday.)

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.08% | 0.07% | -0.02% | 0.05% | 0.13% | 0.26% | 0.06% | |

| EUR | -0.05% | -0.01% | -0.09% | -0.04% | 0.14% | 0.17% | -0.01% | |

| GBP | -0.07% | 0.01% | -0.09% | -0.03% | 0.15% | 0.18% | 0.00% | |

| CAD | 0.01% | 0.10% | 0.09% | 0.06% | 0.23% | 0.27% | 0.09% | |

| AUD | -0.05% | 0.02% | 0.02% | -0.07% | 0.12% | 0.21% | 0.01% | |

| JPY | -0.19% | -0.15% | -0.17% | -0.26% | -0.20% | 0.07% | -0.15% | |

| NZD | -0.23% | -0.18% | -0.16% | -0.27% | -0.22% | -0.04% | -0.15% | |

| CHF | -0.04% | 0.01% | 0.02% | -0.08% | -0.03% | 0.14% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.