Netflix Inc. (NFLX) Elliott Wave technical analysis [Video]

![Netflix Inc. (NFLX) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/Netflix_XtraLarge.jpg)

NFLX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 3.

Direction: Upside in wave 3.

Details: Looking for upside into Minor wave 3 of Intermediate (5) as we seem to be finding support on top of 675$, which corresponds to previous ATH.

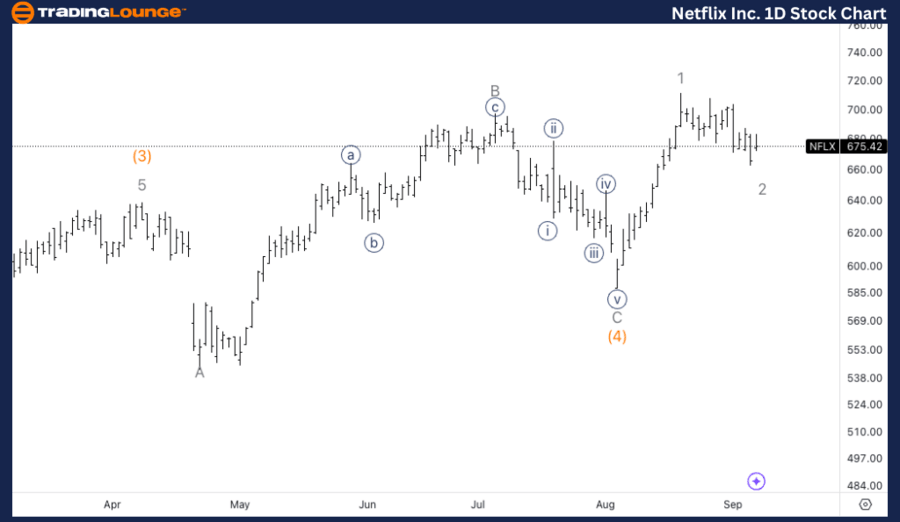

NFLX Elliott Wave technical analysis – Daily chart

In the daily chart, Netflix is currently in an impulsive upward trend, driven by a strong Motive Wave structure. The price is advancing within Minor wave 3 of the larger Intermediate wave (5), signaling bullish momentum. We are witnessing a firm wave 3 push, with the stock finding support around the $675 level, a significant price point that aligns with the previous all-time high (ATH).

NFLX Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {i} of 3.

Direction: Upside in wave 3.

Details: Looking for a three wave move in wave 2 to be completed, as we can see a three wave move, tested support on top of 680$ will add additional confidence.

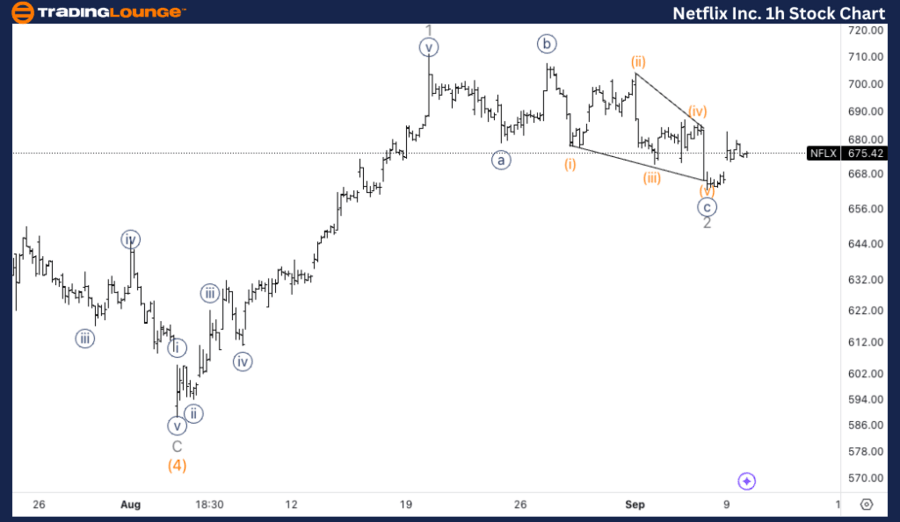

NFLX Elliott Wave technical analysis – One-hour chart

Zooming into the 1-hour chart, we observe that NFLX is in the early stages of an impulsive advance, currently moving within wave {i} of 3. The structure of the chart suggests that wave 2, a corrective wave, is in progress, but we are nearing its completion. The price action has formed a three-wave corrective move, commonly seen in Elliott Wave theory, and tested the critical support around the $680 level. This support area is vital as it adds confidence to the bullish scenario if it holds.

Welcome to our latest Elliott Wave analysis for Netflix Inc. (NFLX) as of September 10, 2024. This analysis delves into NFLX's price movements using Elliott Wave Theory, providing valuable insights for traders looking to capitalize on potential opportunities based on the current market structure and trend developments. In this article, we examine both the daily and 1-hour charts to offer a comprehensive view of NFLX’s price action.

Netflix Inc. (NFLX) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.