NEE Elliott Wave technical analysis [Video]

![NEE Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/CommercialServices/business-woman-client-637435343342689385_XtraLarge.jpg)

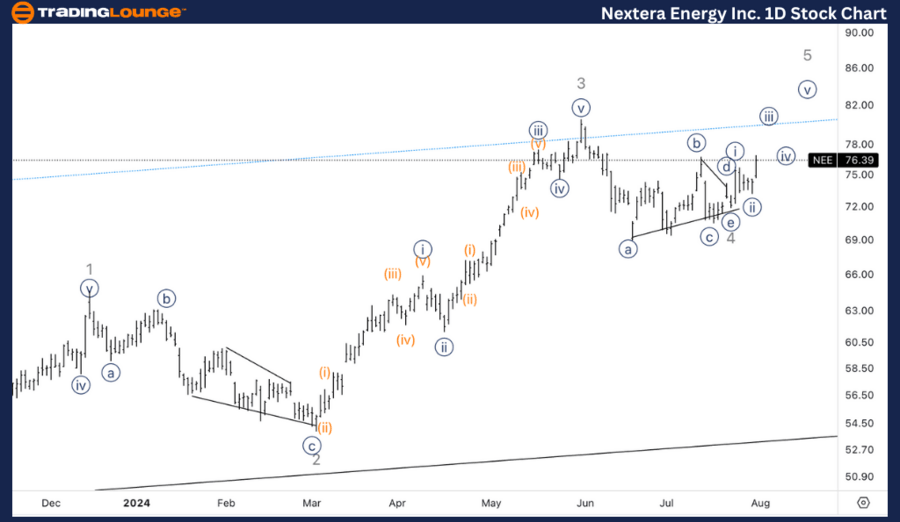

NextEra Energy Inc. (NEE) Elliott Wave Analysis - Daily Chart,

NEE Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 5.

Direction: Upside in wave 5.

Details: Anticipating continuation into wave 5, with potential sub-waves {i} and {ii} already in place. Monitoring for further upward movement within wave 5.

NEE Elliott Wave Analysis Trading Lounge 4H Chart,

NEE Elliott Wave Technical Analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 5.

Direction: Upside in wave 5.

Details: Considering the possibility of wave {i} of 5 being incomplete, suggesting potential higher upside targets. Observing 0.618 times wave 1 at around $88.

This Elliott Wave analysis for NextEra Energy Inc. (NEE) covers both daily and 4-hour charts, offering a comprehensive overview of current market positioning and potential future movements.

Technical analyst: Alessio Barretta.

NEE Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.