NDX and XLC revival now

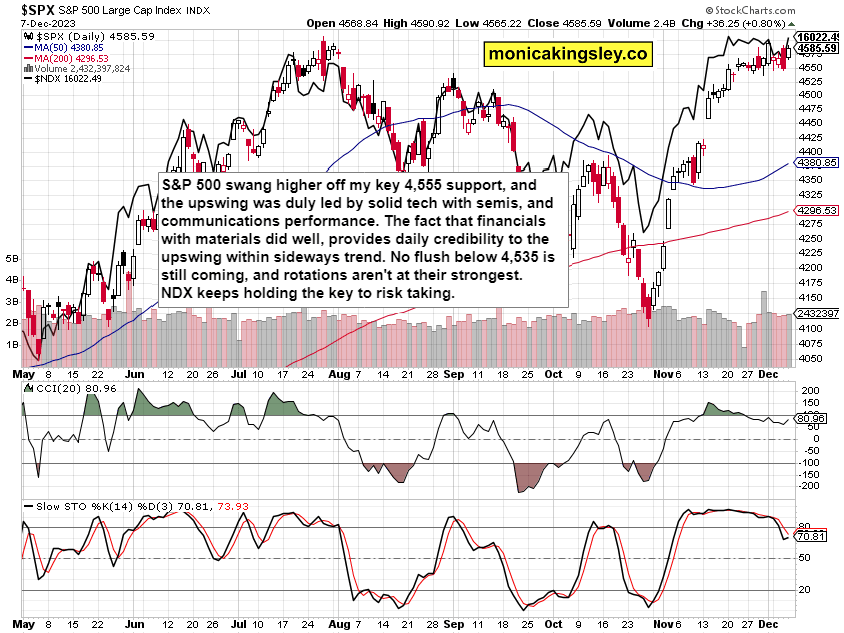

S&P 500 defended my key 4,555 level, the plan presented yesterday worked, and stocks even managed to get to 4,590. As optimistic as that result is, it‘s still within the long and tight range ruling since second half of Nov. While positive in general, the rotations and market breadth leave much to be desired following yesterday – advance-decline line at only 960 is relatively weak, and indicative of still consolidation before FOMC.

As regards individual stocks, the yesterday publicly discussed NVDA, AAPL and MSFT (and the NFLX with TSLA talked in premium analytics) worked well, and also AMD confirmed the turn in semiconductors (before NVDA did).

What was though most valuable about yesterday, was that sticking to a robust plan brought victory.

I‘ve already published today‘s NFPs plan for intraday traders – and when it comes to swing trading positions, there is no immediate need to react either way.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 of them, featuring S&P 500, precious metals and oil.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

S&P 500 and Nasdaq outlook

The developments inside tech sectors were positive yesterday, but breaking first 4,590 and then 4,615 needs continued tech leadership – and objectively speaking, the air is thin out up there these days. The strong advance off late Oct lows is still being worked off – and I‘m looking for further juicy move to take time to develop. Most in the market place are still of the buy the dip sentiment, but experiencing a quick flush instead of lengthier sideways consolidation, isn‘t unimaginable.

How to approach the current setup in terms of trading and investing, I'm leaving reserved for clients.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.