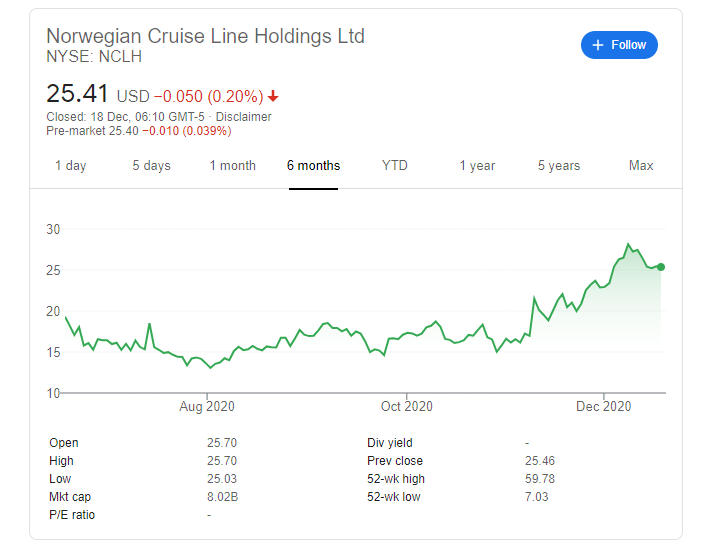

- NYSE: NCLH has been holding onto its gains ahead of the Christmas holidays.

- Recent selling by insiders is somewhat weighing on Norwegian Cruise Line shares.

- Bookings for the upcoming summer season may rise amid vaccination campaigns.

When an insider sells shares, it is never a positive sign. Rober Binder, who sold over 90,000 NYSE: NCLH shares at an average price of $24.76 and raked in some $2.3 million. Is the move by Norwegian Cruise Line's Vice-Chair a sell signal?

While Binder's move may be worrying for some, shares have been cruising higher, closing at $25.41 as of Thursday. Friday's premarket trading is basically showing little change. Investors seem t to shrug off Binder's move.

What is next for Norwegian Cruise Line Holdings?

NCLH Stock Forecast

Investors now have a second reason to be optimistic on NCLH shares – Moderan's COVID-19 vaccine is approaching approval fur usage in the US. An advisory committee at the Food and Drugs Administration (FDA) has given its nod to emergency authorization and final approval is likely shortly.

The first reason to rise is the FDA's approval of the Pfizer/BioNTech jab already distributed across the US and also in Canada and the UK . Immunization against coronavirus is critical for cruise companies that have an elderly clientele. The older and he unhealthy are set to receive the inoculation first, during the winter.

The mere expectations of getting a shot in the arm and becoming protected from the deadly virus may push people to book cruises for the next summer. The Christmas holiday – that for some will be lonely due to social distancing – is a perfect opportunity to dream of pleasure on the high seas.

Is NCLH stock a good buy? Norwegian Cruise Line Holdings has had a rough year but has bounced amid vaccine news. While there may be more room to run, waiting for reports about bookings reports around Christmas may be a prudent step.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.