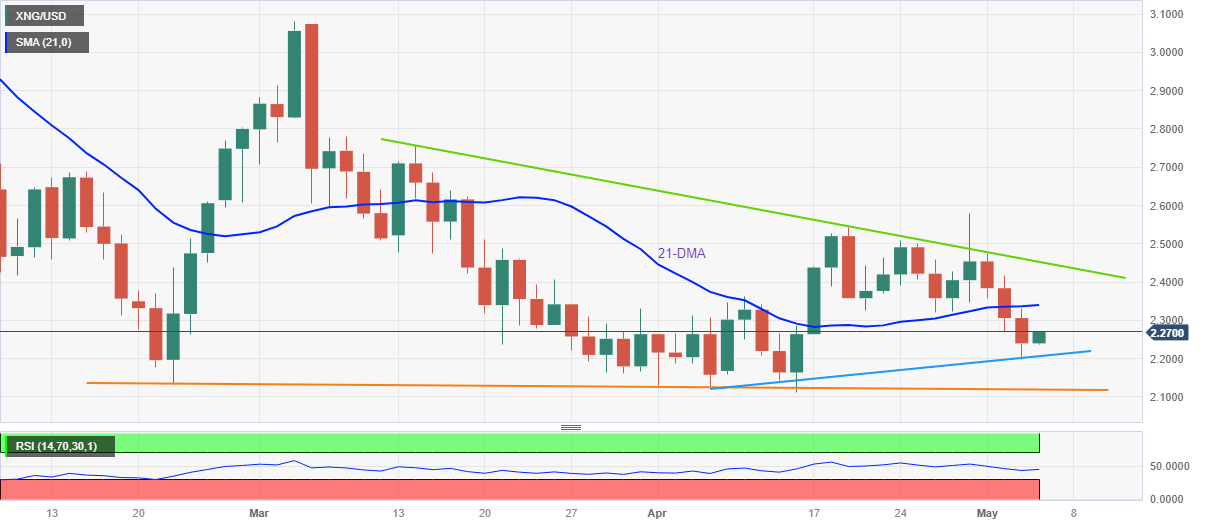

Natural Gas Price Analysis: XNG/USD snaps three-day losing streak near $2.25 on Fed-inspired rebound

- Natural Gas price picks up bids to refresh intraday high, bounced off three-week low.

- Fed’s dovish hike weighs on US Dollar, allows XNG/USD to remain firmer.

- Steady RSI suggests further recovery from one-month-old ascending support line.

- 21-DMA guards adjacent upside, seven-week-long resistance line is the key hurdle.

Natural Gas (XNG/USD) Price remains firmer around $2.27 as the commodity buyers cheer the first daily gains in four during early Thursday.

The energy instrument’s latest rebound from the lowest levels in three weeks could be linked to the US Federal Reserve’s (Fed) hints of a pause in the rate hike trajectory, despite announcing a 0.25% increase in the benchmark rates the previous day.

Adding strength to the XNG/USD rebound could be the ascending trend line from early April, around $2.20 by the press time, as well as the steady RSI (14) line.

It’s worth noting, however, that the 21-DMA hurdle of around $2.35 restricts the immediate upside of the Natural Gas price, a break of which could please short-term XNG/USD buyers.

Even so, a downward-sloping resistance line from mid-March, close to $2.45 at the latest, appears a tough nut to crack for the Natural Gas buyers before retaking control.

Meanwhile, a downside break of the aforementioned one-month-old support line, close to $2.20, can quickly drag the XNG/USD quote towards a broad support line stretched from late February, around $2.12.

If at all, the Natural Gas price drops below $2.12, the $2.00 psychological magnet will gain the market’s attention.

Natural Gas Price: Daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.