- Natural Gas Price remains inactive after rising the most in three weeks.

- Failures to defend bounce off six-week-long rising support line, struggle to cross 50-SMA keep XNG/USD bears hopeful.

- Fortnight-long previous resistance line puts a floor under the Natural Gas Price.

- Cautious mood ahead of Fed Chair Jerome Powell’s speech restricts immediate XNG/USD moves.

Natural Gas Price (XNG/USD) retreats to $2.67 as energy bulls struggle to defend the previous day’s heavy run-up, the biggest in three weeks, amid anxiety surrounding Federal Reserve (Fed) Chair Jerome Powell’s speech at the Jackson Hole Symposium.

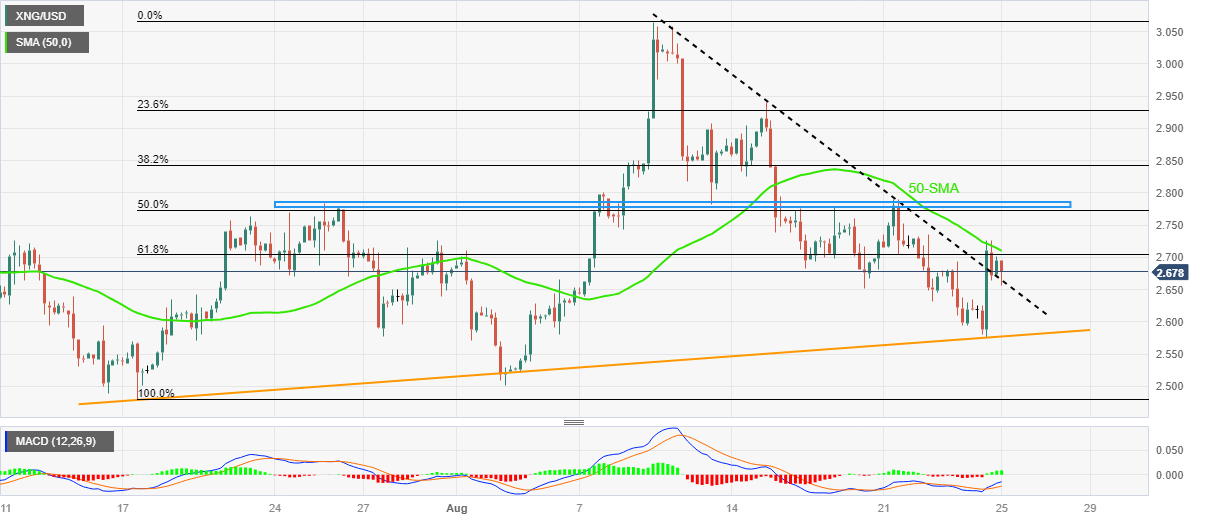

That said, the XNG/USD bounced off a 1.5-month-old rising support line the previous day before reversing from the 50-SMA upside hurdle. The pullback moves, however, fail to break the resistance-turned-support line stretched from August 10, close to $2.66 by the press time.

It’s worth noting that the bullish MACD signals and the market’s cautious optimism ahead of the key event also put a floor under the energy instrument.

Even if the quote breaks the previous resistance line, the aforementioned multi-day-old rising trend line support of $2.58 appears a tough nut to crack for the Natural Gas bears.

Following that, the monthly low of $2.50 and July’s bottom surrounding $2.47 will test the XNG/USD sellers before directing them toward the Year-To-Date lows of $2.11.

On the flip side, a clear break of the 50-SMA level surrounding $2.71 becomes necessary for the Natural Gas Price to convince energy buyers.

However, the XNG/USD bulls should remain cautious unless they witness a successful upside clearance of the one-month-old horizontal resistance area surrounding $2.78-80.

Natural Gas Price: Four-hour chart

Trend: Limited downside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD clings to recovery gains near 0.6550 on weaker USD, upbeat mood

AUD/USD holds sizeable gains near 0.6550 in the Asian session on Monday. A sharp pullback in the US bond yields prompts some US Dollar profit-taking after US President-elect Trump named Scott Bessent as Treasury Chief. Moreover, the upbeat market mood supports the risk-sensitive Aussie.

Japanese Yen builds on its weekly bullish gap-up against USD

The Japanese Yen (JPY) strengthens against its American counterpart at the start of a new week, dragging the USD/JPY pair back below the 154.00 mark during the Asian session. The US Treasury bond yields fell sharply in reaction to Scott Bessent's nomination as US Treasury Secretary.

Gold: Is the tide turning in favor of XAU/USD sellers?

After witnessing intense volatility in Monday's opening hour, Gold's price is licking its wounds near $2,700. The bright metal enjoyed good two-way trades before sellers returned to the game after five straight days.

Elections, inflation, and the bond market

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.