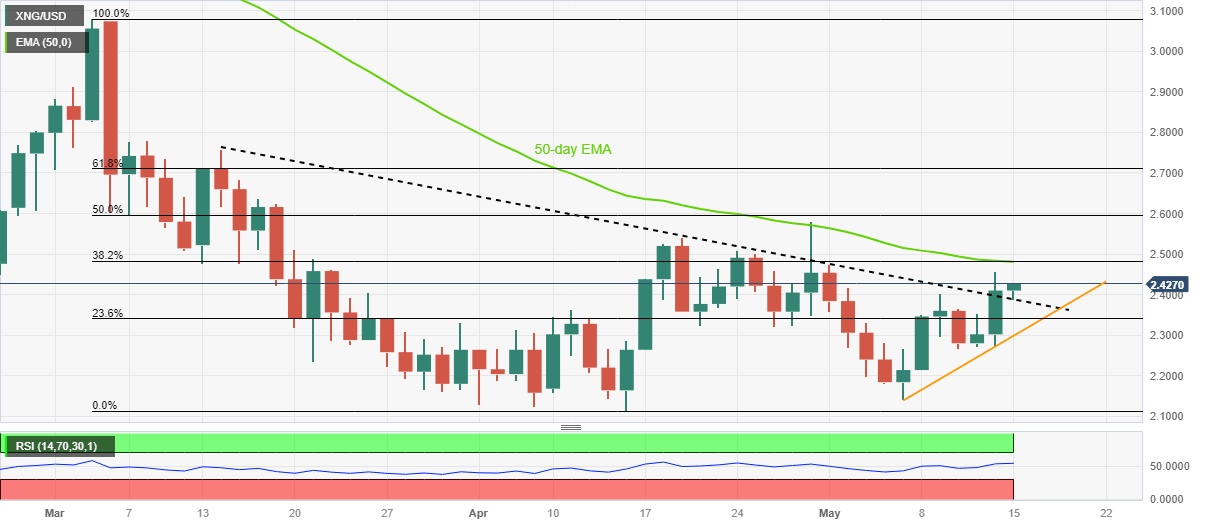

Natural Gas Price Analysis: XNG/USD bulls approach $2.48 resistance confluence

- Natural Gas cheers upside break of two-month-old resistance at a fortnight high.

- Convergence of 50-day EMA, 38.2% Fibonacci retracement of March-April downside appears a tough nut to crack for XNG/USD bulls.

- Ascending support line from May 05 adds to the downside filters for the Natural Gas price.

Natural Gas Price (XNG/USD) remains firmer around $2.42, up for the third consecutive day while flirting with the highest levels in two weeks during early Monday in Europe.

In doing so, the energy instrument cheers the previous day’s sustained break of a downward-sloping resistance line from mid-March, now immediate support near $2.38.

Adding strength to the bullish bias is the RSI (14) line that stays firmer around the 50.00 level, suggesting a continuation of the upward grind.

However, the 50-day Exponential Moving Average (EMA) and 38.2% Fibonacci retracement level of the XNG/USD’s downside from early March to mid-April, near $2.48 at the latest, could challenge the Natural Gas bulls.

In a case where the commodity price manages to provide a daily close beyond $2.48, the odds of witnessing a run-up beyond the previous monthly high of nearly $2.58 can’t be ruled out.

On the contrary, the resistance-turned-support line from March, near $2.38, restricts the immediate downside of the Natural Gas price.

Following that, an upward-sloping trend line from May 05, close to $2.30 by the press time, appears crucial to watch for the XNG/USD bears to watch as a break of which could give back control to them.

Natural Gas Price: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.