Natural Gas turns choppy with pivotal headlines emerging at US trading session on Monday

- Natural Gas prices are popping back above $1.80.

- European gas prices under pressure with Norwegian flow facing hiccups.

- The US Dollar Index trades in the mid-103.00 range ahead of two big central bank meetings.

Natural Gas prices (XNG/USD) starts off in the green this Monday with traders bracing for actions from Russia after Vladimir Putin secured another term as President and Asian traders appear to be operating again in the European Gas futures market. This creates an imbalance in the already fragile European gas market, increasing doubts over whether the old continent will be able to restock its reserves ahead of the next heating season. Although the reserves have not declined as much as expected this winter, new deals to secure refilling are not taking place and Asian traders buy up the current cheap-priced contracts.

The US Dollar trades steady this Monday ahead of no less than five central bank meetings this week with the two most important once: the Bank of Japan (BoJ) and the US Federal Reserve on Tuesday and Wednesday, respectively. The BoJ is expected to move out from its negative rate policy, which would mean the first rate hike in 17 years. Meanwhile, the Fed will need to ease the nerves of markets having pushed forward the initial rate cut to September after stickier inflation data last week.

Natural Gas is trading at $1.82 per MMBtu at the time of writing.

Natural Gas news and market movers: Headlines point to issues for Europe

- Gassco AS? the Norwegian gas network operator reports on Monday that the Aasta Hansteen gas fiel is down due to unplanned maintenance. The outage is expected to last until the 25th March will cut off 7.2 thousand Cubic Metres per day of supply.

- With Vladimir Putin being nomidated again as President of Russia, Ukraine and Europe are facing again six years of geopolitical pressure and a possible tit-for-tat via gas supply and liquidity on global energy markets.

- Bloomberg energy reported this Monday that Natural Gas demand in Asia has moved back to pre-pandemic levels. India is projected to even surpass its pre-pandemic demand for Gas, with more new plants set to come online in 2024-2025.

- Gas flows at the US Freeport facility in Texas are still reduced and lower production is set to remain until the end of April.

- A cold front is set to hit Europe next week, possibly reducing the continent’s reserves further.

- Ole Sloth, head of commodity strategy at Saxo Bank, said that the recent attacks from Ukraine on Russian facilities should be factored in as a reason for higher Natural Gas prices.

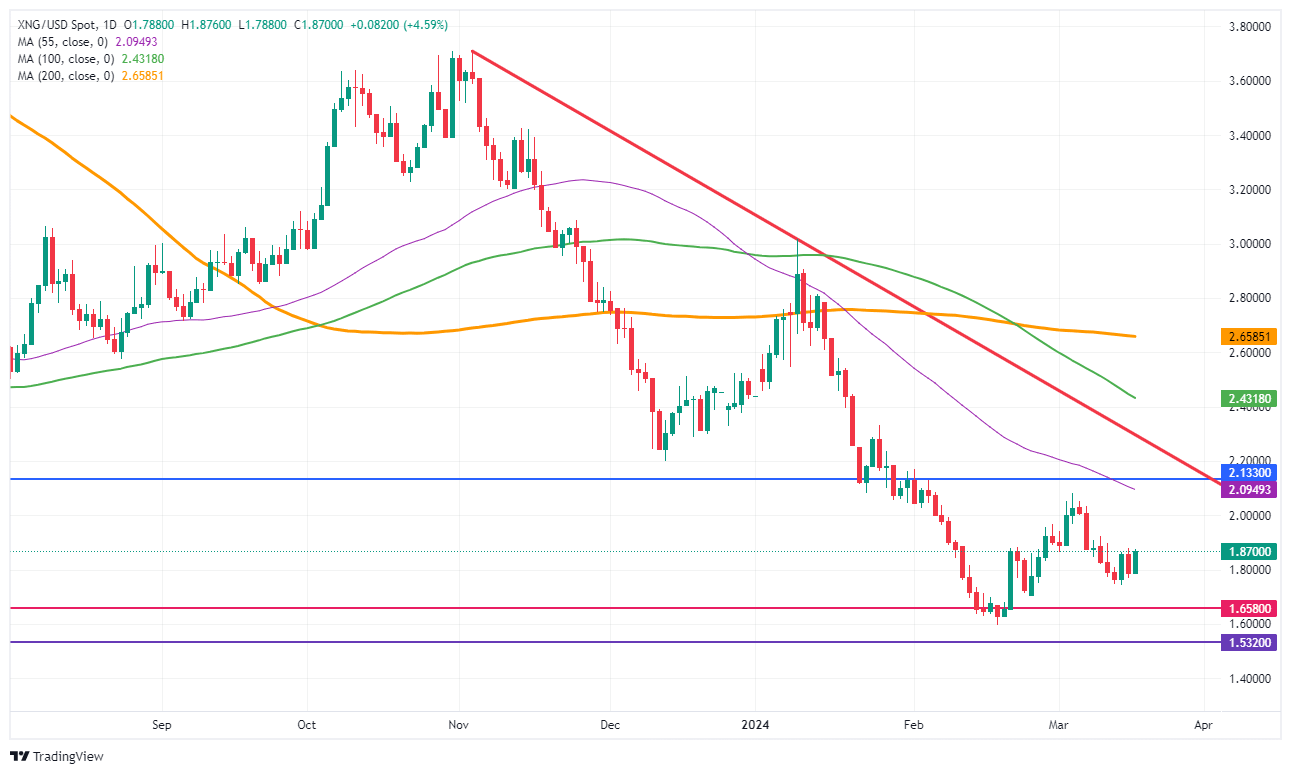

Natural Gas Technical Analysis: European gas market is too open

Natural Gas prices could be seeing a perfect cocktail come to life with the European Gas market set to face some severe pressures. On the one hand, the landslide victory from Russian president Vladimir Putin will make him respond even more severely to the current Ukraine attacks on Russian Oil and Gas facilities, with measures that could disrupt the flows to Europe. Meanwhile, Asian traders are buying up currently cheap-priced Gas contracts on the European market, which could leave Europe behind with elevated prices ahead of the next heating season.

On the upside, the key $2.00 level needs to be regained first. The next key level is the historic pivotal point at $2.12, which falls broadly in line with the 55-day Simple Moving Average (SMA) at $2.09. Should Gas prices pop up in that region, a broad area opens up with the first cap at the red descending trend line near $2.40.

On the downside, multi-year lows are nearby with $1.65 as the first line in the sand. This year’s low at $1.60 needs to be kept an eye on as well. Once a new low for the year is printed, traders should look at $1.53 as the next supportive area.

XNG/USD: Daily Chart

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.