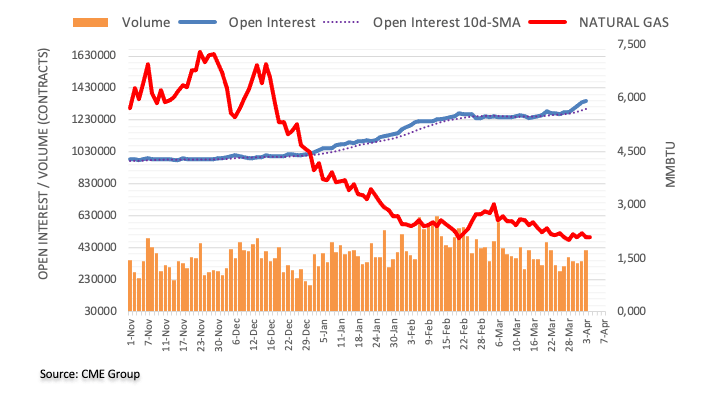

Natural Gas Futures: No changes to the consolidation theme

Considering advanced prints from CME Group for natural gas futures markets, open interest rose further on Monday, this time by nearly 11K contracts. In the same direction, volume increased for the second session in a row, now by around 67.3K contracts.

Natural Gas: Support remains below the $2.00 mark

Prices of the natural gas started the new trading week within the broad consolidative phase in place since mid-March. Monday’s price action was on the back of increasing open interest and volume and exposes further range bound for the time being. On the downside, the next support remains in the sub-$2.00 mark per MMBtu (February 22).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.