Natural Gas stretches intraday profits by popping above $1.90

- Natural Gas prices are soaring ahead of the US trading session.

- Traders see the risk of overcrowded demand for cheap European Gas contracts.

- The US Dollar Index rallies above 104.00 and earlier reached a three-day high.

Natural Gas (XNG/USD) is having a field day by rallying near 4% and popping over $1.90 to the upside. Traders are seeing more room for some upside with the European Gas trading market becoming very crowded. Due to the recent multi-year low in prices, several foreign traders are making their way into the European Gas trading market, with Asia being very active in buying up contracts.

The US Dollar (USD) is off this Wednesday's high in a very mixed second reading of the US Gross Domestic Product release. GDP itself came out little below expectations while the Personal Consumption components jumped higher. Markets are questioning if this is the feared second-roud effect of inflation, looking at the Federal Reserve which has been screaming for months to be datadependent and could be forced to hike one more time, if it wants to salvage its disinflationary path.

Natural Gas is trading at $1.91 per MMBtu at the time of writing.

Natural Gas market movers: Here comes the squeeze

- Recent declines in European Gas prices have spurred other parts of the world into buying. This could push prices higher in Europe, and spillover into global Gas prices.

- China’s Gas imports are expected to climb by 8.2% this year. Buyers are buying more Gas than needed, especially at current cheap prices.

- Turkey’s Natural Gas imports have declined by 8% in 2023, with Russia being the biggest supplier.

- This Wednesday morning EU President Ursula Von Der Leyen proposed to start using the frozen Russian assets for Ukrainian support.

Natural Gas Technical Analysis: $2 in sight and more if European does not act

Natural Gas in Europe is set to face a hot summer with more and more market participants entering the bloc’s Gas trading market. All new additions are buyers, mainly from Asia, interested in the European Gas market with at the moment multi-year low prices and the guaranteed price cap the EU has put in place to protect households from rising Gas prices after Russia decreased its supplies to Europe. Although Europe looks well equipped to refuel ahead of the next heating season, the risk of some volatile spikes could be on the horizon over the summer period.

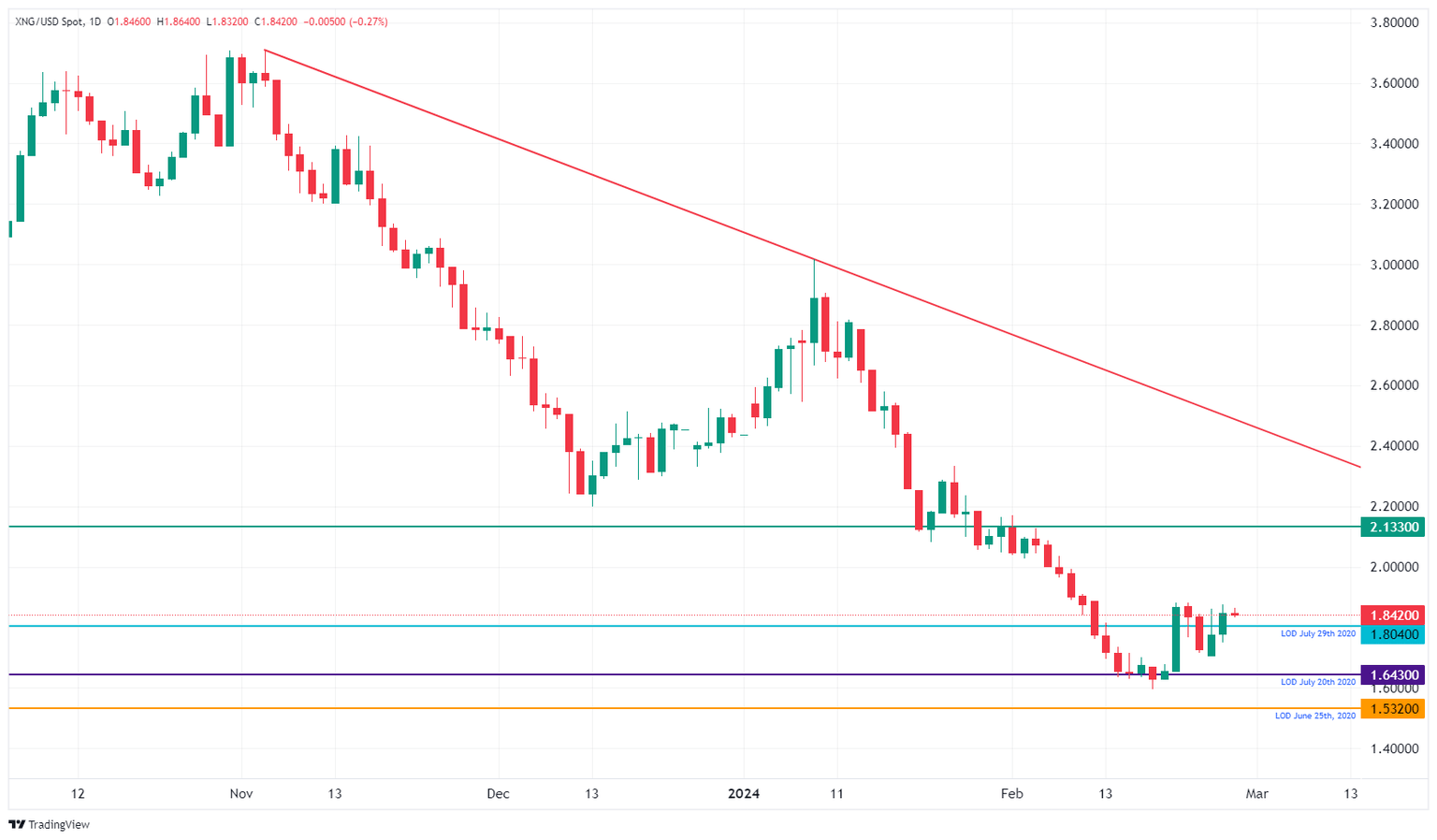

On the upside, Natural Gas is facing some pivotal technical levels to get back to. The next step is $1.99, – the level which, when broken on the way down, saw an accelerated decline. After that, the green line at $2.13 comes into view, with the triple bottoms from 2023. If Natural Gas sees sudden demand pick up, $2.40 could come into play.

On the downside, $1.64 and $1.53 (the low of 2020) are targets to look out for. Another leg lower could come if global growth starts to shrink and there is less demand. Add to that equation both the US and Canada trying to free up more volume of Natural Gas mining, and the scale could quickly tip into an oversupplied market with more downside prices at hand.

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.