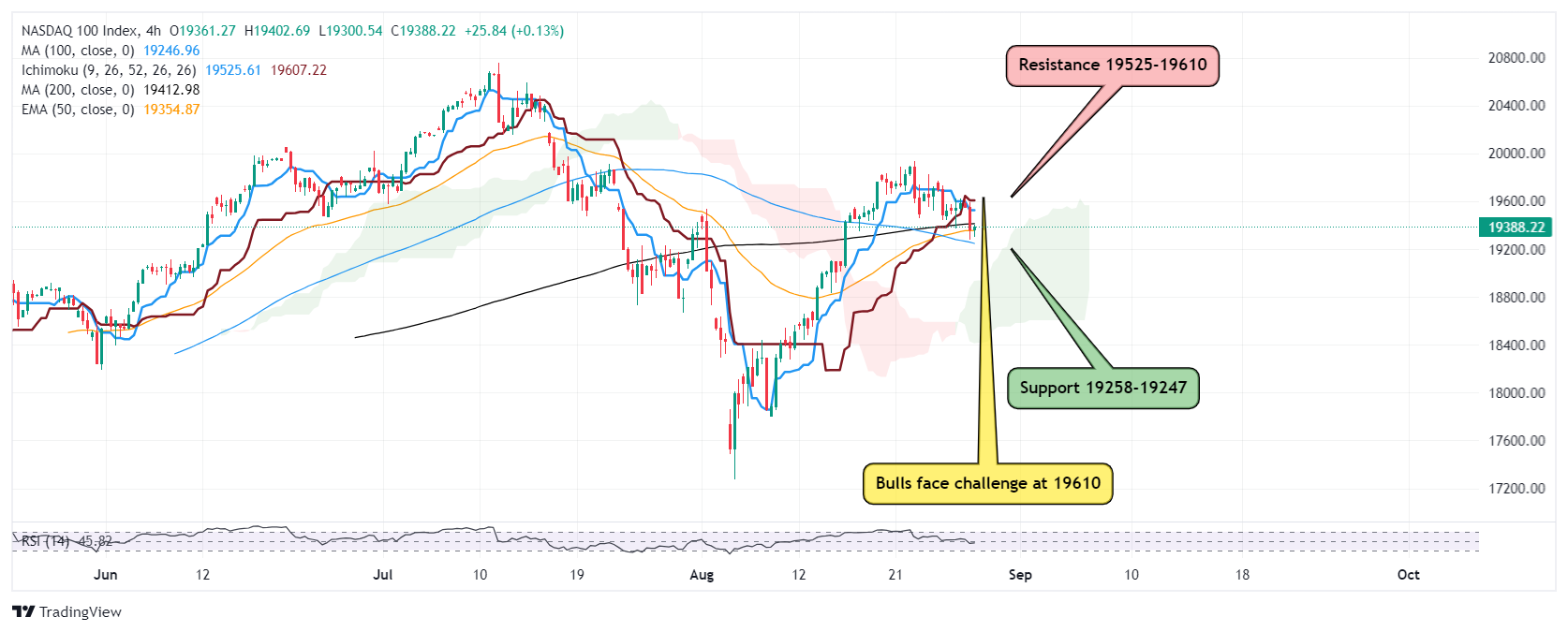

.Nasdaq faces selling pressure, leaning on 50 Day EMA 19257

.Bulls need to reclaim overhead resistance 19610

.INVIDIA results keeping bulls on toes.

Initial bullish rebound attempts lost steam at 19625 as bears took control pushing the tech index lower to approach 50 Day EMA dynamically positioned at 19257

Markets remain concerned about INVIDIA results as news of some houses reducing exposure in the stock increased traders worries.

Bulls need to defend this zone as sustained break below this area will extend decline further to next leg lower 19000 followed by 100 Day SMA 18950

On the higher side, consolidation above immediate hurdle 19525 will ease the way to retest day high 19625 which is turning point to further upside initially targeting 19780-19930

Major resistance sits at 20008

The views of the article are based on price action studies, technical analysis and chart-based studies. The author does not hold positions on items he writes about. The views expressed are for educational purposes and are not trading advice.

Recommended content

Editors’ Picks

AUD/USD deflated from multi-month highs

AUD/USD advanced past the 0.6800 mark for the first time since January, although that early move lacked follow through and later reversed on the back of the strong resumption of the upside traction in the US Dollar.

EUR/USD meets a tough barrier around 1.1200

EUR/USD scaled back part of its recent advance to 2024 peaks around 1.1200 in response to the corrective move higher in the Greenback ahead of the release of Q2 US GDP figures and flash German CPI on Thursday.

Gold struggles to retain the $2,500 mark

After falling toward $2,490 earlier in the day, Gold staged a rebound and trades above $2,500. Renewed US Dollar strength and US Treasury bond yields' resilience, however, caps XAU/USD's upside.

Ethereum could rally 30% after forming double bottom, spot traders buy the dip

Ethereum (ETH) is down over 2% on Wednesday as spot traders are potentially pouncing on the recent market decline to buy the dip. Meanwhile, the top altcoin has formed a double bottom on the daily chart, indicating potential for a 30% rally.

Three fundamentals for the week: Focus on the fragility of the US economy Premium

US Consumer confidence data will provide a gauge of how consumers are feeling. Jobless claims are in focus after Fed Chair Powell's dovish speech. Investors will look to the core PCE index to confirm that inflation is falling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.