- US equity indices bounced sharply on Wednesday.

- Inflationary pressure rises in Europe, but yields fall.

- Powell goes into blackout but signals a 25 bps hike is set in stone.

Equity markets recovered recent ground on Wednesday as the falling yield environment finally gave equity investors some hope. All three major US indices finished up just under 2% with the S&P 500 (SPY) being the biggest gainer on the day. The Nasdaq (QQQ) finished Wednesday up 1.68%. The recovery was broad-based with over 400 of the S&P 500 stocks finishing in the green and all sectors closing higher. The rally was a combination of optimism from the Fed chairman's more doveish comments and some optimism ahead of more Russia-Ukraine talks. Well, hope rather than optimism as the conflict shows no signs of abating.

Nasdaq (QQQ) Stock News

Big tech names and semiconductors held the Nasdaq on Wednesday. Apple (AAPL), Microsoft (MSFT), Tesla (TSLA) all rose nearly 2%, while AMD and Nvidia (NVDA) rose 3% and 4%, respectively. The situation was helped by falling US yields, especially the 2-year, which was spurred by doveish commentary from Fed Chair Powell.

Nasdaq (QQQ) Stock Forecast

$348.50 is our short-term pivot. Above and more gains are likely to test the 200-day moving average at $367. However prolonged failure to break this level will see a move back below $330. Key support at $316 remains in place for now. That is a very strong level, not only due to the lows from May 2021 but also as a huge volume-based level. The Nasdaq (QQQ) remains fragile with the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) both still bearish.

Nasdaq (QQQ) chart, daily

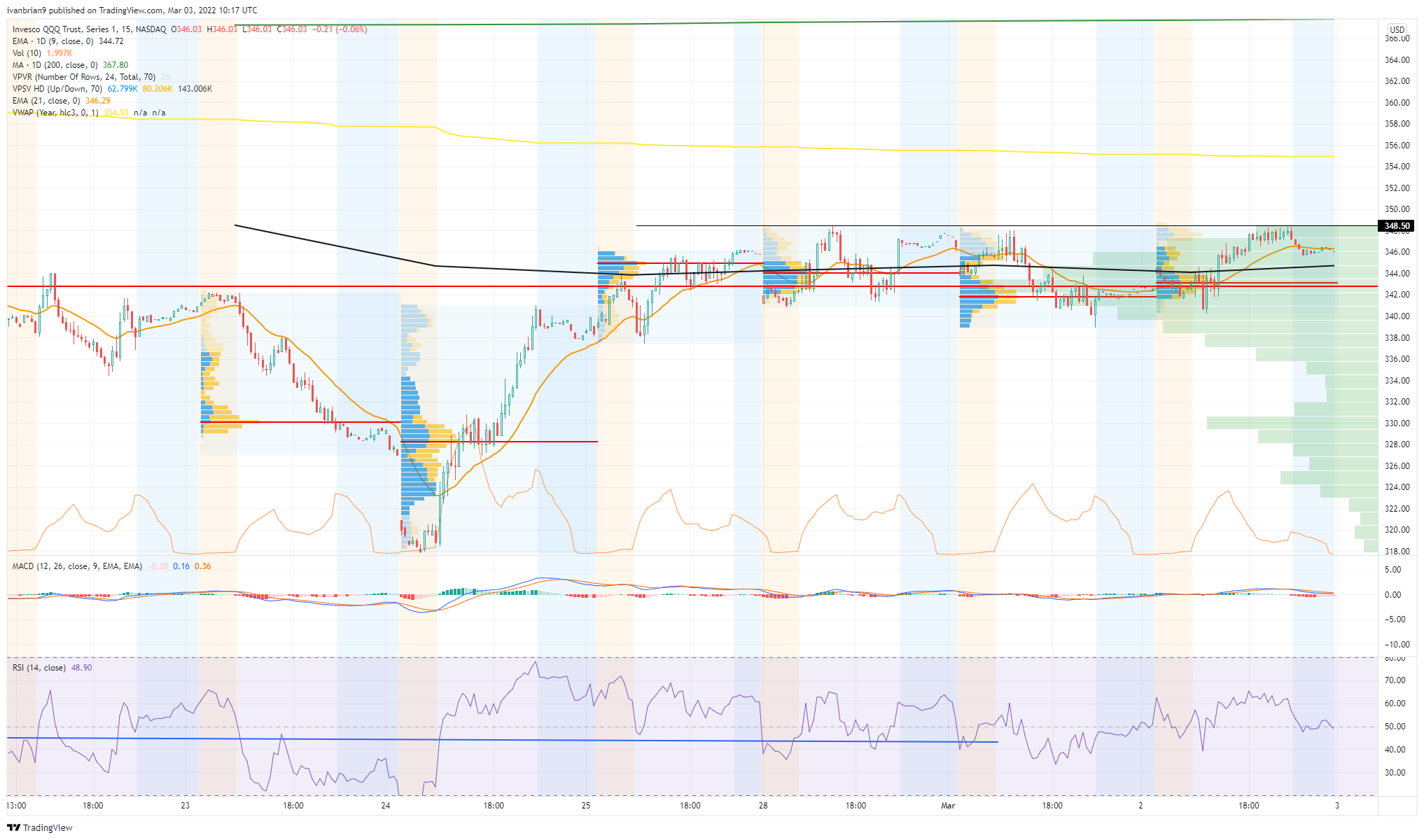

In the short term, look to $348 as the pivot. Failure will see the lower end of the range tested at $338. A break of $338 will likely see a sharp move lower toward $326.

Nasdaq (QQQ) chart, 15-minute

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD flirts with YTD lows below 0.6350 amid pre-Fed market caution

AUD/USD ttrades in the red, flirting with YTD lows below 0.6350 in the Asian session on Wednesday. A cautious market mood and a pause in the US Dollar decline weigh negatively on the pair ahead of the Federal Reserve’s monetary policy announcement.

USD/JPY holds the bounce toward 154.00, Fed and BoJ on tap

USD/JPY is holding the bounce toward 154.00 in Wednesday's Asian trading. The pair finds demand due to a renewed US Dollar uptick and fading hopes of a BoJ rate hike on Thursday. The further recovery could be limited as traders remain wary ahead of the Fed verdict.

Gold extends range play around $2,650 as Fed verdict looms

Despite the latest uptick, Gold price remains in a familiar range near $2,650 early Wednesday. Gold price appears to lack bullish commitment in the lead-up to the US Federal Reserve showdown.

Bitcoin, Ethereum and Ripple show signs of short-term correction

Bitcoin price edges slightly down during the Asian session on Wednesday. Ethereum and Ripple followed BTC’s footsteps and declined slightly; all coins’ technical indicators and price action suggest a possible short-term correction on the cards.

DJIA ends Tuesday in the red, sheds roughly 270 points

The Dow Jones Industrial Average shed another 360 points at its lowest on Tuesday as losses accumulate in the key index and begin to gather speed. The S&P 500 and the Nasdaq also closed in the red.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.