NASDAQ

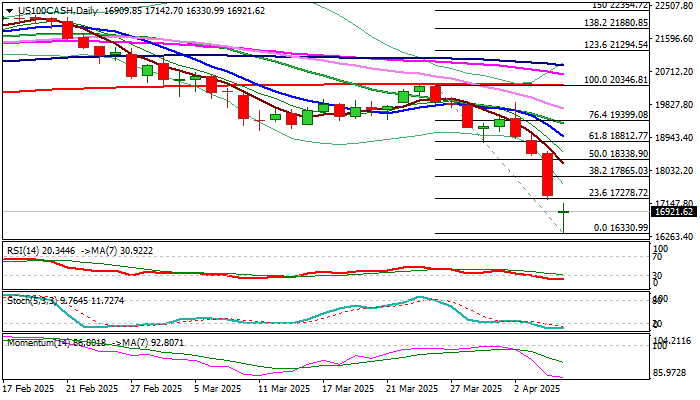

Nasdaq is consolidating above new multi-month low (16463, the lowest since January 2024) after suffering heavy losses in past three sessions and weekly loss of almost 10%.

Partial profit taking on deeply oversold daily studies would provide a breather for consolidation and likely positioning for fresh losses, as long as very negative fundamentals continue to sour the sentiment.

Gap-lower opening at the start of the week after heavy losses and last week’s closing below the base of thick weekly Ichimoku cloud, add to overall bearish picture, but overstretched daily indicators suggest that bears are likely to pause.

Initial barriers at 17278 (Fibo 23.6% of 20346/16330) and 17415 (weekly cloud base) are still intact and guard upper triggers at 17865 and 18338 (Fibo 38.2% and 50% respectively) which should cap extended upticks and keep larger bears in play.

Conversely, breach of these barriers would generate stronger positive signal and probably open way for stronger correction.

Res: 17278; 17415; 17865; 18338.

Sup: 16342; 15700; 14949; 14063.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.