- Nasdaq continues on its record breaking run.

- New highs again on Thursday for most indices.

- Is the Russel 2000 the canary in the coal mine?

Equity markets remain in risk-on, fully bullish mode, and this has only increased as the week has progressed. The Federal Reserve last week set up the rally by having brought forward potential rate rises, and then known-hawk Governor Bullard mentioned that which dare not be named, tapering. Markets though were relieved as investors fretted over the possibility of runaway inflation and a 1970s-style inflationary cycle. The Fed has now dampened those fears, convincing investors that it is not asleep at the inflation wheel. That remains to be seen given the greatest money printing scheme in centuries, but for now, all is well in equity markets. The VIX had briefly spiked above 20 late last week as equities wobbled, but this week's steady gains have seen VIX back to snoozefest levels around 15-16. Similarly, the 10-year yield has not even bothered to move, remaining below 1.5%.

The Nasdaq remains the index of choice this week as it leads most others higher. No surprise given the relative underperformance for April and May. The comparison chart below shows the relative performance of the main indices since March. Notice how the Dow Jones (red line) has totally shed its leadership role with the Nasdaq now catching and surpassing the S&P 500. -637602171756908155.png)

Interestingly, the main feature of this recent rally has been the return to high quality, and this is obviously best exemplified by the mega tech names whose balance sheets are awash with cash but also have strong growth metrics. In June Apple has broken out of its wedge formation (see here), while Facebook (FB) and Alphabet (GOOGL) have set new record highs. Tesla has also powered through some key levels, helping push the Nasdaq along, see here. The chart below shows FB, AAPL, GOOGL and AMZN versus the Nasdaq. Amazon and Apple shares outperform the Nasdaq, while Facebook and Google just underperform though still setting new record highs.

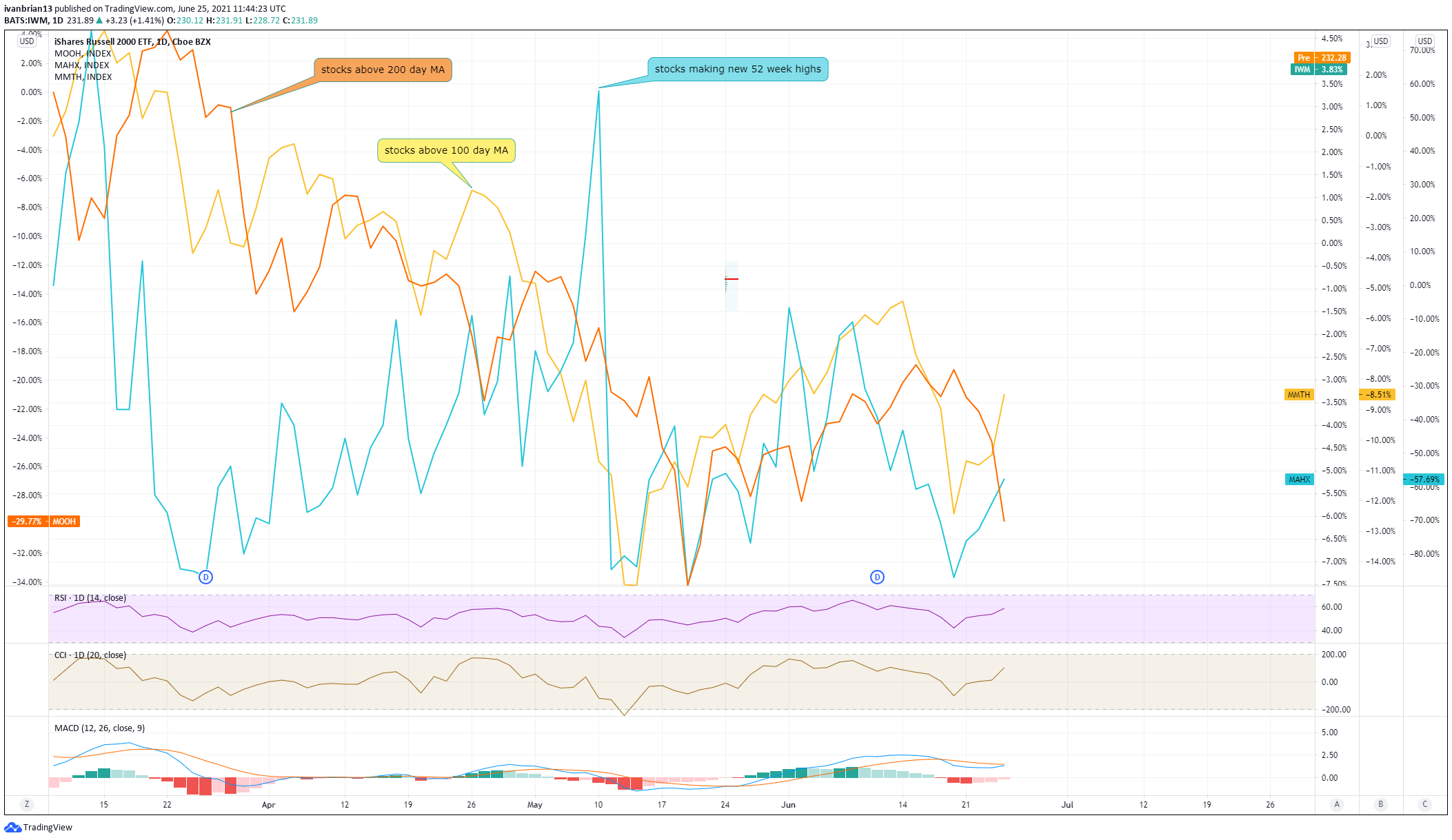

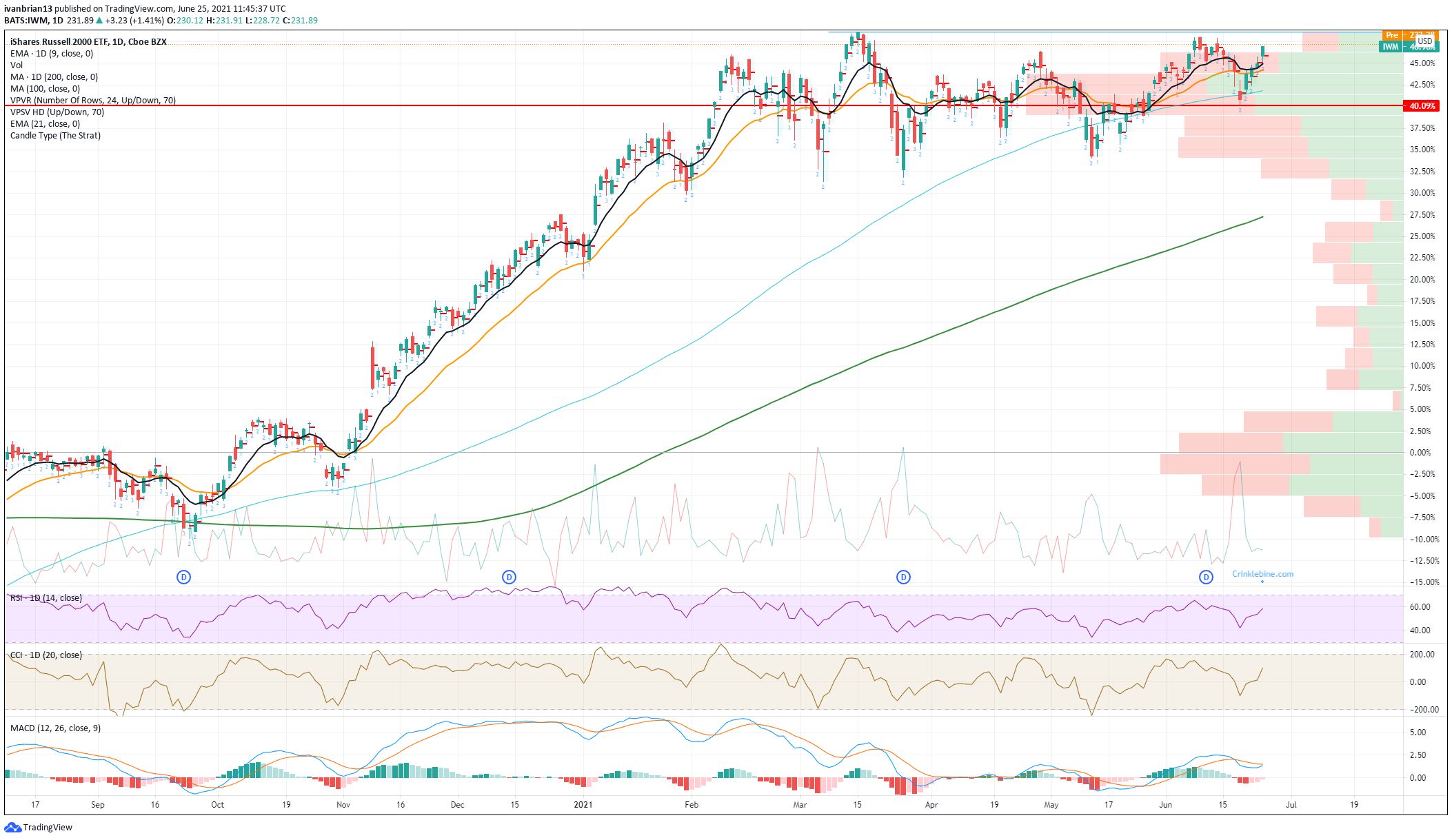

All this does give the worry of broad market indifference and a potential lead coming from market breadth indicators. June has seen the Russel 2000 underperform and put in a potential double top, which will need breaking if the rally is to continue. Also falling are the number of stocks making new 52-week highs and the number of stocks trading above 100 and 200-day moving averages.

This Russell 2000 potential double top needs to be broken to maintain the rally.

Nasdaq (NQ1, QQQ) forecast

The futures (NQ1) E-mini contract is used for our analysis, but the levels are matched to the QQQ Nasdaq ETF. The strong trend remains in place with Thursday's nice continuation candle. The 9-day moving average remains the guide for the short term with 14,250 the key support. The volume profile is still pretty light up here, so the rally has not yet gained steam. A break, therefore, of 14,250 would likely see a quick intraday scalping possibility to move to 14,050. This would be the first support to test since it is the old high from April and now the bottom of the trend channel. The Relative Strength Index (RSI) is very close to overbought. Key supports are 14,050, 13,462 and 12,950.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637602176510703609.png)