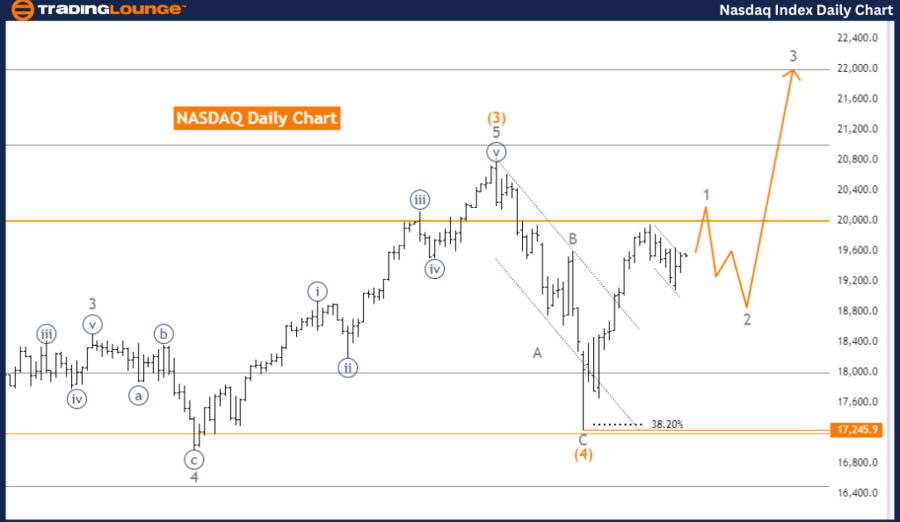

NASDAQ Elliott Wave Analysis Trading Lounge Day Chart.

NASDAQ Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Gray wave 1.

Position: Orange wave 5.

Direction next lower degrees: Gray wave 2.

Details: Orange Wave 4 appears completed, and now gray wave 1 of Orange Wave 5 is in progress.

Wave cancel invalidation level: 17245.9.

The NASDAQ daily chart, according to the Elliott Wave analysis, shows that the market is currently in a trending phase. The analysis indicates that the market is in an impulsive mode, suggesting a continuation of the broader trend. The primary structure under observation is gray wave 1, marking the beginning of a new wave cycle.

The market is positioned in orange wave 5, the final wave of the current sequence. This follows the completion of orange wave 4, suggesting that the corrective phase has ended, and the market is now moving upward in the final phase of this cycle.

Regarding the direction for the next lower degrees, the focus shifts to gray wave 2. This implies that after gray wave 1 completes, the market may enter a corrective phase within gray wave 2, before potentially resuming its upward movement.

At present, gray wave 1 of orange wave 5 is active, indicating the early stages of the final wave within this sequence. This upward trend is expected to continue unless the price reaches the wave cancel invalidation level of 17245.9, which would invalidate the current wave count.

In summary, the NASDAQ daily chart remains in a trending phase with the market positioned in orange wave 5. Following the completion of orange wave 4, the market is progressing within gray wave 1 of orange wave 5. The analysis suggests continued upward movement, with the next focus on gray wave 2. The analysis holds as long as the price stays above the wave cancel invalidation level of 17245.9.

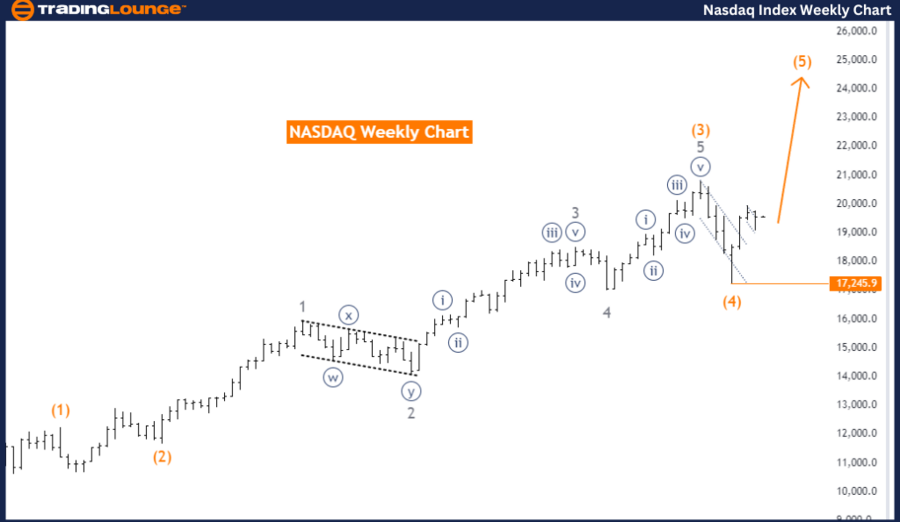

NASDAQ Elliott Wave Analysis Trading Lounge Weekly Chart.

NASDAQ Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Orange wave 5.

-

Direction next lower degrees: Orange wave 5 (started).

-

Details: Orange wave 4 appears completed, and now orange wave 5 is in progress.

-

Wave cancel invalidation level: 17245.9.

The NASDAQ weekly chart, based on Elliott Wave analysis, indicates that the market is currently in an impulsive trend phase, with a focus on the progression of orange wave 5. This wave is part of a larger ongoing sequence and represents the final upward movement following the completion of the previous corrective phase, identified as orange wave 4.

The analysis suggests that orange wave 4 has concluded, marking the end of the market's corrective phase. The market has now transitioned into orange wave 5, signaling the start of a new upward trend. This wave is expected to push the market higher as it unfolds. The trend is considered strong, given its impulsive mode, which is typically characterized by a clear directional movement with minimal retracements.

Orange wave 5 is significant as it usually represents the last phase of a larger wave cycle. The progression of this wave is crucial in determining the continuation of the current trend. The market is expected to continue its upward movement unless a significant reversal occurs.

A critical aspect of the analysis is the wave cancel invalidation level, set at 17245.9. This level serves as a key threshold; if the market price falls below it, the current wave count would be invalidated, potentially signaling a shift in the market's direction. However, as long as the price remains above this level, the upward trajectory of orange wave 5 is expected to persist.

In conclusion, the NASDAQ weekly chart reflects a strong bullish trend, with orange wave 5 currently in progress after the completion of orange wave 4. The analysis anticipates that this upward movement will continue unless the price drops below the wave cancel invalidation level of 17245.9.

Technical analyst: Malik Awais.

NASDAQ Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.