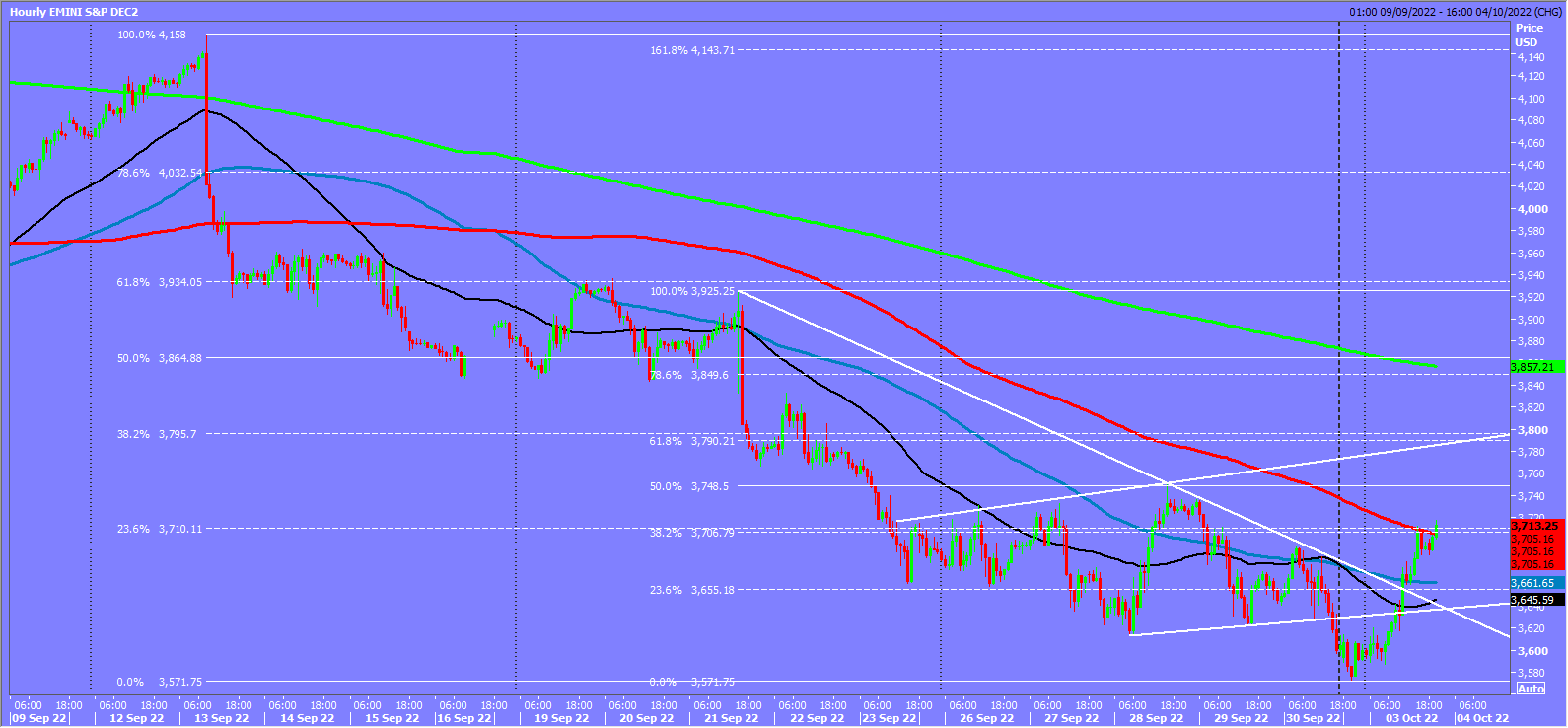

Emini S&P December futures initially headed lower as expected testing key 200 week moving average support at 3590/85, but over ran to 3572. We very quickly recovered above 3590 - longs did well reaching targets of 3650/60 & strong resistance at 3700/20.

A high for the day exactly here but yesterday's bullish engulfing candle suggests a bear squeeze has started.

Nasdaq December tested the important 200 week moving average at 11180/150. A break below 10990 was required for a sell signal but this was the low yesterday.

Emini Dow Jones futures followed the others higher to retest strong resistance at 29550/650 Shorts need stops above 29750.

Remember when support is broken it usually acts as resistance & vice-versa.

Daily analysis

Emini S&P December bullish engulfing candle off the 200 week moving average in severely oversold conditions suggests a low for the correction, at this stage at least. A high for the day exactly at strong resistance at 3700/20 but be ready to buy a break above 3720 targeting 3750/53. We should struggle to beat this level here but shorts are probably too risky now. If we continue higher look for 3790/95. Eventually we could reach 3850/60.

A dip below 3690 signals a test of support at 3660/50. Longs need stops below 3640.

Nasdaq December bullish engulfing candle off the 200 week moving average in severely oversold conditions suggests a low for the correction, with a potential double bottom buy signal. The bounce hit the target & strong resistance at 11350/390 with a high for the day exactly here. Buy a break above 11400 targeting 11500 & 11650/700. A high for the day certainly possible but shorts are risky now in what is likely to be a short squeeze in to the end of the week.

Holding strong resistance at 11350/390 targets 11270/250 before support at 11200/150. Longs need stops below 11050.

Emini Dow Jones shot higher to strong resistance at 29550/650 Shorts need stops above 29750. Buy a break above here targeting 29850/900 & 30150/200. Eventually we could reach 30500/600.

First support at 29300/200. Longs need stops below 29100.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

NZD/USD holds the rebound near 0.5550 after RBNZ's expected 25 bps rate cut

NZD/USD holds the rebound near 0.5550 after the RBNZ delivered the expected 25 bps interest rate cut to 3.5%. The pair reached a five-year lows earlier this Wednesday amid the global meltdown on the back of tariffs-led recession fears and escalating US-China trade war.

AUD/USD recovers further to 0.6000 despite escalating US-China trade war

AUD/USD is building on its recovery from its lowest level since March 2020, retesting 0.6000 in Wednesday's Asian trading. The pair's upside appears elusive as officials confirmed that the US will proceed with a sweeping 104% tariff on Chinese imports starting this Wednesday.

Gold price extends its consolidative price move near multi-week low

Gold price remains confined in a range near a multi-week low touched on Monday amid mixed fundamental cues. The widening global trade war and recession fears lead to an extended sell-off in equity markets worldwide. Moreover, bets for more aggressive Fed rate cuts and a weaker USD act as a tailwind for the bullion.

Trump's tariffs could be beneficial for Bitcoin: Here's why

Bitcoin dropped below $76,000 on Tuesday as the crypto market extended its decline after President Donald Trump imposed an extra 50% tariff on China. Despite the immediate price dip, several crypto experts suggest that Bitcoin could see tremendous growth if the US Dollar continues to plunge.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.