Nasdaq 100 vs S&P 500 showdown: Where should your money be? [Video]

![Nasdaq 100 vs S&P 500 showdown: Where should your money be? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nasdaq/yellow-taxi-in-times-square-of-new-york-city-manhattan-29728130_XtraLarge.jpg)

Watch the video extracted from the WLGC session on 17 Oct 2023 below to find out the following:

-

Which one to bet on between the Nasdaq 100 and S&P 500?

-

The immediate direction, key support and resistance of the S&P 500.

-

The complete trading plan for Nasdaq 100 as it is building the right handle.

-

How could a bearish scenario develop as the war is happening.

-

And a lot more.

The bullish vs. bearish setup is 206 to 302 from the screenshot of my stock screener below pointing to a negative market environment.

Both the short-term and long-term market breadth are still inferior as the market is still pulling back or at best consolidating. However, Nasdaq 100 presents a swing trading opportunity (refer to the setup as discussed in the video) as it is building its right handle.

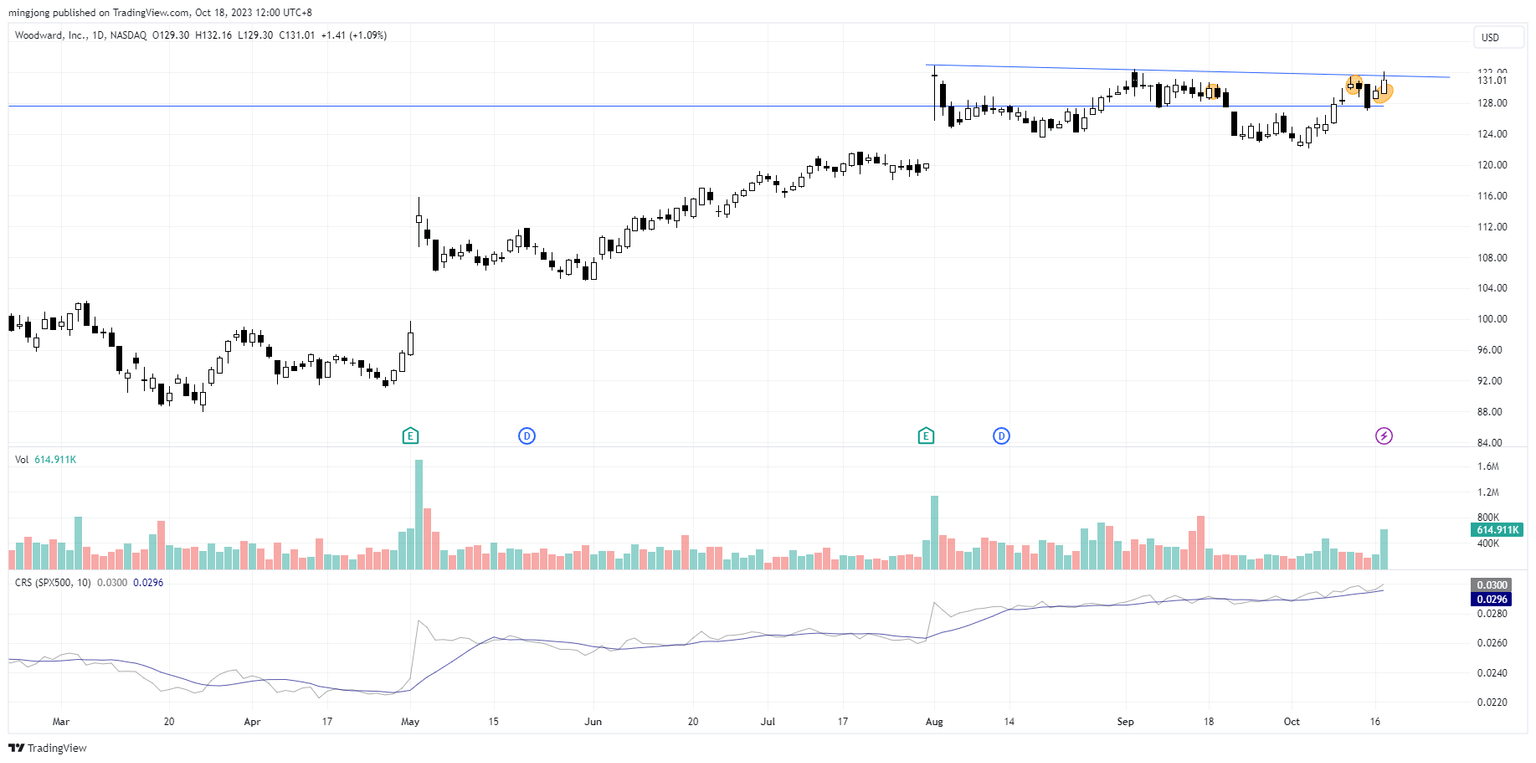

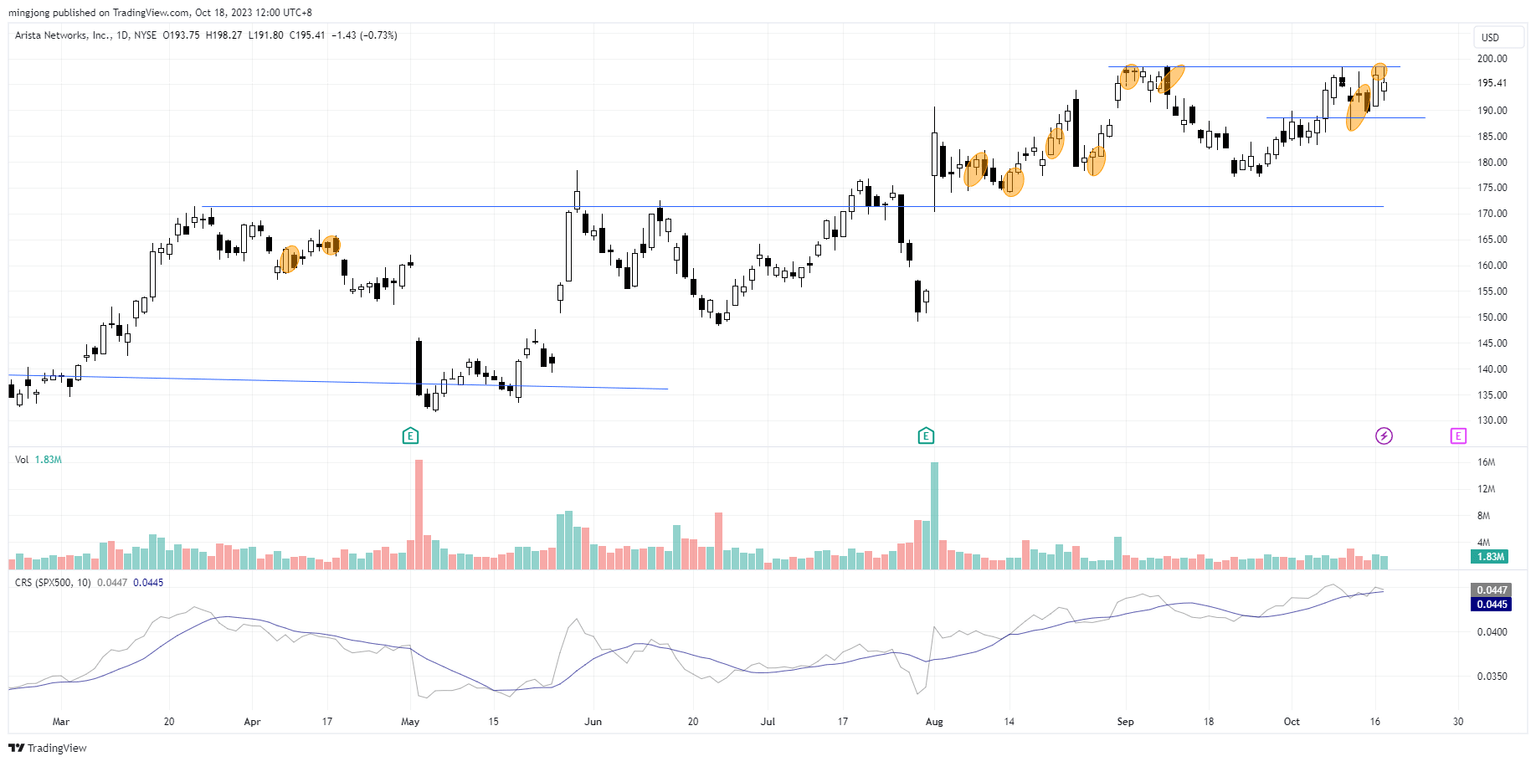

7 “low hanging fruits” (AEO, YELP, etc…) trade entries setup + 20 others (WWD, ANET, etc…) plus 38 “wait and hold” candidates have been discussed during the live session.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.