Must be soft landing, markets say

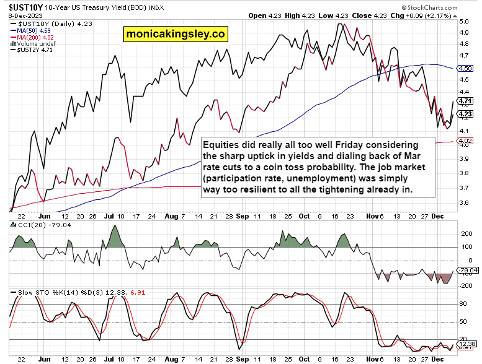

S&P 500 had little second thoughts on NFPs, and rebounded in yet another soft landing celebration. You could rightfully say that the job market didn‘t show any signs of slowdown Friday with participation rate increasing and unemployment rate retreating – that‘s a bit of contradiction of weak Wednesday‘s JOLTS data, but still good enough for considering orderly slowdown in economic activity as inflation keeps declining – I‘m looking for Tue CPI to come in on the cooler side at either 3.1% or 3.2%.

Just where do those Mar rate cut projections come from, is a bit puzzling – why would the Fed cut rates if economic activity wouldn‘t get on the verge of slowing down significantly? The belief that inflation is making sustainable progress to 2% this fast, can‘t be taken at face value – I think the decline in yields is a combination of decrease in inflation metrics and worrying signs that even if the economy isn‘t in a declared recession, tax receipts are slowing down even if fiscal spending is through the roof and overpowering the restrictive Fed that‘s selling us the notion that the bond market has done the tightening for the central bank already enough.

S&P 500 saw continued AI frenzy on GOOG Gemini scoring high on human characteristics, and META with MSFT stock price benefiting from AMD solutions adoption, boosting all of these stocks – and smaller tech plays did well, well enough for rotation inside the sector when cyclicals such as financials and industrials did well. Also my sectoral pick of communications raced higher – but I‘m leaving way more detailed sectoral and individual stocks views as reserved for clients within the regular weekly update for investors in this article (with Ellin we touched on a single pick in our channel together with this two day-summary of S&P 500) – just treat yourselves to quality daily and intraday analytics...

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

Credit markets

Source: www.stockcharts.com

As the caption says, stocks fared reasonably well given the daily spike in yields, and dollar revival higher – its rally that I called to happen from 102.30, is still progressing after Thursday‘s hiccup (also called before the US wakes up Thursday in our intraday channel as one of the conditions for S&P 500 making a daily comeback).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.