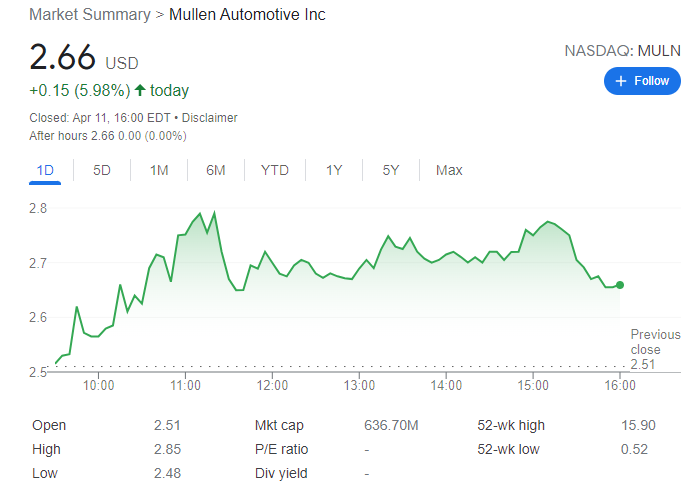

- MULN stock extends its recovery on Monday, ends the day up 5.98%.

- Mullen Automotive shares had been under pressure from scathing Hindenburg report.

- The EV meme stock up again in Monday's premarket.

Update: MULN stock's technical outlook is bullish from a medium to longer-term perspective as the price is yet to mitigate the monthly bearish impulse in any significant fashion. The price is correcting from the 2020 March support area following last month's bullish close with eyes back to the 2020 September old support area. This has a confluence with the 38.2% Fibonacci retracement level around $6.40.

From a weekly perspective, the bullish impulse that started in early March 2022 which reached a 23.6% Fibo of the monthly bearish impulse around $4.15 has also corrected in a 50% mean reversion of the rally. The bulls are moving in at this juncture, supporting the price above $2.35 with eyes towards $4.80 and $5.00 for the weeks ahead.

End of update

Update: MULN moved against the tie on Monday, ending the day 5.98% higher at $2.66 per share. Generally speaking, stocks started the day on the wrong footing, as most global indexes closed in the red. In the US, the Dow Jones Industrial Average edged 1.25% lower, with the Nasdaq Composite losing 2.24%. The S&P 500 lost 71 points to end the day at 4,416.95. There was no particular catalyst weighing on equities, but the usual concerns related to hawkish central banks and the Russian invasion of Ukraine, with Western nations' response to it. Adding to the dismal mood, Chinese inflation came in higher than anticipated. Also, the country's massive lockdowns to contain the latest coronavirus outbreak are expected to exacerbate supply-chain issues, mostly responsible of price pressures.

Previous update: MULN stock has opened the week trading in the green, as it stays above $2.50, up 4.18% at $2.62 at the time of writing. A retail trading favorite, MULN stock has been on some kind of rollercoaster for the past few trading days, both on the newsflow and the price action. Mullen Automotive was subject of a very negative report last week from Hindenburg Research, but as reported below, the claims have been somewhat rebutted by Bitnile CEO positive comments following NILE's private investment on the company. MULN is an electric vehicle "meme stock" that has been targeted by many retail traders as a potential short squeeze candidate in the past few weeks.

MULN stock made up some ground on Friday after a tumultuous few days for the stock following a scathing report from noted short-seller Hindenburg Research. MULN stock is a retail favorite and had been close to the top of social media charts over the past month.

Mullen Automotive is a US-based electric vehicle manufacturer led by CEO David Michery.

MULN stock news: Bitnile private investment pumps Mullen

MULN stock was up much higher on Friday before losing ground into the close. MULN stock traded up at $2.77 for a gain of over 15% but lost ground as the week drew to a close. So, why this big turnaround?

Well, Bitnile (NILE) CEO Milton Todd said in a Youtube Risk On interview that Bitnile had invested privately in MULN and remains invested in the company. He also addressed concerns over Mullens electric battery range which Hindenburg aimed at. Bitnile CEO Milton Todd held an interview with EV Grid CEO Tom Grace. In the interview, Gage reportedly said “The 600-mile number [is] a number that depends on how big the car is, how big the battery is and how efficient the drivetrain and aerodynamics are. So it’s quite possible to do it. Until it’s done under observed conditions you don’t know what you’re talking about. But if you put enough battery in a car, it can go 600 miles.”

This certainly helped investors who had been nervous over going back into MULN stock after the Hindenburg report last week. We have detailed the report in a previous article but given it was titled "Yet another fast-talking EV hustle" you will get that it was less than complimentary. It took aim at Mullen's claims over its battery as well as recent news regarding a major order for electric vans: "The two electric cargo vans that Mullen claims it will be manufacturing are Chinese EVs rebranded with a Mullen logo. Import records show the company recently imported two vehicles from China, one of each model".

MULN stock forecast: Crosstrends exacerbate high risk

The move on Friday held above the $2.06 support and so kept MULN stock technically in a short-term uptrend but still a longer-term downtrend. Breaking $4.21 will confirm the short-term trend has merged into a longer-term uptrend.

This is high-risk investing, though, as MULN stock is an early-stage investment.

MULN stock chart, daily

Prior Update: MULN stock has opened the regular session positively on Monday but only just about. Unusually for MULN it is actually barely moving and volatility is dropping. There has now been some conflicting newsflow over the stocks following on from Hindenburg's harsh report last week. As detailed below there has been some rebuttal to the report which has helped the stock calm down but also now means a bit of directionless trading. Who is correct, it is up to investors to work that out for themselves at the moment. As far as we are aware Mullen has made no reply to the Hindenburg report. They of course do not have to. At the time of writing, MULN stock is beginning to make a move higher, trading at $2.55 for a gain of 1.5% as the stock looks to edge a bit higher. Retail interest is still high judging by the messages across social media and most appear to be from bullish retail investors.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stays firm near 0.6300 amid modest risk appetite

AUD/USD is posting small gains near 0.6300 in early Asian trades on Monday, opening the week on the front foot. Risk sentiment remains in a sweeter spot following the weekend's news of lower US tariffs on Chinese electronic supply chain. Tariffs talks will remain on the radar.

USD/JPY rises above 143.50 at the weekly opening

USD/JPY is trading well bid above 143.50 amid a positive start to the Holy Friday week. The US Dollar holds the rebound from multi-year troughs, digesting Trump's tariff news from the weekend. The Fed-BoJ policy divergence expectations will keep the Japanese Yen supported, limiting the pair's upside.

Gold retreats from record highs of $3,245 as US Dollar finds its feet

Gold is rereating from record highs of $3,245 early Monday, extending Friday's late pullback. Reducded demand for safe-havens and a broad US Dollar rebound undermine the yellow metal amid the news of not-so-steep US tariffs on China's semiconductors and electronics.

Week ahead: ECB set to cut, BoC might pause as Trump U-turns on tariffs

ECB is expected to trim rates, but the BoC might pause this time. CPI data also in the spotlight; due in UK, Canada, New Zealand and Japan. Retail sales the main release in the United States. China GDP eyed as Beijing not spared by Trump.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.