MULN Stock Forecast: Mullen Automotive loses 6% in Tuesday morning session

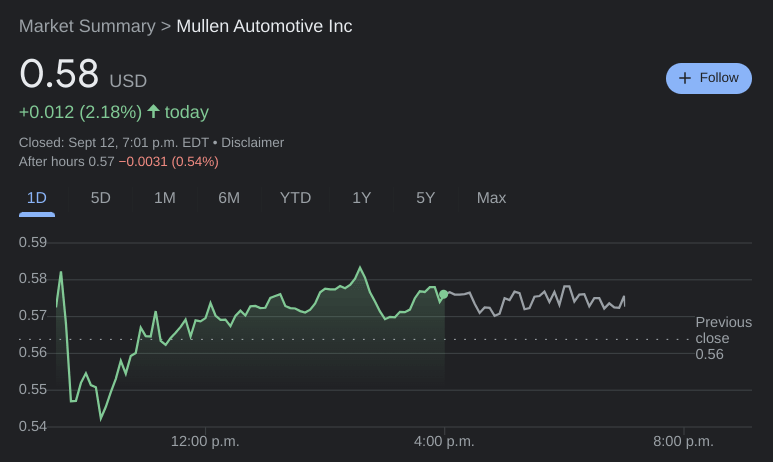

- NASDAQ:MULN gained 2.18% during Monday’s trading session.

- EV stocks rise again as Tesla extends its winning streak.

- Lucid stock receives an upgrade on the strength of its battery technology.

UPDATE: Mullen Automotive stock sank 6.7% to $0.5378 in Tuesday's morning session. MULN has mostly been heading lower since hitting a range high of $0.79 on September 8, last Thursday. BYD Company (BYDDY), the major Chinese EV automaker, is ahead alongside other Chinese EV manufacturers at the same time after Barclay's announced its hunch that BYD will soon become a major global automaker. 7,251 put contracts for the $5 strike expiring this Friday have traded for $0.05. Are we expecting a 1,000% rally this week?

NASDAQ:MULN rose higher to start the week as investors await the August CPI figures for the current picture of inflation in the US economy. On Monday, shares of MULN gained 2.18% and closed the trading session at a price of $0.58. All three major averages climbed higher on Monday as stocks extended their rally from last week. The major economic news is August’s CPI report which is set to be released on Tuesday morning. Overall, the Dow Jones added 229 basis points, the S&P 500 gained 1.06%, and the NASDAQ rose higher by 1.27% during the session.

Stay up to speed with hot stocks' news!

Electric vehicle stocks also extended their gains led by Tesla (NASDAQ:TSLA) which rose higher for the fifth consecutive session. The stock gained on emerging news on a possible Canadian GigaFactory plant as well as increased production capacity of up to 5,000 Model Y’s per week at GigaBerlin by the first quarter of 2023. Other EV makers on the rise on Monday included RIvian (NASDAQ:RIVN), Lucid (NASDAQ:LCID), and Nio (NYSE:NIO). Nio actually led the way with a gain of 13.52% as Deutsche Bank analyst Edison Yu named it his top EV stock in China.

Mullen stock price

Lucid stock rose higher by 9.75% as it received a promising upgrade from a Wall Street analyst. R.F. Lafferty analyst Jaime Perez initiated coverage of the company with a Buy rating and a price target of $19.00. A lot of the bullish call is based on Lucid’s battery technology providing a longer range than Tesla on a single charge.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet