MULN stock opens lower on Thursday

- MULN stock closes down again on Wednesday losing 2.8%.

- MULN stock is lower again in Thursday's premarket.

- MULN stock suffering from a lack of momentum and the Hindenburg fallout.

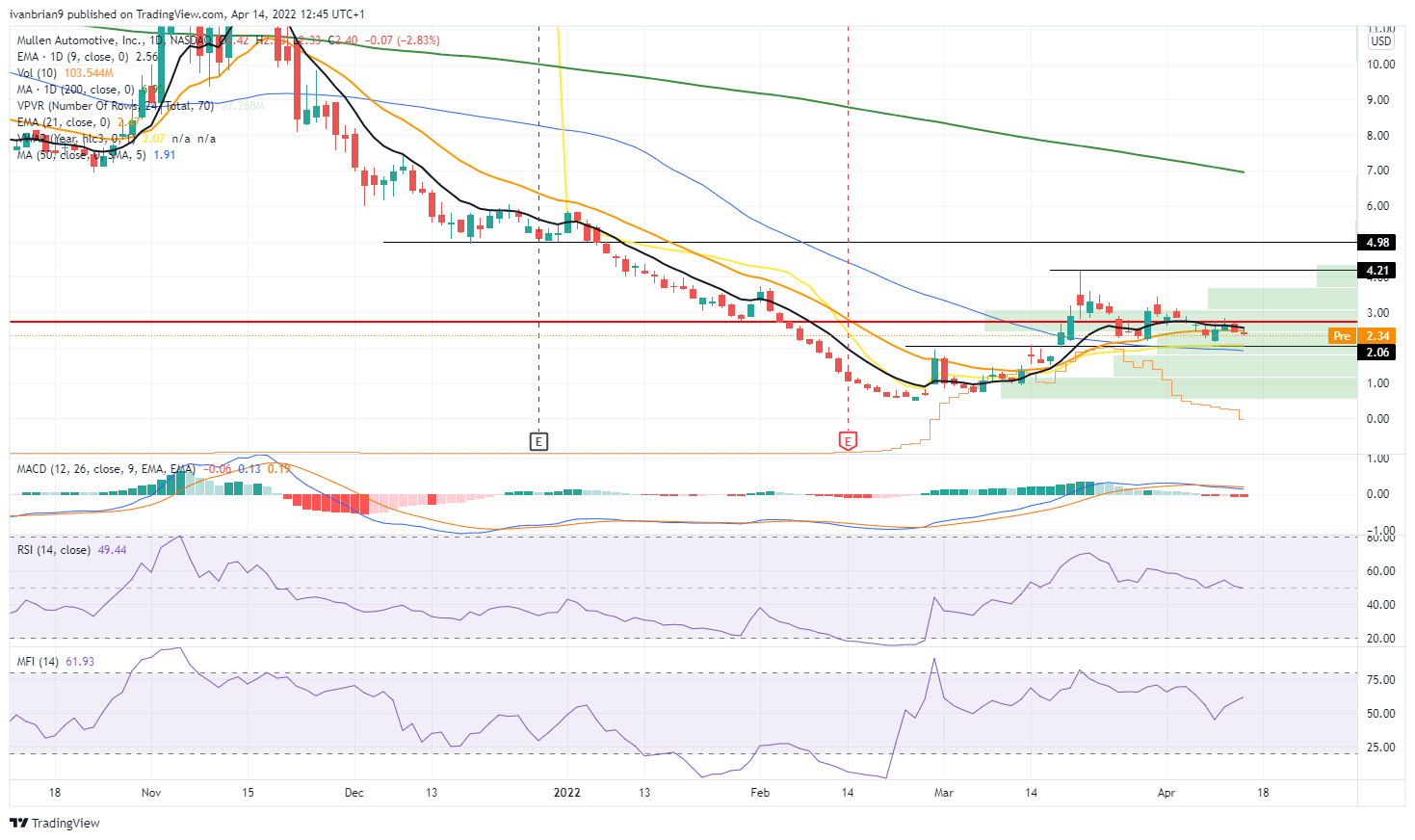

Update: Unfortunately the fallout continues for MULN stock early on Thursday. The stock has opened 3% lower and briefly dropped 5% lower before recovering slightly. Momentum has now completely evaporated and the key support at $2.06 is getting closer and closer. It is difficult to see how this can be turned around and we expect further falls for MULN stock if it gets below $2.06. Newsflow remains light so the Hindenburg report is dominating the narrative. Unless some new information comes out this is likely to lead to more losses for MULN stock.

MULN stock continues its slide lower with more losses in Thursday's premarket, following on from a near 3% fall on Wednesday. This is despite risk assets rising on Wednesday as markets overlooked the high PPI report and focused instead on falling yields.

MULN stock news

The EV sector was strong on Wednesday with some powerful moves from notable names. The big daddy of the EV sector, Tesla added over 3% and is back above the $1,000 level. I should state for clarity I am short Tesla. But other EV names also spiked on Wednesday. Rivian (RIVN) added a whopping 7.86% and Lucid popped 3.57%. So MULN is then definitely an underperformer. This is not surprising given that Hindenburg Research issued a strongly negative report on the company last week. That has led to continued pressure on MULN despite the odd recovery. There was an attempted recovery on some confusion over battery range claims but for the most part, it appears shorts are in the driving seat. Momentum is key for these sort of retail, penny stocks and once that dries up the falls can be sharp. MULN is no different. The lack of any response that we are aware of from Mullen or Mullen management to the Hindenburg report is slightly concerning. Of course, there is no obligation to respond but the report was quite strong in its criticism.

MULN stock forecast

As mentioned with momentum, notice how the volume has dropped sharply in MULN stock. This is one warning sign of falling momentum as is price. Each spike in Mullen fails at a progressively lower level than previously. Again the case with the most recent move and failure to break or even get near $4.21 was the first warning sign. $2.06 was the last breakout level and so is the immediate support. Breaking this and MULN will likely move below $1 in our view. This is high risk and not investible in our view. If you want to trade it please be aware of the risk involved. Many EV companies will not make it as competition gears up from mainstream automakers who are switching into the space. These automakers have huge capital behind them and established production and distribution networks. That gives them a strong competitive advantage over new entrants. It is extremely expensive to enter the auto manufacturing space. Many start-up EVs companies will not survive so be aware of that in your investing decisions.

MULN stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.