Mullen Automotive: Investment? No – Compelling speculation, yes

-

Mullen Automotive inks deal for IP and distribution rights for the DragonFLY.

-

Rebranded the Mullen GT, it has a top speed over 200 MPH.

-

Mullen Automotive has many irons in the fire but remains speculative as an investment.

-

5 stocks we like better than Mullen Automotive.

Mullen Automotive Inc (NASDAQ:MULN) is an early-phase EV start-up with no production, and no revenue, so is not much of an investment. Buying the company is speculation, at times compelling speculation, because production and revenue appear to be close at hand. The company has several irons in the fire, and it will only take one to get the business in gear while it works on the roll-out of its flagship model.

How can it produce revenue if it’s not producing its car, you might ask? The answer is that CEO David Michery’s strategy is to assemble vehicles for off-shore manufacturers to produce revenue and fund the company’s advance. The latest news is an agreement with Qiantu Motors that settles a long-standing dispute and paves the way for another Mullen Model to hit the roads.

The Mullen GT is back on the slate

One of Mullen Automotive’s many attempts at producing cars based on 3rd-party IP is the DragonFLY, produced by Qiantu Motors. Qiantu Motors is a China-based company that produced the DragonFLY for 2 years before halting and ending Mullen’s plans.

Now, 2 years later, the companies have agreed for Mullen to license the IP and distribute the DragonFLY in the US. Mullen will have to redesign some features to fit the US market, but that is expected to begin soon.

A “supercar” is an all-EV sports car that can accelerate from 0-50 in under 2 seconds and reach a top speed of over 200 miles per hour.

“Qiantu has been working on developing electric vehicles since 2013. We are honored to cooperate with Mullen Automotive to bring Qiantu K50 to the U.S. market,” said Chairman Lu of Qiantu Motors. “As an important step in Qiantu's internationalization, we are confident that the Qiantu K50 will reach even more customers and provide a superior driving experience.

With its sleek design, excellent driving and handling performance, and impressive full carbon fiber exterior, we believe the Qiantu K50 will succeed in the U.S. EV market, offering users a new level of performance and convenience.”

Mullen is producing vans?

Mullen Automotive received an order for 6,000 Class 1 EV vans last year from Randy Mario auto group in North Carolina. The deal is worth about $200 million in revenue, and the first deliveries are expected soon. The company did not make any fanfare from the start of production but has come out with statements reaffirming delivery and images showing vans at its Tunia facility ready to be delivered.

All that’s needed now is for deliveries to be made and the first sales logged, but there is a risk. Mullen wouldn’t be the first to suffer a recall-related setback with the onset of production.

And there is always the I-Go. The I-Go arrived in Europe earlier this year and was received by Newgate Motors. Newgate Motors is still advertising the vans prominently, so we have to assume they are OK with what they have. The first sales should be announced with the next earnings report.

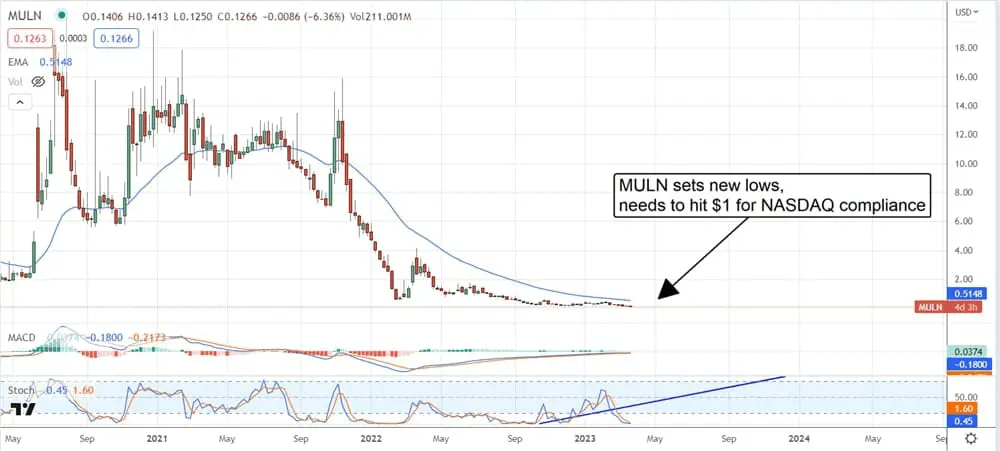

Mullen falls to new lows, shorts aren’t done with this one yet

Mullen Automotive shares are trending lower again due to short-selling and dilutive sales of shares. The stock is trading at less than $0.13 per share and at levels almost too cheap to ignore. The risk of going to $0 is present, but so is the chance to sell with triple-digit gains. This isn’t a stock to bet the mortgage on, but it’s certainly worth a small position because you can’t win it if you aren’t in it.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.