MRNA Stock News: Moderna defies gravity, set to rise amid coronavirus vaccine rush

- NASDAQ: MRNA is set to extend its fall as rival AstraZeneca moves forward with large coronavirus trial.

- Concerns about Moderna Inc's low-temperature storage needs is also weighing on the stock.

- A probe by the US Department of Defense is a third adverse factor.

Update: NASDAQ: MRNA is set to extend its gains on Friday after rising on Thursday – defying the broader sell-off in stocks. The S&P 500 crashed by 3.5% as the White House is reportedly rushing through a coronavirus vaccine as early as October. Moderna is one of the leaders in the race, conducting a Phase 3 trial of its immunization candidate.

Buy every company reporting coronavirus-related progress – that seemed to be the modus operandi of investors in recent months. However, as time passes by, markets are separating the wheat from the chaff – taking a closer look at firms and often selling off shares.

That may be Moderna's case. The Massachusets-based pharmaceutical firm is at the forefront of developing COVID-19 immunization – but has run into a few hurdles.

Here are three MRNA downers:

1) AstraZeneca's trial: While Moderna Inc. is at an advanced stage of testing its coronavirus vaccine candidate, a project by the University of Oxford and AstraZeneca is not only considered the world leader – but also announced a broad 50,000-strong trial starting in the US. Investors may prefer picking a more significant contender.

2) Cold feet due to freezing needs: Reports suggest that Moderna's COVID-19 solution needs to be stored at extremely low temperatures. Keeping medicine in cool and dark places is not a novelty, but the need for additional care could make distribution more complicated. That may also keep Moderna behind.

3) DOD probe: The US Department of Defense is looking into a claim by Knowledge Ecology International that MRNA failed to disclose the use of government grants in its patent applications. That would be a violation of federal law. The investigation is at the best case a distraction from the urgent coronavirus project.

These three issues could further pressure Moderna Inc's shares.

MRNA Stock Price

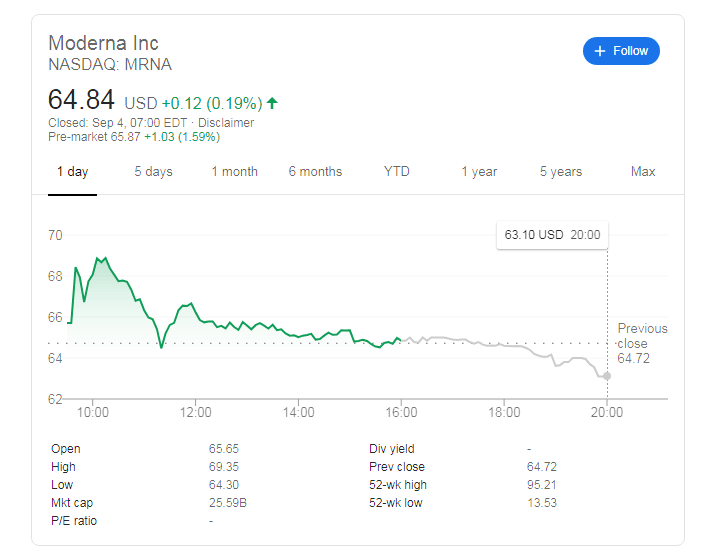

NASDAQ: MRNA close Monday's session at $64.89 – the lowest since early July. At the time of writing, the equity is changing hands at $63.20 in pre-market trading, representing an additional fall of over 2%.

Critical support awaits at $62.60, the pre-surge August low, and then at $52.20. Resistance is at the recent peak of $70.50, followed by the 52-week high of $95.20 it reached when it announced a new and promising test.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.