- NASDAQ: MRNA has surged after reporting promising interim results for its COVID-19 vaccine.

- Moderna Inc's coronavirus immunization scheme has five advantages over Pfizer's.

- The shares' close above the previous peak is a promising technical indication.

Does the early bird get the worm? Not necessarily. When it comes to the global race to beat COVID-19, there is room for various vaccine solutions to help the world emerge from the crisis. Thirst for any solution and production limits make every immunization scheme a winner at this point.

What about the long run? When the world is saturated with vaccines, quality may make a difference. So far, only two efforts have announced promising interim results from their covid efforts, with Moderna Inc coming second after the initial announcement from Pfizer and BioNTech.

However, there are five reasons why Moderna has the edge:

1) Storage temperature: Any logistical hurdle can be surpassed, but a lower barrier makes life easier. While Pfizer's vaccine needs to be stored in ultracold -70 to -80 celsius ahead of the final five days before distribution, Moderna's inoculation can survive 30 days at +2 celsius. That makes distribution far easier.

2) Efficacy rate: The difference between Pfizer's 90% and Moderna's 94.5% may sound like splitting hairs, but the PR effect of having a more efficient vaccine may encourage investors and also governments to opt for the latter.

3) Diversity: Moderna's CEO Stéphane Bancel stressed that his company's solution has been tested among high-risk patients and those who come from different ethnic backgrounds. That makes the results more robust and immediately adequate for a larger audience.

4) US government support: While Pfizer boasted about not taking money from Uncle Sam, Moderna has worked for hand in glove with the federal government. Dr. Anthony Fauci, America's top epidemiologist, was quick to hail Moderna's results. The backing of Washington – no matter the administration – is another win for Moderna.

5) Expertise: Moderna is focused exclusively on the Messenger RNA technology – that was the vision of founders Robert S. Langer, Derrick Rossi, Kenneth R. Chien, Timothy A. Springer and Noubar Afeyan.That would allow them to upgrade their vaccine rapidly and potentially ramp up production.

All in all, Moderna Inc's vaccine seems to be set up for greater success.

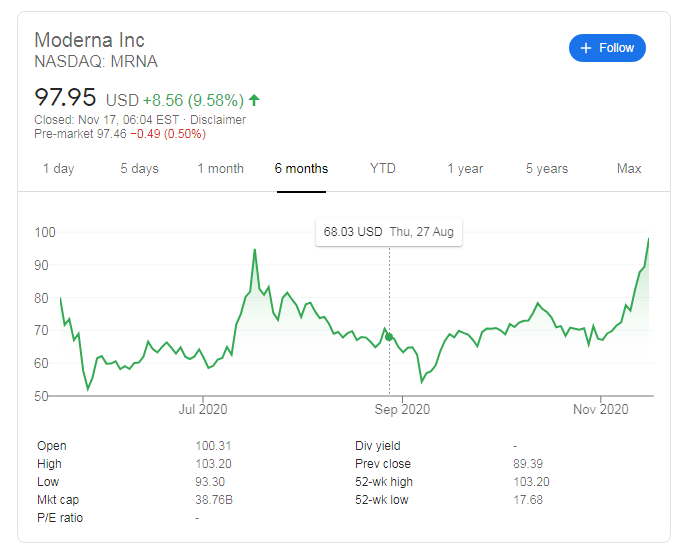

MRNA Stock Price

NASDAQ: MRNA closes at $97.95 on Monday, following the big news. As the chart shows, that is above the previous peak of $94.85 in July. The next target is $100.

Support awaits at $90, followed by $78.50, a high point in October.

See What you need to know about the dollar in the post-vaccine announcement world

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.