MRNA Stock News and Forecast: Why is Moderna stock down again?

- Moderna shares suffer more falls on Wednesday as the negative trend persists.

- MRNA hit by regulatory bodies in France and Germany preferring Pfizer/BioNTech vaccine.

- Moderna has weak results and antiviral pill news hitting the stock further.

Moderna suffered yet again on Wednesday as the fallout from multiple headwinds continues to see trouble ahead for the MRNA share price. The stock has had some steep falls with last Friday seeing it lose nearly 18% and gap lower. Now all the stock has done is consolidate those losses, and that to us makes it look like more of the same, or technically speaking a continuation pattern.

Moderna (MRNA) stock news

So why the recent fall, and can this be turned around? Moderna was one of the best performing stocks in 2021, and despite the steep falls seen recently it still is. We have to remember that this stock has been stellar. Even now MRNA shares are still up 119% for 2021 despite being down 40% in the last three months. Moderna was flying on the back of the global rollout of MRNA vaccines from itself and Pfizer (PFE)/BioNTech (BNTX). However, the stock ran into some trouble after recent earnings on November 4. EPS and revenue both missed, and the stock suffered.

While this was negative, it was perhaps news of alternative antiviral treatments in development from both Pfizer and Merck (MRK) that have been the main catalyst for the share price fall in Moderna. Merck has pre-orders for its antiviral pill from the UK and US, and the UK has already approved it for use. Pfizer then released data last week on its own antiviral pill, which look very promising. Antiviral pills are given after catching covid and aim to prevent hospitalization and death. This week saw both France and German health authorities say they prefer Pfizer/BioNTech vaccines to be used in those under 30 if available over the Moderna vaccines.

Moderna (MRNA) stock forecast

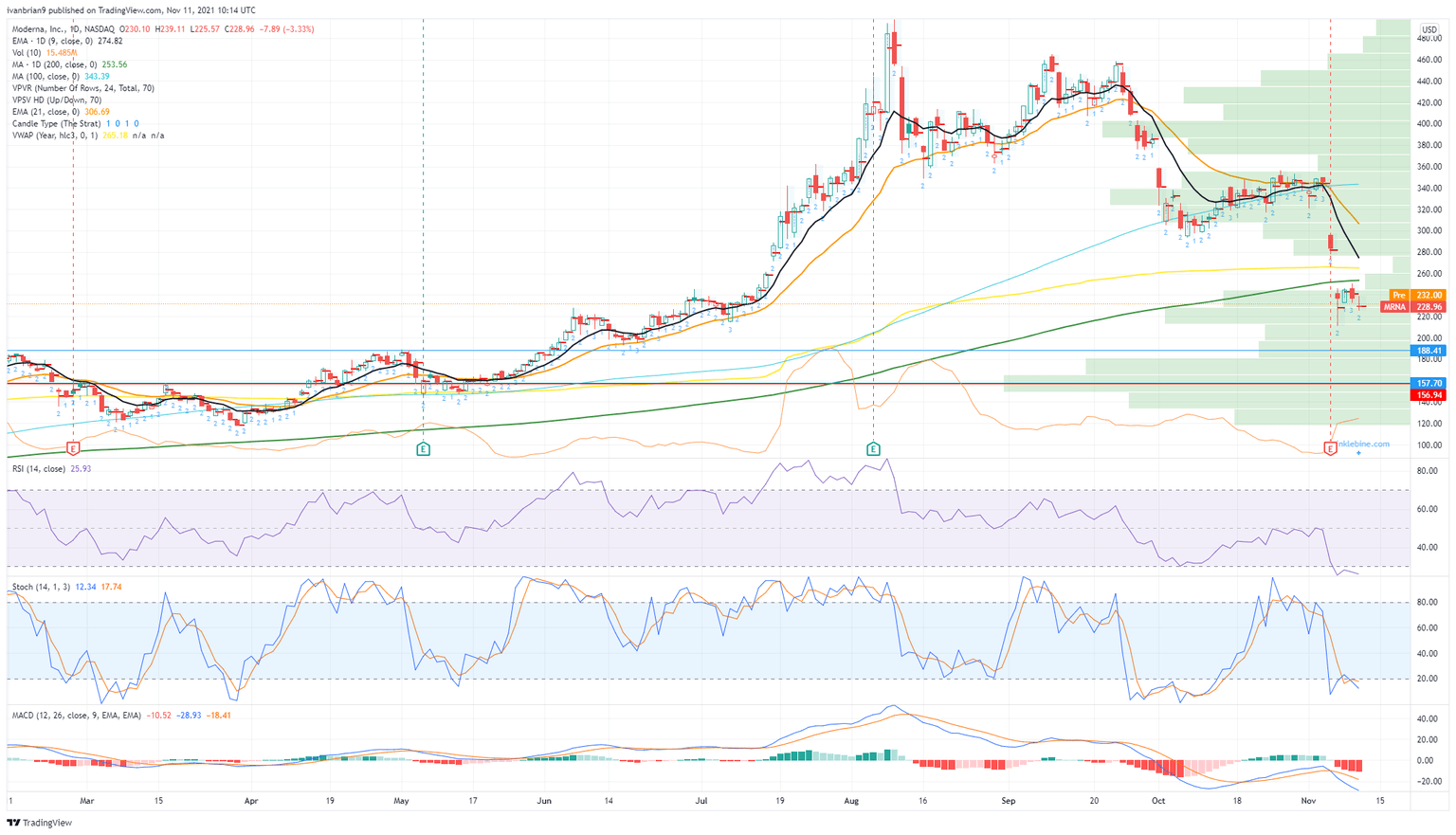

Breaking the 200-day moving average is never a good sign and puts MRNA stock strongly bearish across all time frames now. This area from $253 to $265 is now strong resistance, because in addition to the 200-day moving average at $253, the yearly VWAP is at $265. We still stick to our $188 interim target and $157 as a strong support zone where a long can be tried.

MRNA 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.