Around the middle of February, the geopolitical playbook was highlighted. In that article, it was noted that serious armed conflicts were often surprisingly short-lived in terms of market impact. In terms of the S&P500’s impact, the average fall through big geopolitical events had only been a total drawdown of -6.1%. You can read the full piece here for a recap.

The global stocks recovery

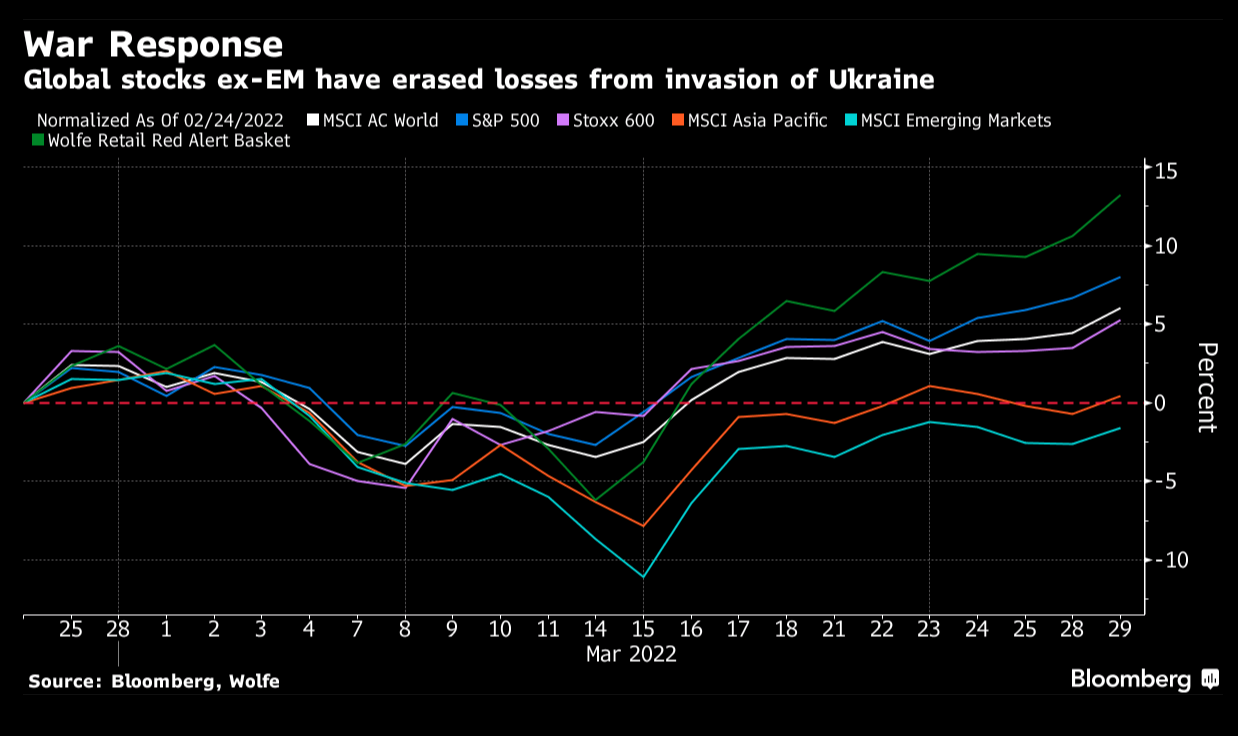

Bloomberg reported that the rebound in global stocks has now been completed bar emerging market stocks. If you take a look at the chart below you can see that the S&P500 only skirted with around a -2.5% drawdown. When you consider the large human cost of armed conflict it I perhaps surprising that the financial impact can be so limited. It was emerging markets that saw the greatest drawdown with over -10% falls which came around one month after the initial post referenced above on March 15.

Russian’s MOEX index remains depressed

Although trading has resumed in Russia the MOEX index is down over 40% on the year. The chances of the Russian index quickly rebounding are low as confidence in Russian stock will take some considerable time to recover. Also, it should be noted that the Russian stock market is not as important to the Russian economy as its counterparts would be in the UK, US, or Europe. The total value of the Russian stock market is around $400 billion. When you consider that the market capitalisation of Visa alone is worth more than the entire index that puts it into perspective. It also shows that even though the general playbook for geopolitical risk is to buy the dip there are nuances to keep aware of.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended content

Editors’ Picks

AUD/USD: Extra gains look likely in the near term

AUD/USD added to Wednesday’s gains and broke above the key 0.6200 barrier following the pronounced retracement in the US Dollar amid widespread concerns over the impact of Trump’s tariffs on the global trade.

EUR/USD: There is a minor resistance at 1.1300

EUR/USD gathered renewed steam and advanced north of 1.1200 the figure to clinch new highs, always on the back of intense tariff woes and the marked sell-off in the Greenback.

Gold flirts with record peaks near $3,175, Dollar tumbles

Gold continued its record-setting rally on fresh tariff-related headlines, surging past the $3,170 mark per troy ounce after the White House confirmed new tariffs, sparking another round of US Dollar selling.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.