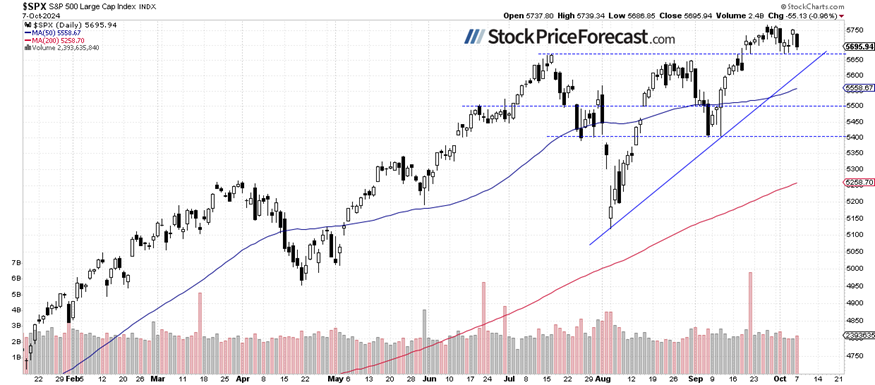

Stock prices retraced Friday’s gains on Monday as tensions surrounding the Middle East conflict increased. The S&P 500 index lost 0.96%, but it remained within its recent trading range. This morning, it is expected to open 0.4% higher, further extending its sideways movement.

I still think the market is forming a top, and the seasonal pattern suggests the low of the correction may occur in October.

Investor sentiment slightly worsened last week, as shown by last Wednesday’s AAII Investor Sentiment Survey, which reported that 45.5% of individual investors are bullish, while 27.3% of them are bearish, up from 23.7% last week.

The S&P 500 continues to trade within a consolidation, as we can see on the daily chart.

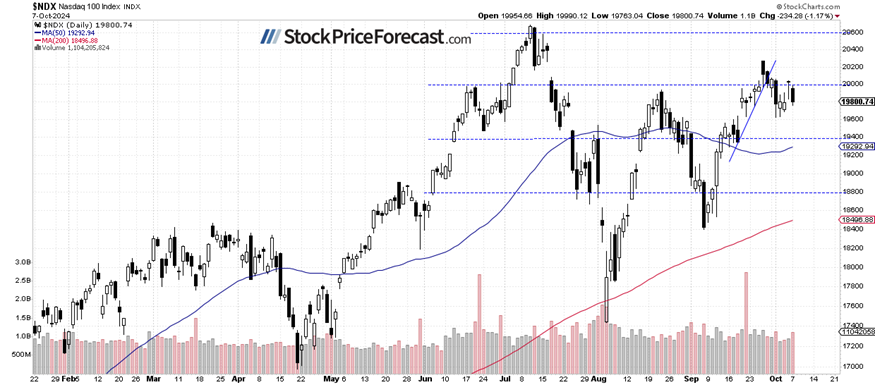

Nasdaq 100 pulled back below 20,000 again

The Nasdaq 100 lost 1.17% on Monday, after gaining 1.2% on Friday. The market remains in consolidation around the 20,000 level, but it pulled back below that mark yesterday. This morning, the Nasdaq 100 is expected to open 0.4% higher, as indicated by futures contracts. Resistance remains at 20,250.

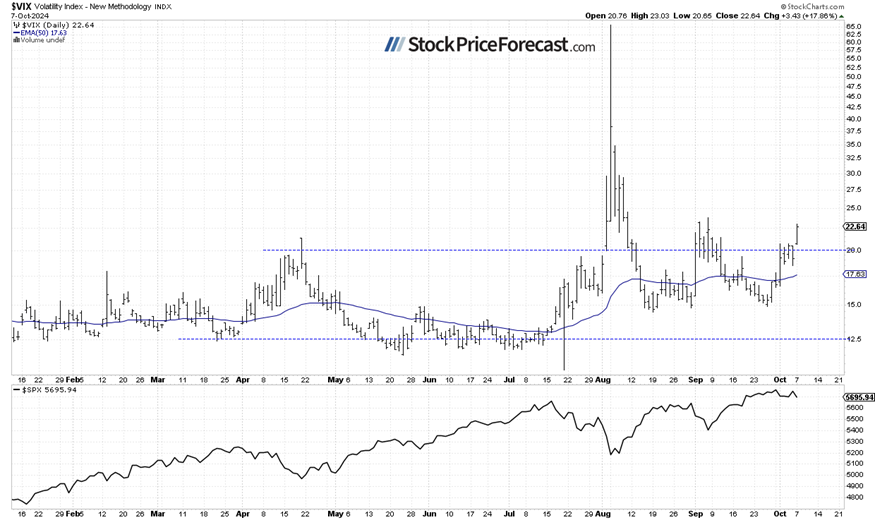

VIX moved higher

On September 6, the VIX index, a measure of market fear, reached a local high of 23.76. It was indicating elevated fear among investors. However, a stock rebound followed by a record-breaking rally pushed the VIX lower. On the previous Thursday, it fell to 14.90, its lowest level since late August. However, yesterday it climbed again, reaching 23.03, signaling rising investor fear.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures contract continues moving sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday, it pulled back to the support level around 5,725, but this morning, it’s trading around the 5,750-5,770 level again. Resistance remains at 5,800, and the market's direction appears inconclusive.

Conclusion

Today’s session is likely to open on a positive note, with the S&P 500 rebounding after yesterday’s nearly 1% decline. Will the market approach its recent highs and the 5,800 level again? For now, it seems likely to continue its consolidation.

Investors are awaiting Thursday’s Consumer Price Index release and the upcoming quarterly earnings season.

Last Tuesday, I wrote “The key question is whether the uptrend will continue despite overbought conditions. While no clear negative signals have appeared, the rally seems overstretched.” The question remains: is this a topping pattern before some more meaningful downward correction or just a consolidation before another leg up?

I opened a speculative short position in the S&P 500 futures contract on September 16.

In my Stock Price Forecast for October 2024, I wrote “the market extended its uptrend in September after rebounding from the early August low. No clear negative signals have surfaced; however, a correction could still occur. Historically, October is a seasonally weak month, especially during its first weeks. Will the stock market sell off soon? Although monetary policy easing supports the bulls, uncertainty surrounding geopolitical risks and the upcoming presidential election may still weaken sentiment.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

-

The S&P 500 is likely to rebound after yesterday’s pullback, extending consolidation.

-

The market may still be forming a topping pattern before a downward correction.

-

In my opinion, the short-term outlook is bearish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.