Modine manufacturing Co.: Five waves ended – Corrective pullback underway

In today’s update, we’ll revisit the Elliott Wave structure of Modine Manufacturing Co. ($MOD) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, the 5-wave impulsive cycle from May 2023 has concluded, and a corrective pullback has begun. This pullback presents a potential buying opportunity in the coming weeks. Let’s break it down.

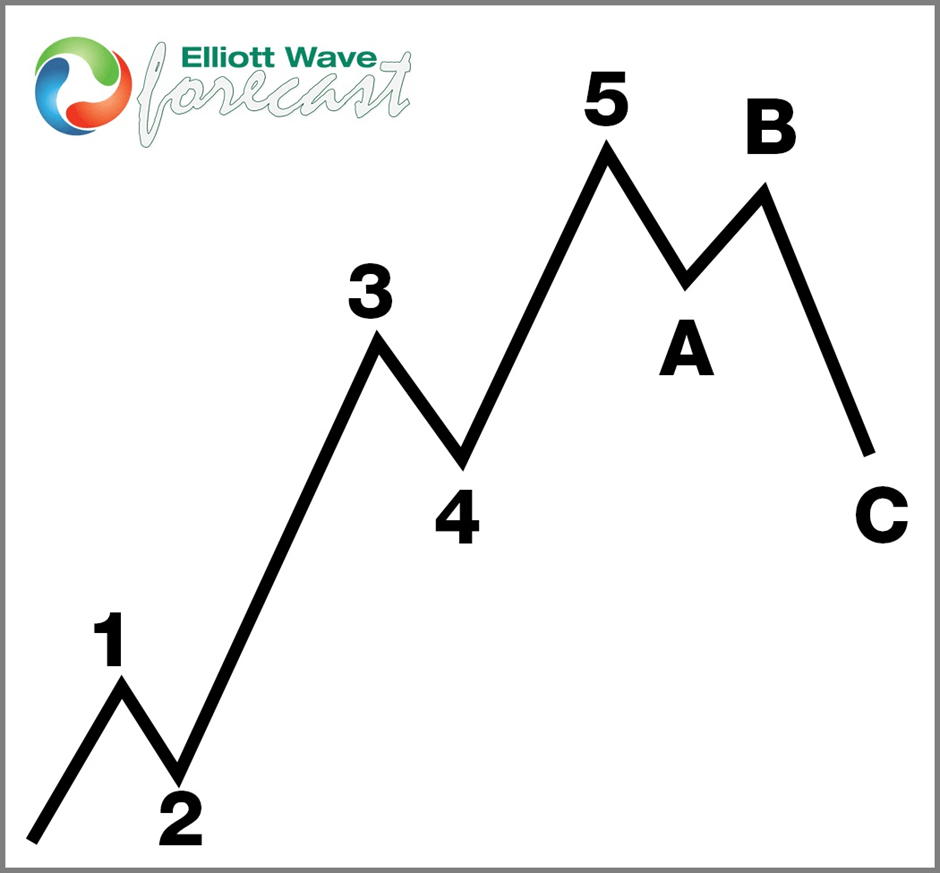

Five wave impulse structure + ABC correction

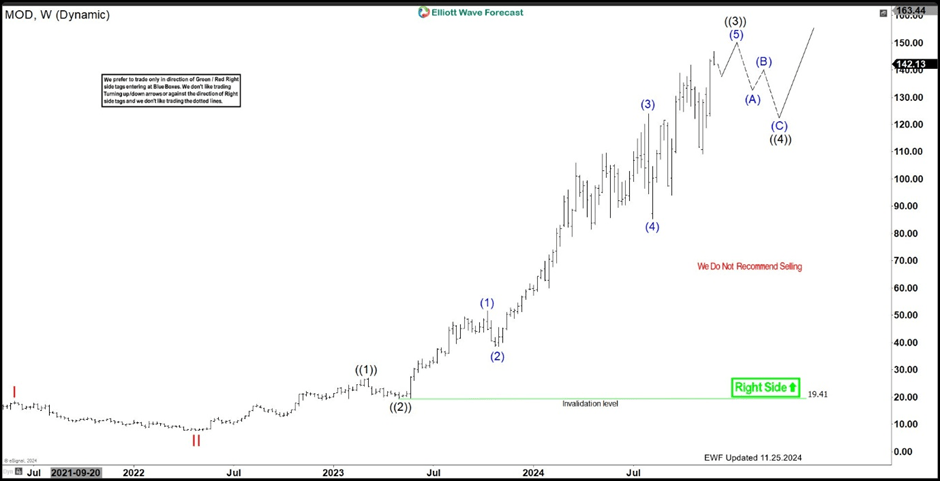

$MOD weekly Elliott Wave view November 25th 2024

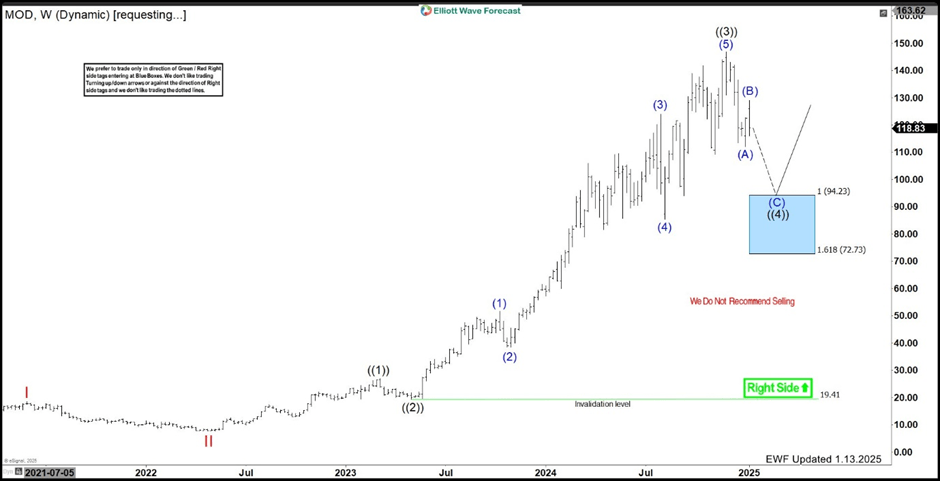

$MOD weekly Elliott Wave view January 13th 2025

Since our last update, $MOD has confirmed the completion of wave (5) within the broader wave ((3)). The stock has now entered a corrective phase, consistent with Elliott Wave Theory. Here’s how the structure is unfolding so far:

-

The first leg lower, labeled wave (A), has already formed, marking the initial phase of the pullback.

-

This was followed by a bounce in wave (B), which appears to have concluded.

-

The stock is now likely entering wave (C) of the larger wave ((4)) correction, which should target the Blue Box area at $94.23–$72.73.

Blue Box area: A key buying opportunity

The Blue Box area represents a high-probability reversal zone where buyers could re-enter for the next bullish cycle. This correction, which follows the 5-wave impulse, allows the market to reset and create new opportunities for traders.

-

Blue Box Target Zone: $94.23–$72.73

-

Wave structure: Corrections typically unfold in 3 swings (ABC), with wave (C) often extending into the Blue Box.

As $MOD approaches this zone, traders should closely monitor price action for signs of reversal and a resumption of the larger uptrend.

What’s next for $MOD?

Once wave ((4)) completes in the Blue Box area, we expect $MOD to resume its bullish trend with a rally in wave ((5)). This next impulsive move could take the stock to new highs, continuing its long-term uptrend.

However, traders should exercise patience and wait for confirmation before entering new positions. Risk management is crucial, as corrections can sometimes extend beyond expected levels.

Key takeaways for traders

-

Wave Completion: Wave (5) of ((3)) has ended, and the corrective pullback in wave ((4)) is underway.

-

Current Focus: $MOD is trading lower in wave (C), targeting the Blue Box area between $94.23–$72.73.

-

Buying Opportunity: The Blue Box offers a high-probability zone for buyers to re-enter before the next bullish wave ((5)).

-

Long-Term Outlook: After completing wave ((4)), $MOD is expected to resume its larger uptrend, providing significant upside potential.

Conclusion

The current correction in Modine Manufacturing Co. ($MOD) aligns with our Elliott Wave analysis and offers a strategic buying opportunity. As the stock approaches the $94.23–$72.73 Blue Box, traders should prepare to capitalize on the next leg of the uptrend. Stay patient, focus on risk management, and let the Elliott Wave structure guide your decisions.

Keep an eye on $MOD’s price action as it progresses toward the Blue Box, and we’ll provide further updates as the market develops. Happy trading!

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com